Infinity Expert Advisor: Infinite Profit

5 minutes for reading

Dear traders, welcome to RoboForex Blog!

Trading on financial markets, including Forex, has always required a fast and precise analysis of the situation and minimum emotions. Hence, the recent development of algorithmic trading with its trading robots and systems of various complexity looks quite logical. A food expert advisor trades dispassionately, in strict compliance with its algorithm and strategy.

Infinity EA

The protagonist of this post is Infinity – an expert advisor based on a strategy with the same name. Judging by how it works off various signals, it may be called scalper. The expert advisor can work with virtually any currency pair, so we may call it multicurrency. It can work on different timeframes, but as for my experience and several reviews, M15 and H4 suit the best.

The work of Infinity is based on 2 indicators; they are not standard but specially selected by the creator of the trading system and customized for this strategy.

The Center of Gravity indicator

This indicator is an alteration of Bollinger Bands. In Infinity, it is used with selected parameters that cannot be set up manually – they are hidden, and the initial code is not provided by the creator.

The Candle Average Indicator

This indicator has its formula but performs the functions of a usual oscillator, i.e. it filters the signals of the first indicator.

Signals to open trades

As the signal to open a trade, Infinity uses touching or crossing one of the channel borders, formed by the Center of Gravity, by the price chart.

To open a buying trade, the following conditions must be complied with:

The price reaches the lower border of the Center of Gravity, while the Candle Average histogram is below -0.81.

To open a selling trade, the following conditions must be complied with:

The price reaches the upper border of the Center of Gravity, while the Candle Average histogram is above 0.81.

Studying the initial settings of the Center of Gravity, we figured out that they are as follows:

- Bars Back – the number of candlesticks for analysis – 120.

- m – the coefficient of linear regression – 4.

- i – the number of candlesticks for a shift to the past – 0.

- kstd – the coefficient measuring the distance from the central line to the borders; the bigger the coefficient, the larger the channel – 2.4.

- sName – the point on the chart, marking the start of the calculation of participating candlesticks – 720.

For the Candle Average, the settings are as follows:

- Length – the Moving Average parameters – 3.

- H period, L period, C period – the highest, lowest, and closing prices of the period, respectively – 3.

The classic variant of the trading strategy does not use Take Profit or Stop Loss, all trades closing by Trailing Stop only. However, the developers of Infinity decided that it was too risky and added Stop Loss levels to the expert advisor, strict but customizable. Meanwhile, Trailing Stop is also used, as in the initial variant.

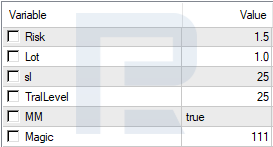

Initial settings of Infinity

- Risk – the risk in each trade, in % of the deposit – 0.5.

- Lot – a fixed lot, if automatic money management is not used – 1.

- sl – fixed Stop Loss for each trade, in points – 100.

- TralLevel – Trailing Stop, in points – 50.

- MM – automatic money management, calculating the lot in % of the deposit – false.

- Magic – the “magic number” for the expert advisor to identify its orders.

All settings are customizable.

