Larry Connors' Double 7 Trading Strategy

5 minutes for reading

In this material, we will get acquainted with the "Double 7" medium-term trading strategy of the famous trader Larry Connors. We will learn what it is based on, and how it can be used in trading. We will consider its advantages and disadvantages and give an example of trading using this strategy.

How the Double 7 strategy works

The Double Seven is a fairly simple trading system that was introduced in the book “Short-Term Trading Strategies That Work”. It was written by the famous investment consultant and stock trader Larry Connors in co-authorship with the developer of trading systems Cesar Alvarez. The strategy was created for trading in the stock market, and the authors used it to trade major stock indices (S&P 500, Dow Jones) or index ETFs.

The Double 7 is based on the concept that when trading major market indices, an effective strategy is to buy on pullbacks in a major uptrend. A valid uptrend is defined as the price being above the 200-day Moving Average. A pullback is defined as a close below the lowest low of the last seven days, in which case a buy is opened. Once a buy is opened, one must wait for a new seven-day high to close the position.

After reading the trading rules, we can see that the "Double Seven" was developed for daily charts and is only used to open and close long positions in a rising market. That is, it works only in one direction – to buy the asset, shorts (short positions) are not used in this strategy and Stop Loss orders are not set. When tested by Connors and Alvarez, the system showed positive results on stock indices, ETFs, and highly liquid US stocks.

Setting the Moving Average indicator

This strategy uses the Moving Average indicator to determine the current trend. Moving averages are included in most modern trading terminals, plotted directly on the price chart. In the popular trading platforms, MetaTrader 4 and MetaTrader 5, you can install the Moving Average on the chart of the selected instrument through the Main Menu: Insert → Indicators → Trending → Moving Average. In the setup window that appears, select period 200, line colour and thickness, MA method: Simple.

How to trade the Double 7 strategy

The algorithm for using the strategy in trading:

- The price chart should be above the 200-day moving average, indicating an uptrend.

- We must wait for the day to close at the low of the last 7 days.

- If points 1 and 2 are met, a buy position is opened.

- The signal for exiting a position is to close the day at the seven-day high.

