Boosting Your Deposit with Bunny: Testing the Expert Advisor

5 minutes for reading

Today, we will get acquainted with a trading robot which is meant for small starter deposits but trades much faster and with a higher risk than, say, Piplaser. The Bunny expert advisor is a scalper trading flats; it uses the same technique of averaging as the Martingale method.

Trading algorithm of the Bunny expert advisor

The trading algorithm of this robot is meant for trading flats; many state that most of the time the market is moving in a trend. However, there is an opinion that trends take only 30% of the market time, while the remaining time is dominated by flats. By this theory, flats last roughly 2 times longer than trends. Even though many traders are sure that we should make money on trends (and so am I), but some try to prove the contrary. The Bunny expert advisor is one of their examples.

Apart from being a scalping robot, the Bunny is also promoted as an expert advisor for small deposits; I have already discussed some of such robots in the blog. However, there is one point: the Bunny uses 2 risky techniques – the averaging of open positions and Martingale. The latter technique is used for averaging and consists of doubling the lot each time the trader opens a new position to average the already opened one.

You may, of course, switch off Martingale in the settings of the robot; however, averaging is a part of the trading system meant for protecting form a movement. I do not know whether the Bunny EA uses any indicators; however, judging by the results of back-testing, it trades differently: sometimes it opens trades by the trend while in other cases it opens trades strictly counter it and, naturally, averages.

After the expert advisor opens its positions, the market not necessarily proceeds in their direction, so it has to average frequently. Regardless of being meant for trading flats, the Bunny advisor keeps trading 24 hours a day, never “caring” about the price being in a trend or a flat. It seems like the robot does not even try to distinguish between them, opening trades for some other reasons.

Trading flats

Trading the trend will be clear even for those who are not familiar with trading. Open a trade at the beginning of a movement in its direction and close at the end of the movement (or a bit earlier/later, which is not so important).

However, trading flats may not be so transparent and clear. Very long ago, in 2008, night scalping was popular; by the way, it was based on trading flats. The strategy was simple: at night, which is normally the Pacific session, movements on most markets were minimal and the price got stuck in flats for several hours.

For trading those flats, market players often used expert advisors as they had to open many trades very fast, placing very small Take Profits and Stop Losses, sometimes on several instruments at once.

Moreover, you had to trade all night long, which is not for everyone to endure.

Technical characteristics of the Bunny expert advisor

Try to choose the main currency pairs, i.e. EUR/USD and GBP/USD, and M1 as the timeframe, though on other periods, the expert advisor also works well.

The minimal deposit is $50, on the condition that you will trade with a minimum lot and leverage no smaller than 1:500.

The Bunny advisor parameters

- MultiLotsFactor is the Martingale factor

- “Lots” is the starter trading lot

- TakeProfit in points (for 5-digit quotations, multiply by 10)

- StepLots is the distance between the averaging orders and the main one

- UseTrailing switches on Trailing Stop

- TrailStart is the number of points needed for switching on trailing Stop

- TrailStop is the size of Trailing Stop

- MaxCountOrders is the maximal number of averaged orders

- SafeEquity limits the risk in percent of the Equity

- SafeEquityRisk is the size of the risk in percent of the Equity

- Slippage is the maximal deviation of the price at placing orders (for 5-digits numbers, multiply by 10)

- MagicNumber is the number for the orders of this copy of the expert advisor.

Testing and optimizing the Bunny EA

As long as this expert advisor shows great results with the default settings, I decided against optimizing it. Instead, I tried it on various timeframes.

When optimizing the expert advisor remember that in robots, Martingale seriously distorts the results of tests compared to real ones; so, optimize it with MultiLotsFactor = 1.