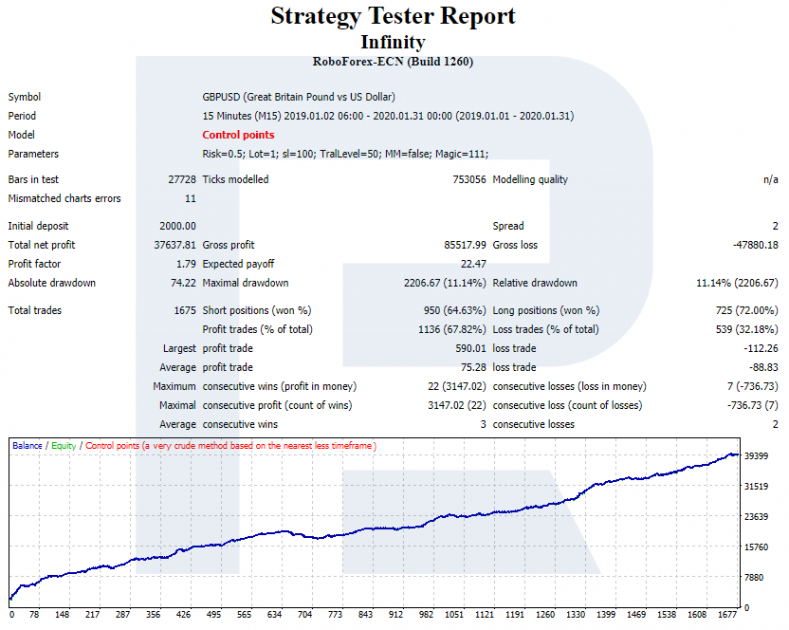

Testing and optimizing the Infinity Expert Advisor

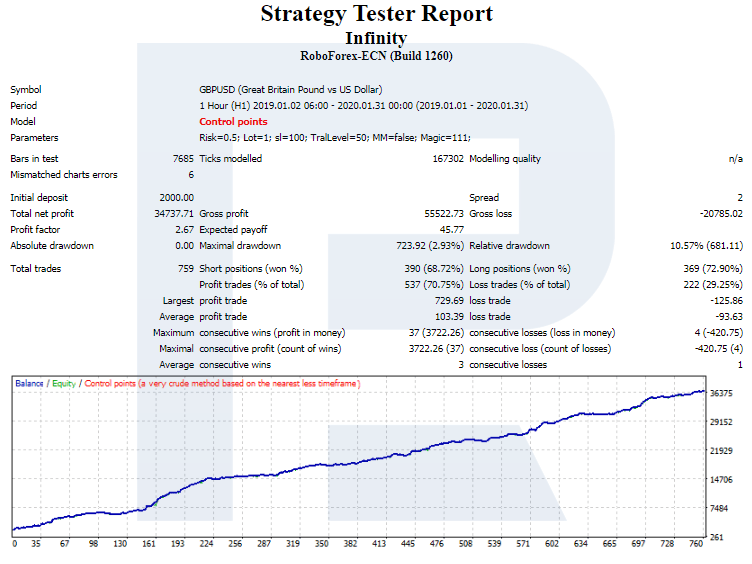

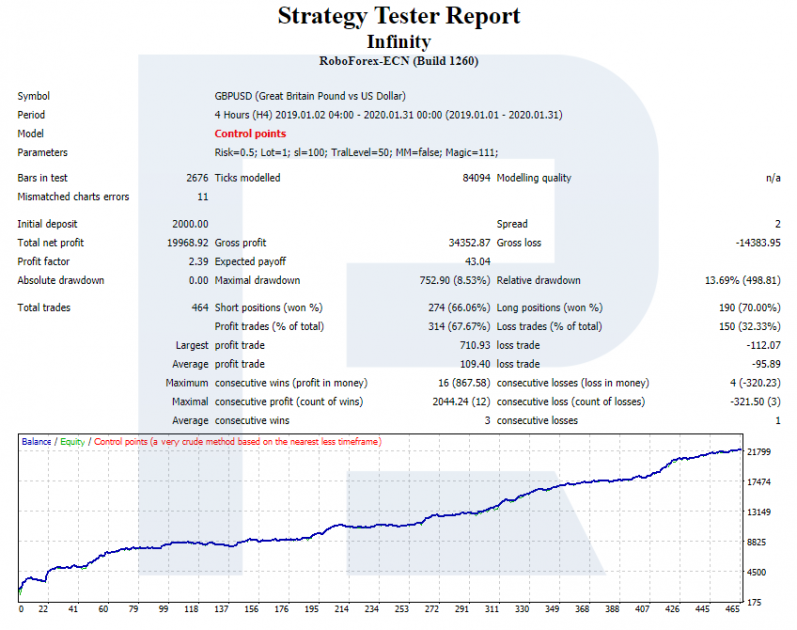

Is it really necessary to optimize the settings of the expert advisor? Maybe yes, maybe no. Anyway, you must test the work of the advisor in the MetaTrader 4 built-in strategy tester. Testing of the robot with initial settings on H1 with EURUSD showed rather interesting results:

On various timeframes, the following results are received:

The curved lines show that M15 gives the best results, probably because there emerge more signals to be worked off.

With such values, we should optimize the parameters and settings to get better results on the same timeframes. In the default settings, automatic money management was off but the capital was increasing. The primal hypothesis which said that with money management on the capital would multiply was confirmed. At the same time, the Stop Loss played an important role, preventing the deposit from a deep drawdown and a collapse.

