Pending Orders: Learning Buy Limit and Sell Limit, Buy Stop and Sell Stop

6 minutes for reading

This article is devoted to trading with pending orders: Buy Limit, Sell Limit, Buy Stop, Sell Stop. Pending orders are great helpers in various trading strategies.

What for do we need pending orders?

A pending order is an order to open/close a buying/selling position as soon as the price reaches a certain level. Unlike market orders that are executed immediately by the current price, pending orders is only triggered when the quotations reached a specified value. If they do not reach it at all, the order will simply not be executed.

A trader is not always glued to the trading terminal and cannot always grasp the right moment for opening a position. To close or open one at a certain price while busy doing other things, they use pending orders.

This is most useful for those who trade by tech analysis. They can place pending orders near strong support/resistance level counting on a bounce off it or a breakaway.

Apart from orders to open positions, traders actively use pending closing orders: Stop Loss and Take Profit.

- Stop Loss is a protective order meant to close a losing position. It is placed to limit risks if the trading situation goes wrong.

- Take Profit is an order that automatically closes a profitable position as soon as the quotations reach the level specified by the trader.

Learn more about SL and TP in the article below:

Limit orders to open positions

A limit order is an order to open a position at a specified or better price. For buying orders, the threshold is below the current market price, for selling orders it is above. Hence, limit orders are used when the trader expects the price to reach a certain level and then reverse.

Such orders are often used in strategies aiming at bounces off strong support and resistance levels. The peculiarity of limit orders is that they are executed at a price not worse than set. They can even be executed at a better price if the set level gets into a gap.

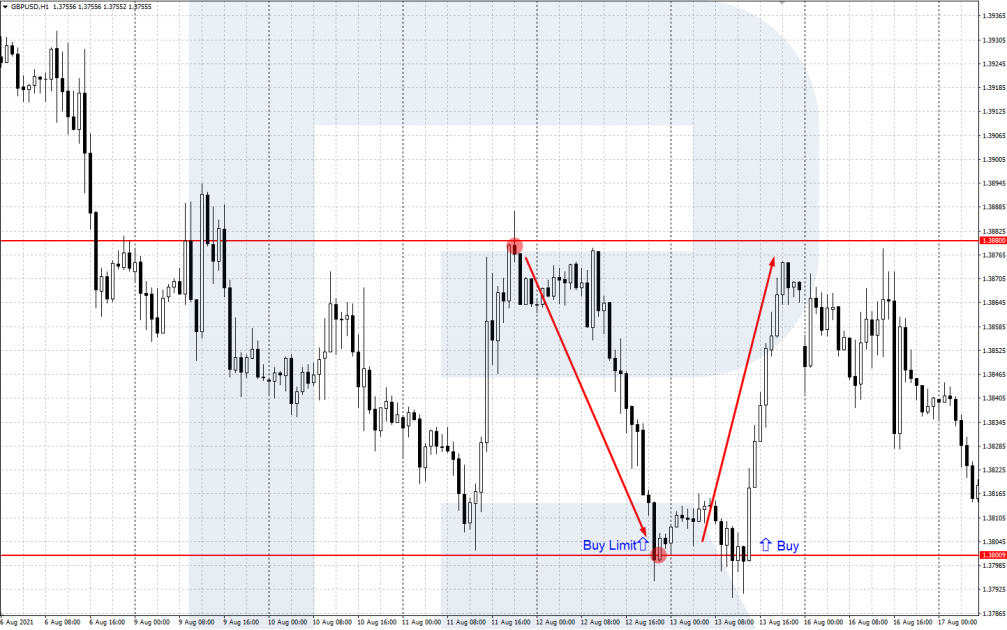

Buy Limit

Buy Limit is a pending order to buy at the Ask price below the current market price. This order is used when the trader expects the price to fall to a certain level where they plan to open a buying position. For example, if the GBP/USD price is 1.3880 but the trader wants to buy the pair at 1.3800, they need to place a Buy Limit at this level or slightly above it.

