Divergence and Convergence in Trading: How to Use Signals

5 minutes for reading

This article is devoted to such terms as divergence and convergence as well as their use in trading.

What is divergence

Divergence is the instance when the price chart diverges with the used trading indicator. This looks as follows: in an ascending movement the price chart forms a new high that is higher than the previous one while the indicator shows a high that is no higher than the previous one. This inequality might mean that the bulls are losing power, so next thing a descending correction or even a reversal follows.

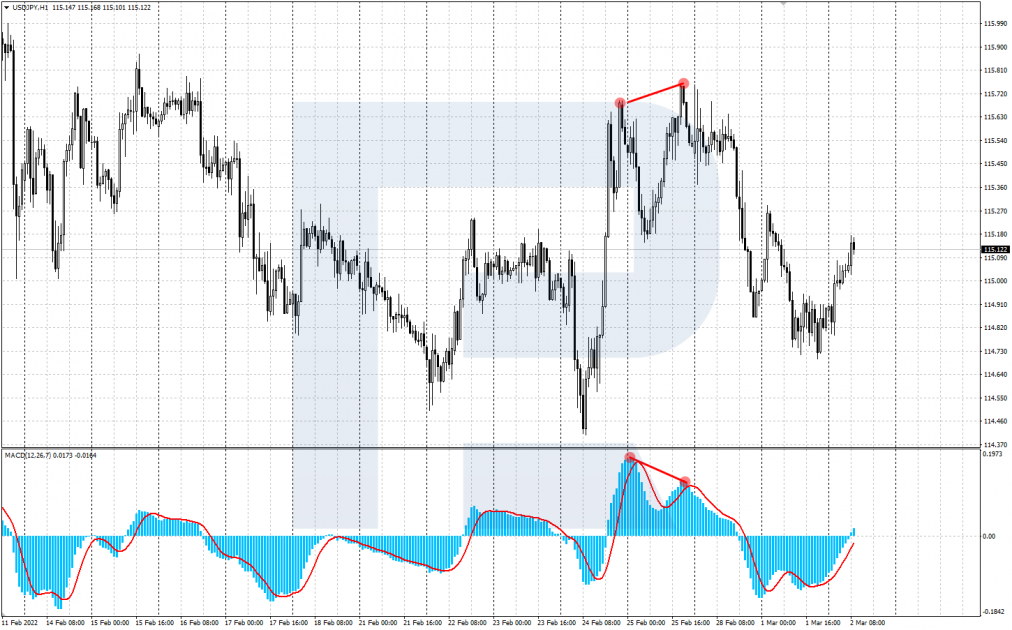

A classic divergence consists of two highs of the price chart and two corresponding highs of the trading indicator. One of the most popular indicators for catching divergences is the MACD (Moving Average Convergence/Divergence).

A divergence may not limit itself by two highs if there is quite a strong ascending movement in the market. Before a descending correction or reversal follows, a triple divergence might form. This means the price chat shows three highs, each one higher than the previous one, while the indicator demonstrates three highs, each one lower than the previous one.

What is a convergence

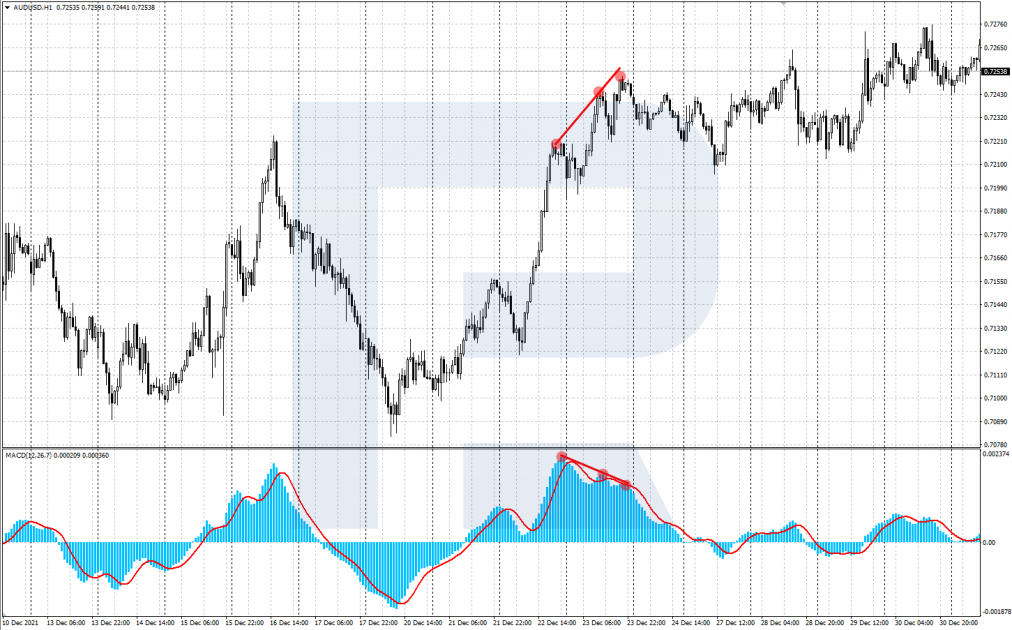

Convergence is when the price chart and the indicator chart converge. This looks as follows: in a descending movement, the price chart shows a new low, which is lower than the previous one, while the indicator demonstrates a low higher than the previous one. The indicator does not confirm the decline which means the bears have become weaker, so next step, an ascending correction or reversal can follow.