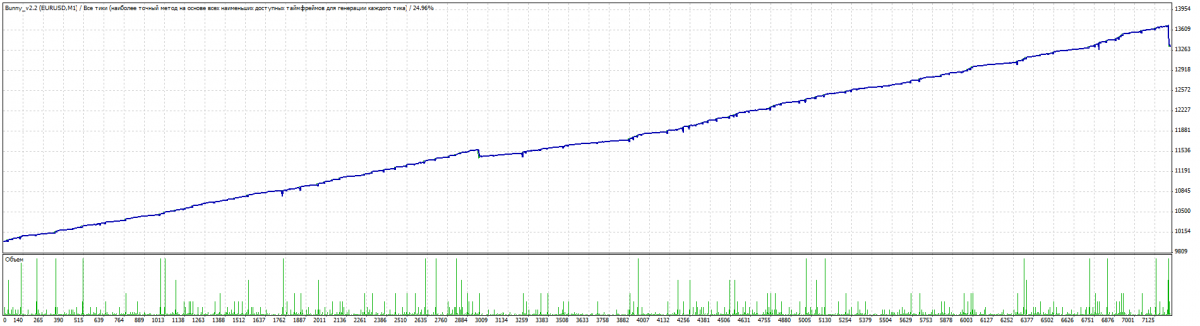

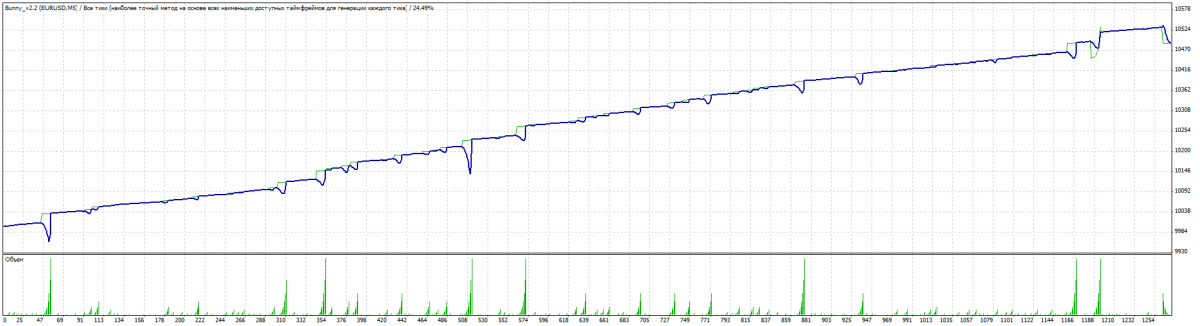

These are the results of the Bunny expert advisor test drive on the euro, M1:

M5:

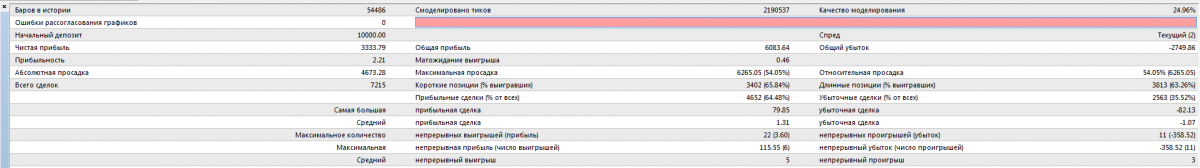

M15:

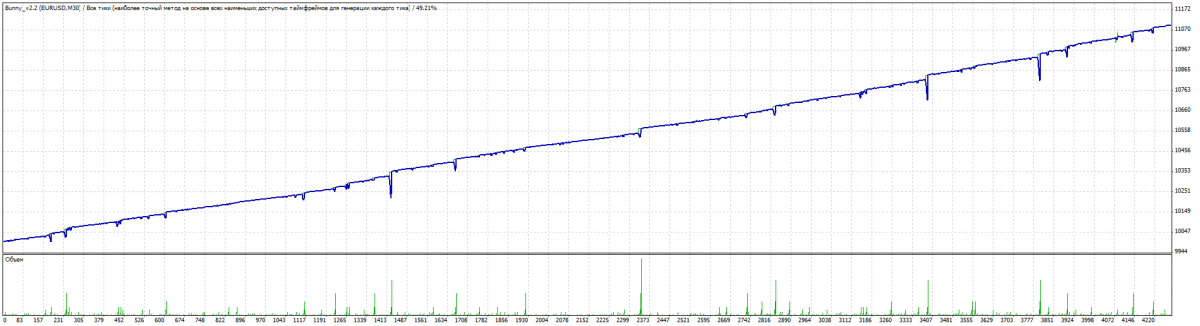

M30:

H1:

The difference is that on H1, the Bunny EA opens many more trades, which is clear. Drawdowns were the smallest on M1, the largest – on M30, so I recommend using M1.

Closing thoughts

Judging by the above mentioned, the Bunny expert advisor demonstrates a high profitability thanks to the averaging and Martingale only. On the other hand, Martingale is a perfect way to “blow up” small deposits. If you risk small sums, this robot is good, but always remember that it is risky and withdraw your profit from time to time.