Example of trading the Double 7 strategy

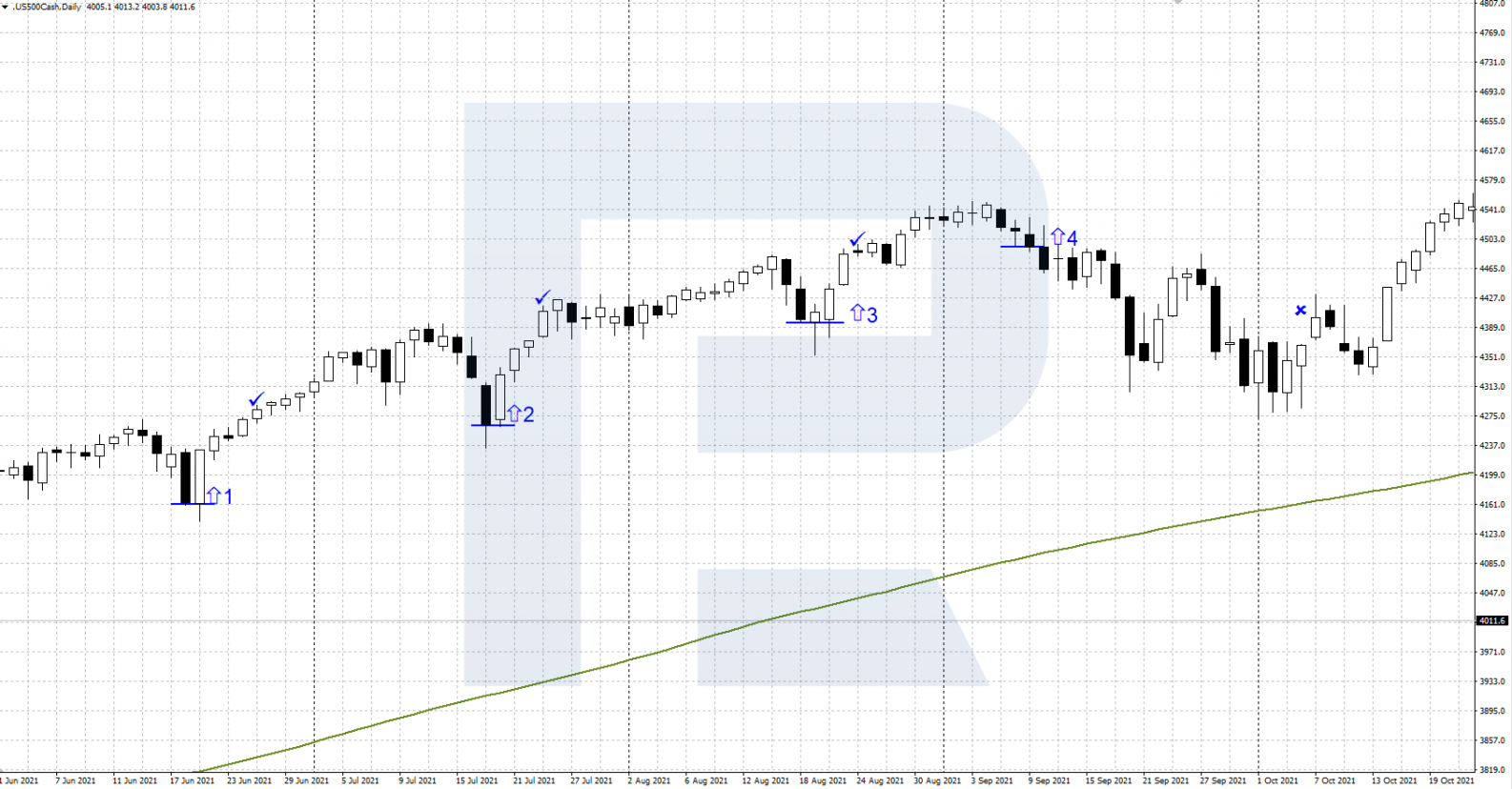

- In the selected chart segment, the price of the S&P 500 stock index is trending upwards and is above the Moving Average with a period of 200

- When the price closes at the 7-day low, a buy position 1 is opened. Quotes move upwards and the position is closed at a profit when the 7-day high is reached

- At the next price close at the 7-day low, a buy position #2 is opened. Quotes move upwards and the position is closed with a profit when the day's closing price reaches the 7-day high

- At the next price close at the 7-day low, a buy position #3 is opened. Quotes move upwards and the position is closed with a profit when the day's closing price reaches the 7-day high

- At the next price close at the 7-day low, a buy position #4 is opened. Quotes begin to decline and the position is closed with a loss after a few days when the day's closing price reaches the 7-day high

Advantages and disadvantages of the Double 7 strategy

Advantages:

- Works well in a rising market, giving entry points into an uptrend after small corrections. The strategy generates profitable trades, as long as there is a strong uptrend

- There is no "stop order" in high market volatility, as no Stop Losses are placed

Disadvantages:

- At the end of an uptrend and a downward reversal, the trading performance declines sharply

- There is no possibility of trading short positions (shorts) during a downtrend

- Lack of Stop Losses can lead to prolonged and significant drawdowns of the trader's deposit

Conclusion

The Double 7 is a fairly simple trend-following trading system developed by Larry Connors and Cesar Alvarez. It is a medium-term investment strategy that involves buying during corrections in a rising market without the use of Stop Losses or leverage.

According to a study conducted by the strategy’s creators, it showed steady positive performance in the stock market between 1995 and 2007. Since 2008, its performance level has declined significantly and it is difficult to determine its degree of effectiveness at this time. Before using this system in real trading, its performance should be tested on historical data from recent years.