How to Invest in Stocks for Beginners

9 minutes for reading

No one is born experienced, all of us have to take the way from a beginner to an expert. A trader’s way in the market is no different, but we always wish to make as few mistakes as possible on it. In the stock market, mistakes cost money, that is why the abundance of them directly influence your deposit.

Now, the situation is especially hard for beginners. The coronavirus prevents many companies from working on their full scale, the US presidential elections are heating market volatility, and it is not quite clear what the billions of the USD allocated to support economies will lead to.

On the other hand, we must be in the midst of a crisis, and stocks should trade at their local lows – however, many stocks are nearing their all-time highs, making the choice even more torturing. What a beginner should do?

In this article, I will tell you how to choose instruments in the situation of the pandemics and the US presidential elections if you have just heard about the stock market.

Investments in famous companies

The first thing that comes to the mind of a beginner is to invest in world-famous companies. This is a good idea because the larger a company, the less it is dependent on news that may even turn false in the long run. Such companies always have the growth potential, and even if the president changes, they hardly feel it.

However, mind that in the stock market, you not only make money on the stock price growth but also get dividends paid to you. This is another reason to pay attention to large companies because they can provide for stable dividends payments, sometimes even in a crisis.

Great. The decision seems perfect: look for famous companies and invest in them. However, which companies would you call famous? For some, a famous company is NVIDIA (NASDAQ: NVDA) or Advanced Micro Devices (NASDAQ: AMD). For mere users of PCs, McDonald's Corporation (NYSE: MCD) will be a large popular company. As you see, there are more questions than answers, so I suggest taking an easier way.

Investments in index stocks

The first and easiest way is to invest in index stocks, i.e. stocks included in the S&P 500, Dow Jones, Nasdaq 100, and others. Such companies, which stocks are in the indices, are large businesses, leading in their corresponding sectors.

Let us have a look at the example of the S&P 500. For a company to get into the index, it must fulfill the following requirements:

- It must be registered in the USA;

- The capitalization must be over 8.2 billion USD;

- The trade volume of its stocks must be over 250,000 per month;

- 50% of its stocks must trade in the exchange;

- The last four quarters must be profitable.

If a company meets these requirements, it may hope to enter the index. Meanwhile, a new company that gets in usually squeezes out the weakest one. Thus, the issuers that are included in the index are potential candidates for conservative investments.

👉 More detailed information about investing in stock market indices, you can find in the post below.

Investments in stock indices

The S&P 500 unites 500 companies, and here, the trader also has to choose: which stock to buy, or whether to buy all the 500? For the latter option, your deposit needs to be impressive, that is why you may consider investing in the index itself.

Now, it costs 3,460 USD per contract. Not quite affordable, is it? So, if your deposit holds 5,000 USD, this will not be enough for 2 contracts even, not to mention that you should invest in different instruments or companies.

So, there is another way, and you can invest in the same S&P 500 but through the ETF.

Investments in index ETFs

The ETF is a stock investment fund, which stocks trade in the exchange. It consists of a certain set of securities or assets; it may include companies of one sector or companies included in one stock index.

There are plenty of ETFs with all sorts of investment ideas. The crucial thing here is that the ETF allows us to invest in index stocks with much smaller sums but enjoy the same percentage of profit.

ETF SPDR S&P 500 (NYSE: SPY) is now traded for 345 USD per contract. This is 10 times cheaper than the S&P 500 itself while the profitability almost always remains the same. In this case, there is no need to pay extra. You can also choose ETFs for other stock indices.

So, here we get another investment idea for beginners: invest in ETFs!

Where to find the list of the world’s largest companies?