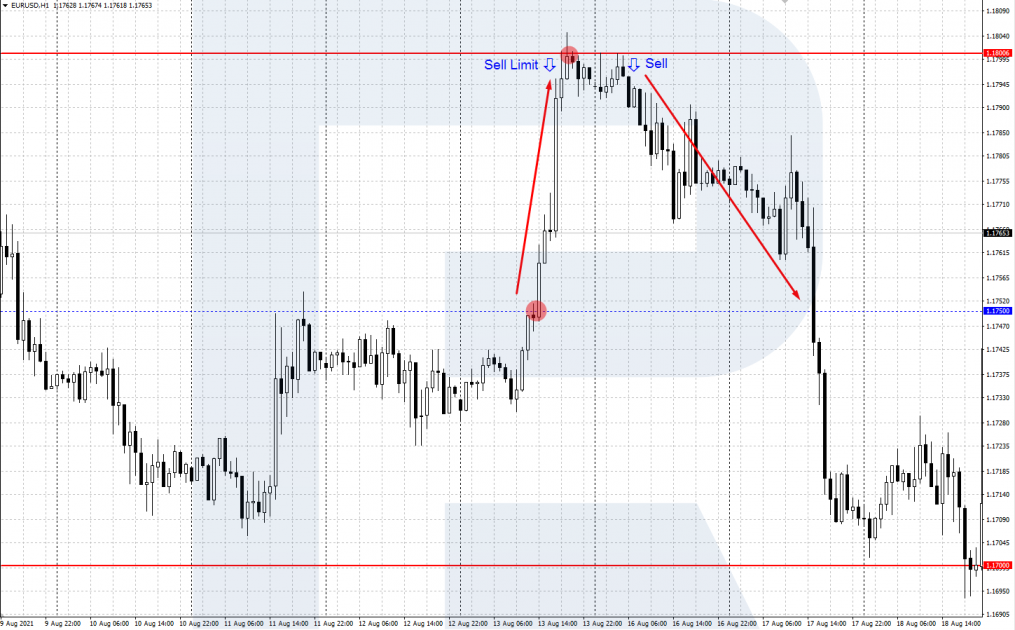

Sell Limit

Sell Limit is a pending order to sell at the Bid price above the current market price. This order is used when the traders relies on the growth of quotations to a certain level and plans to open a selling position there. For example, if EUR/USD is now near 1.1750,while the trader wants to sell the asset at 1.1800, they place a Sell Limit at this level or slightly below it.

Stop orders for opening positions

Stop order is an order to open a market position as soon as the price reaches a specified level. An order to buy is placed at a price slightly above the current one, a selling order — slightly below it. Stop orders are used when the trader expects the price to reach a certain level and go on in the same direction.

They are used in trading strategies that work with breakaways of levels. The peculiarity of this type of order is that as soon as the price reaches the specified level, they turn into a market one automatically.

If the market is calm at this moment, the order will be executed at the specified price. If there is a sharp price impulse (on some important news, for example), some slippage might occur, and the position will open at a price slightly worse that on set.

Buy Stop

Buy Stop is an order to buy at the Ask price slightly higher than the current one. Upon triggering, the order opens a buying position at the level to which the price has grown.

Example:

AUD/USD quotations are at 0.7130. The trader expects the pair to continue growing if it breaks through the nearest resistance level of 0.7150. Slightly above this level (at, say, 0.7160) they place a pending Buy Stop order. When the Ask price reaches 0.7160, a buying position will open.

Sell Stop

Sell Stop is an order to sell at the Bid price below the current market price. Being triggered, the order opens a selling position at the level that the price has reached declining.

Example:

USD/JPY quotations are near 110.50. The trader expects that the pair will keep declining if it breaks through the support level of 110.30. They place a pending Sell Stop order a bit lower that that (say, at 110.25). As soon as the Bid price reaches 110.25, a selling position opens.

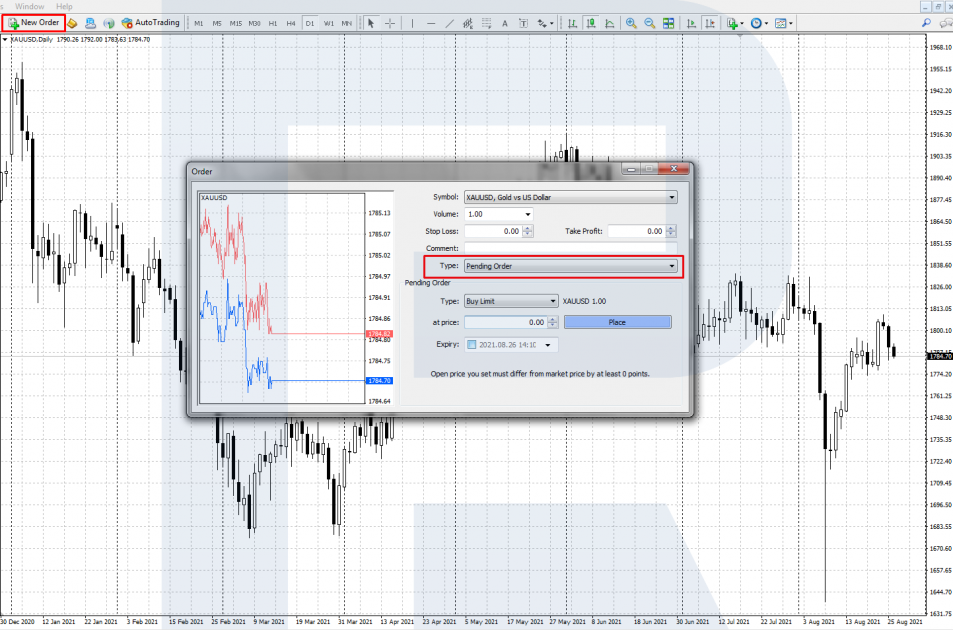

Placing pending orders in the terminal

To place a pending order in a popular MetaTrader 4 trading terminal, open New Order via the Main Menu or a button on the desktop.

In Order Type choose Pending, then choose between a Buy Limit, Buy Stop, Sell Limit, and Sell Stop. Then specify the opening price and the order expiry date, if needed. Then click Place Order.

Your order will be placed and executed by the broker as soon as the price reaches the specified level. You can also add limit orders at once — a Stop Loss and a Take Profit. In this case, your position will both open and close (by SL or TP) on its own.

Closing thoughts

Pending orders are good helpers for some traders and cannot just be replaced for others. They help execute many strategies, limit losses, and take profits.

A trader may even not look at the market if they placed correct pending orders beforehand (though always controlling risks). Planned positions will open or close automatically as soon as the price reaches the set level.