A classic convergence consists of two lows of the price chart and two corresponding lows of the indicator chart. This situation mirrors the divergence. The term “divergence” is more popular, so traders tend to call convergence a “bullish divergence”. To detect convergences, the MACD also suits well.

A convergence can also not limit itself by two lows, if there is a stable downtrend in the market. Before a correction or a reversal starts, a triple convergence may form: on the price chart, there will be three subsequently lowering lows, and on the indicator chart, three corresponding lows will be growing.

Divergence vs convergence in trading

A divergence or a convergence on the chart is considered a useful trading signal. Many traders fish for them to open or close their positions.

If you're asking how to determine convergence and divergence, various indicators can be used, the most popular of them being the MACD, RSI, and Stochastic. Convergences/divergences can be traded on any highly liquid assets, on timeframes from H1 and higher.

How to sell with divergences

When a divergence appears, it gives a signal to sell: the quotes set a new local high but the indicator does not confirm it. However, quite often signals from divergences go against the current trend, giving a good reason for closing profitable positions because a reversal becomes too possible.

As for opening new positions against the trend, here one needs to be extremely careful. Beginners should rather abstain from this. To open new positions, divergences during corrections are better. If there is a correction of a downtrend, and a divergence appears in the meantime, this is a good signal to sell. Positions should be open by the current trend.

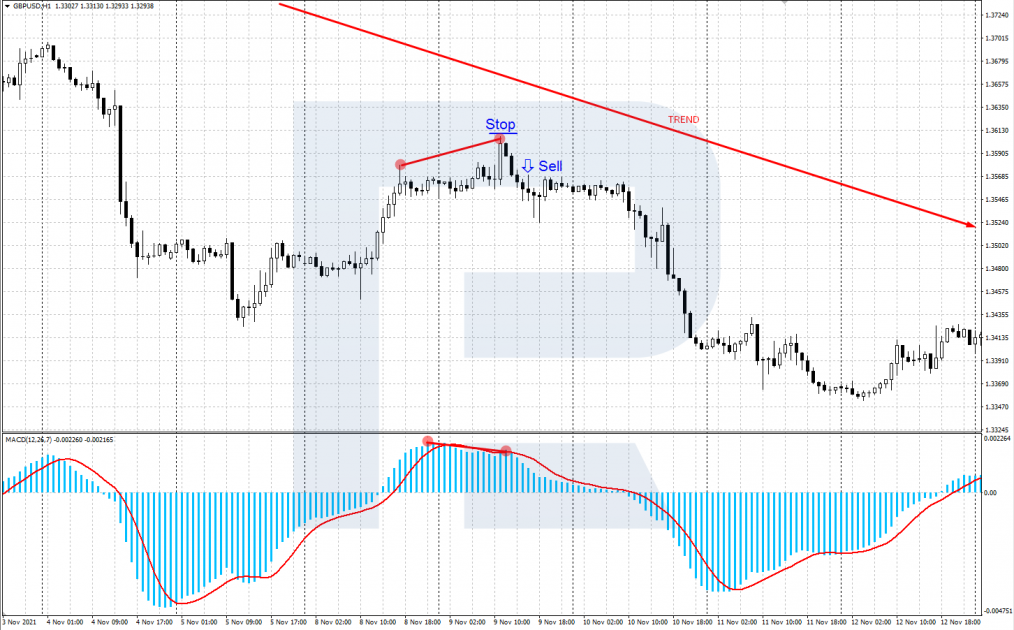

Example of selling by a divergence

- On H1 of GBP/USD in an ascending correction the MACD signaled about a divergence.

- After a local high formed and the price reversed downwards, a selling position by the trend can be opened.

- Stop Loss is to be placed behind the last high, and Profit can be taken as soon as a strong support level is reached.

How to buy by a convergence

After a convergence forms, a signal to buy emerges: the price sets a new local low but the indicator does not. As a rule, convergences give signals against the current trend, giving a good reason to close sales because a reversal is highly probable. As with divergences, trading against the trend is a bad idea for beginners.

To open a buying position, a convergence in a descending correction is necessary. If there is a correction in an uptrend, and a convergence forms, this is a good signal to buy. The correction might be coming to an end, so the quotes will start growing soon.

Example of buying by a convergence

- On H1 of XAU/USD in a descending correction the MACD signals about a convergence.

- After a local low forms and the quotes reverse upwards, a buying position by the main trend can be opened.

- Stop Loss is placed behind the last low, Profit can be taken when a strong resistance level is reached.

Bottom line

In this article we described the difference between divergence and convergence. Divergence vs convergence stand for the process of diverging/converging of the price chart and the trading indicator. These are good trading signals used for opening and closing positions.

To make signals more efficient, the divergence/convergence should be used alongside other instruments of tech analysis. Before trading for real, practice on a demo account.