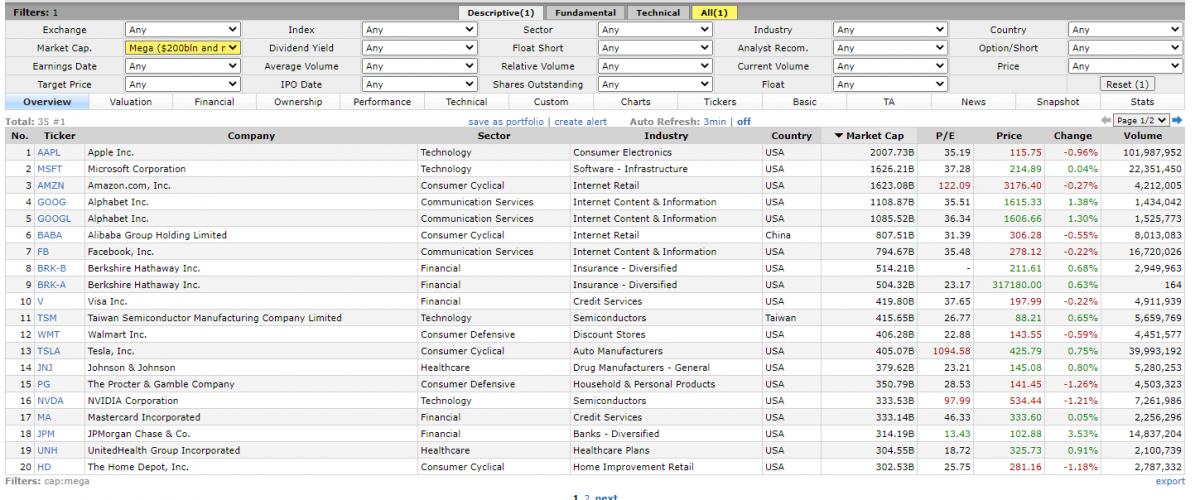

Yet, you can take the first route and try to buy stocks of the largest companies. Your choice will be a bit more difficult, however, you can narrow the circle by their size, which will be the criterion of their “fame”. To get started, let us limit the list by the size of their capitalization. On the Finviz.com website, you can hide issuers with capitalization below 200 billion USD. Here we have the list of 35 companies, potentially suitable for investments.

Let us do the simplest thing: sort the companies by their size and choose 5 largest. These will be the world’s largest companies traded in the exchange.

However, this is not where our choosing ends. Sure, we have 5 world’s largest companies. But to decrease your risks, you need to invest in those issuers that work in different sectors, i.e. the main business of each company on your list must somehow differ from the businesses of the others. So, here is the final set:

- Apple Inc. (NASDAQ: AAPL)

- Microsoft Corporation (NASDAQ: MSFT)

- Amazon Inc. (NASDAQ: AMZN)

- Alphabet Inc. (NASDAQ: GOOG)

- Facebook, Inc. (NASDAQ: FB)

Now let us discuss each one in more detail.

Apple Inc.

Apple Inc. is the world’s largest company in terms of capitalization. This is the only company that managed to sell out the device it had just presented for an hour. Apple presentations gather millions of people worldwide; nowadays even movies are filmed on Apple mobile devices.

Its advantages are numerous, but the main merit is a complete base of loyal clients which brings a stable inflow of money and lets the company pay generous dividends to its stockholders.

Microsoft Corporation

The next company is Microsoft Corporation. Billions of people all over the globe use the Windows OS, created by the company, on their PCs and laptops. Microsoft Office products are no less popular. Microsoft is one of the largest transnational companies producing proprietary software for IT equipment.

The company’s annual revenue has reached 134 billion USD, which is higher than the GDP of many countries where millions of people live and work. Investments in such a giant cannot be called risky.

Amazon

Amazon is no less popular than its counterparts above. It is now the leader of online retailing. Almost half of all electronic commerce in the USA is taken up by Amazon; according to some evaluations, over 100 million US citizens pay for membership in Amazon 119 USD annually.

However, the main part of the profit is generated by Amazon Web Service, i.e. the cloud calculation platform. The company’s annual return amounts to 320 billion USD, which is almost three times larger than that of Microsoft Corp. Amazon employs 876,000 people.

Alphabet Inc.

Alphabet Inc, previously called Google, is also the leader of its segment. The Google search system takes up 90% of the world market; the most famous video platform YouTube belongs to Alphabet; the Android OS is number one on mobile devices.

Alphabet is almost everywhere in the sphere of technology, from virtual reality to unmanned cars with artificial intelligence. How can a beginner avoid such an appealing option?

Facebook Inc

Last but not least is Facebook. This is the leader in the world of social networks. The company boasts over 1 billion active users a month. Instagram, WhatsApp, Facebook Messenger – these are the platforms known to everyone who uses social networks, and they also belong to Facebook Inc.

Facebook is the only company on the list that has its long-term debt at zero, while the profitability of the business is 31%. Its Short-Float is below 1%, which means virtually no one plays these stocks short. Facebook is a brilliant candidate for long-term conservative investments that suit beginners perfectly.

At what price should we buy stocks?

After you have chosen the stocks for investments, you only need to choose the price for buying because this is what the profitability of your stocks depends on.

A beginning investor usually has very limited knowledge of tech analysis. Thus, the simplest and most useful instrument will be the 200-days Moving Average. Looking at the price charts above, we can conclude that it is most profitable to buy stocks at the place where the price comes close to the 200-days MA or touched it.

If the price drops lower, this means another opportunity to buy the stocks at a lower price. Later, the stocks of all companies on the list rose much higher than the price you could once buy then for. if you had bought them at the 200-days MA.

Closing thoughts

So, what are our investment options:

- Investments in index stocks;

- Investments in indices;

- Investments in index ETFs;

- Investments in the world’s largest companies.

Such investments are long-term and conservative; however, if the global economic situation is good, you can expect a two-digit percentage of interest yield. A change in the president’s chair or the pandemics increase volatility in those instruments, but this may be used as an opportunity to search for better prices.

Always remember, that I have just shown you several options, while the final decision is after you.