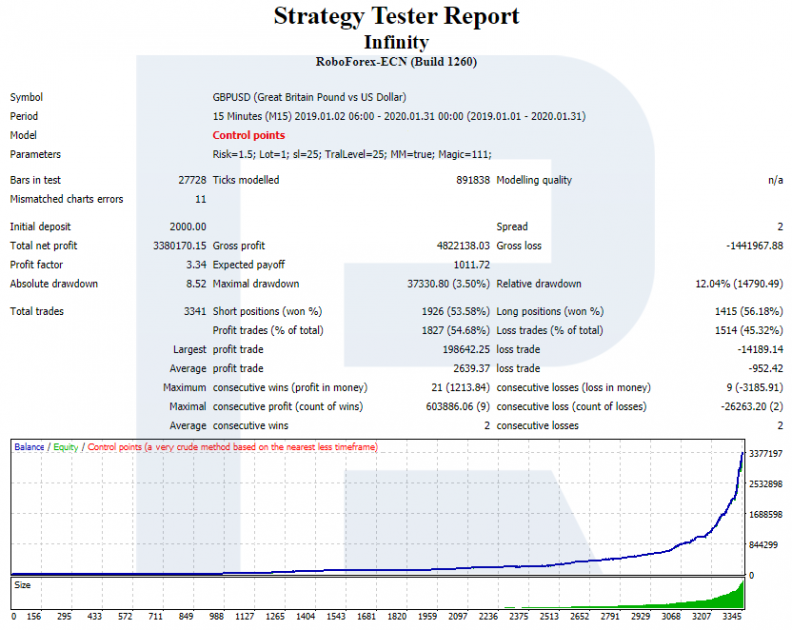

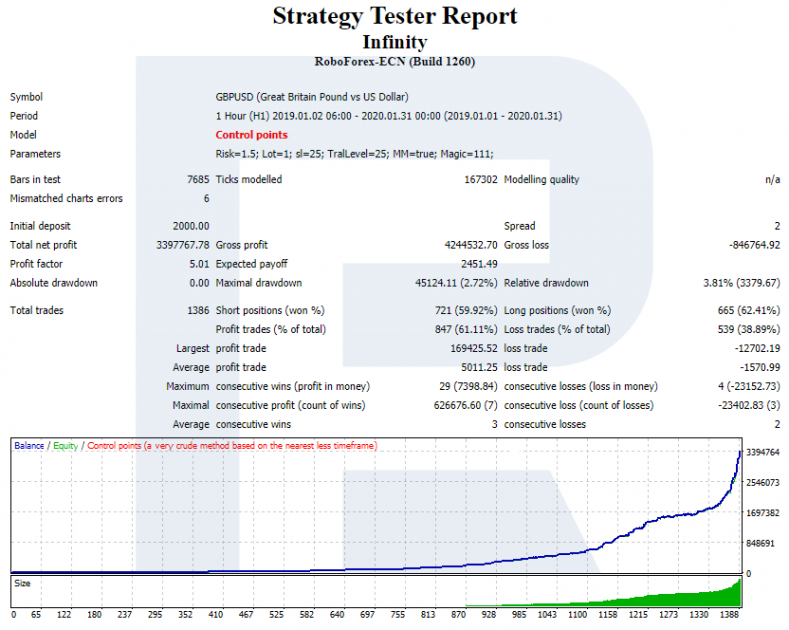

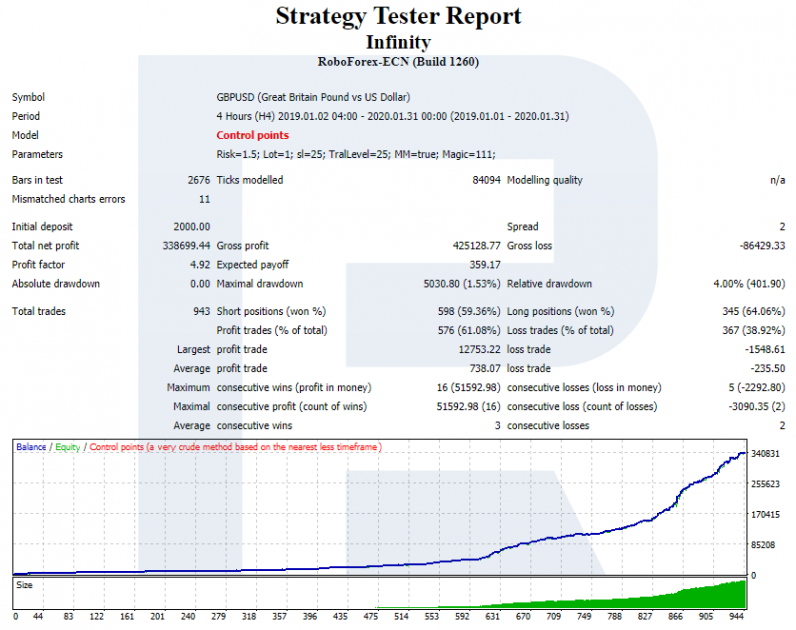

The next hypothesis suggested checking the results on M15, H1, H4 with the same but optimized parameters. The settings were as follows:

The results of the comparative testing were as follows:

Summary

As we can see on the charts, after the optimization, the profitability of each timeframe remains virtually unchanged. The profit factor on each timeframe was 3 or higher, which means that the sum of profitable trades was several times larger than of losing ones.

On the whole, speaking modestly, the results are impressive. However, I would like to additionally test the system and the expert advisor, changing and optimizing the settings involved in the emergence of the signals to sell and buy. The only disadvantage of the expert advisor is, perhaps, the inability to change the indicator settings. All in all, the results demonstrated by the robot speak for me.

Successful trading to you all!