Fed Will Go on Increasing Interest Rate

7 minutes for reading

What do investors do in the stock market every day? In essence, they try to forecast the future, using tech and fundamental analysis as instruments. However, one can do without it if they find someone who is more exact in their forecasts and copy their trades.

Warren Buffett, also known as the Omaha Oracle, is supposed to be the most successful stock market fortune-teller. We have already told you about his trades.

And today, we will touch upon the most urgent situation. What are the forecasts of market players? Who does the investment community keep such a close eye upon? Let us discuss this.

History repeats itself

There are things which are easy to forecast. Imagine a large company signs a contract with a smaller one for supplying accessory. Most probably, the shares of the small company will be growing because this order might yield an all-time high profit.

But what with more global forecasts? How to find out which market segment will receive most of investments? For this purpose, we can use history: we look how investors behaved in the past and make a new forecast based on it.

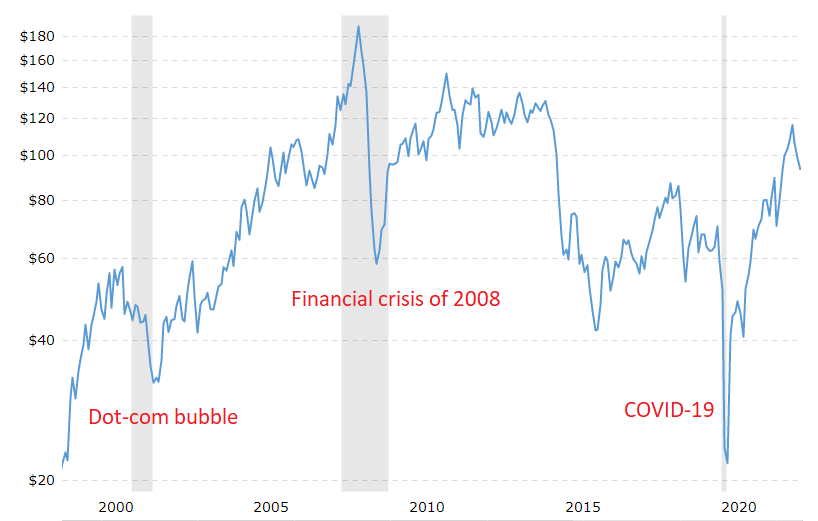

For example, during the financial crisis of 2008, oil prices dropped to 60 USD, after which the government announced certain economic support measures. Those companies that survived the crisis started increasing production powers, the demand for oil grew, and the prices headed upwards.

The story repeated itself: details differ but the overall picture remains without changes. The COVID-19 pandemic provoked a shut-down of companies, the demand for oil dropped, and at a certain point oil prices turned out negative.

Then the US government, like in 2008, announced a new QE programme and initiated paying financial aid to citizens. Demand for good grew, workload on plants stared growing accordingly, demand for oil began to recover and pushed the prices up.

Speaking in detail, oil prices were influenced as well by the falling of investments in the branch, and logistics errors, and the state of war in Ukraine. But on the whole black gold quotes behaved similarly to what happened after the dotcom bubble burst or the financial crisis hit.

Why investors are waiting for Powell’s comments

The idea with oil must be nearly over because the quotes have risen above the prepandemic levels. And now many investors wonder where to look for new ideas.

Now the attention of the investing society is focused on the actions of the US Federal Reserve System; specifically on how it tries to beat inflation in the country.

Experts are trying to forecast what the head of the Fed Jerome Powell will do. Will he go on restricting the monetary policy or will he give hints on a slow-down in the growth of the rate, or will he say it is time to go back to QE?

Some even say that Powell does not quite understand what is happening, and the situation is out of control. However, market players do not count on such a scenario yet. This can be noticed by the yield on three-year treasury bonds that started falling in June.

We should pay credits to the head of the Fed: he keeps hinting on which indicators to pays attention to for analysis and on which conditions he will make these or those decisions.

Since 2008, QE programmes brought the US debt up from 87% to 137% of the GDP. To cut down on the debt, it must start growing slower than the GDP. And the growth of the latter is necessary for paying off the debt.

However, current inflation over the country is at its highs of the last 40 years, and the Fed increases the interest rate to beat it. However, this increase leads to the debt becoming more expensive to serve, the growth of the GDP slows down and so does the economy. Hence, less tax payments. So where to get money for serving the debt?

In the 1970s, inflation in the US was also high but the debt load was under 30%. In the end, it is time to invent something new (like Japan has managed to think of QE) or find a solution in the history of another country (the debt of Japan in 2020 reached 266% of the GDP).

Isn’t there mistake in inflation calculations

For now, Jerome Powell sticks to the plan invented after the financial crisis. At that time, inflation leaped up to 6%, then dropped to -2%.

Here we can see his first mistake, and it is the idea of inflation being a temporary phenomenon. Even in 2021 he insisted on inflation being temporary, which means there was no need to increase the rate too soon. And this year he has admitted he was mistaken.

This perplexes investors.What will the Fed do now? Will the interest rate grow further? If so, then how high? Or will the cycle of growth end in 2022, and will recession make the government think about bringing down the rate and taking measures to support the economy?

On the decision of the head of the Fed, behaviour of stock market investors depends. Until recently, judging by what Powell used to say, market players expected the growth of the interest rate to end in 2022 and a decline in the rate to 2023. With these expectations, treasury bonds yield stopped growing in June, while the S&P 500 and NASDAQ 100 stock indices headed up.

However, these days it occurs more and more frequently to investors that the head of the regulator had underestimated the scale of the problem. In 2022, inflation will not be able to drop to the planned 2%, and the actual interest rate is too low to beat it.

If Powell admits this fact, he will have to count on a longer cycle of interest rate increase. This does not only mean a decline in stock indices but also further growth of treasury bond yield, making bonds more appealing investment options than stocks.

How was Jackson Hole Symposium

Last week, there was an economic symposium at Jackson Hole that gathered heads of Central Banks of developed countries. Jerome Powell also spoke there. Investors anticipated his speech: they needed to know what the Fed would do next.

The speech took just 8 minutes, but it was enough for the richest people in the US to lose 78 billion USD.

What did Powell say

The gist of the speech was that the Fed would take every effort in beating inflation and that this could lead to a decrease in consumers' income, growth of the unemployment, and a slow-down of the economy. Unfortunately, this is the reality.

In other words, Powell made it clear that the interest rate will go on growing. Upon hearing this information, investors started to change their expectations, and the possibility of a decrease in the interest rate in 2023 dropped at once. Simultaneously, the yield of bonds sky-rocketed, and the S&P 500 and NASDAQ 100 stock indices started falling.

While the interest rate is growing, bonds are becoming more appealing investment options, so money flows to them from stocks. This said, we may suggest that stock indices will head on to the lows of June.

Closing thoughts

If we have enough knowledge and check economic indices regularly, we can predict rather exactly what will go on in the economy and make investment decisions accordingly.

This forecast needs to include the actions of the Fed, and this entails studying the biography of its head in order to understand whether they are ready for risks, are able to admit their mistakes, and can change the course when necessary.

Powell's speeches have helped investors make decisions. However, his latest speech demonstrates that the time for optimism has not come yet.