How to Trade in Forex During Crises?

6 minutes for reading

In times of crises in the global or local economy, traders have only questions: how to trade and make money? Should one pay attention to currency pairs — or invest in protective assets, such as gold, right away? Which trading strategies to use?

Before answering these questions, let me remind you that Forex, unlike, other markets, always feature liquidity and volatility. If the stock market might be experiencing certain lull, currency pairs keep trading all the time, and in crises, they are almost always in trends (ascending or descending). However, even this rule has exceptions.

The next idea should neither be news to you: trading in crises, especially in a highly volatile market, implies increased risks. They will also be touched upon in this article.

And now let us look at some examples of how crises can influence currency prices and how we can use it in trading.

Types of crises and examples of trading

A crisis can emerge at the global level (the COVID-19 pandemic is a good example) as well as at the local one. One example of the latter type is natural disasters.

Such events cause damage to the infrastructure and people's homes, goods supply, transport, and manufacturing. As a rule, the country becomes unable to produce and export goods because it spend all of its resources on recovery.

In most cases, the country's national currency starts falling. This gives a chance to sell pairs containing this currency. However, the beginning of such falling, not to mention its end, is rather hard to predict. The currency might even not react to the natural disaster.

Let us look at the example of AUD/USD and GBP/USD during floods in Australia and Great Britain in March and June 2012. While the Australian dollar demonstrated a serious slump, the pound remained in a flat.

The movements of national currencies depend on the scale of the disaster and the country's readiness to cope with the consequences. As seen on the charts below, we cannot always evaluate these factors fully. It seems that in such circumstances, the only reliable strategy is scalping or intraday trading. However, sometimes in crises, the market allows to trade medium and long run. In the end, everything depends on the trader’s ability to assess the macroeconomic situation correctly.

As one example, take the debt crisis of Europe in 2009-2010. The trigger was the economic crisis in Greece, and market panic ragged the common European currency down. At that tie, the euro lost up to 20% of its price.

If the trader analyzed the situation deeply, they could use a long-term strategy based on the falling of EUR/USD but this would have been a hard job to do. Hence, to work medium and long-term during crises, you need brilliant analytical skills and an ability to forecast market behavior.

Investments in protective assets

Major market players agree that during crises, investments in precious metals are the safest and most reasonable way to keep your money safe.

When currency prices start wandering chaotically, investing in, say, gold will be wiser. A money flow in gold provokes its growth.

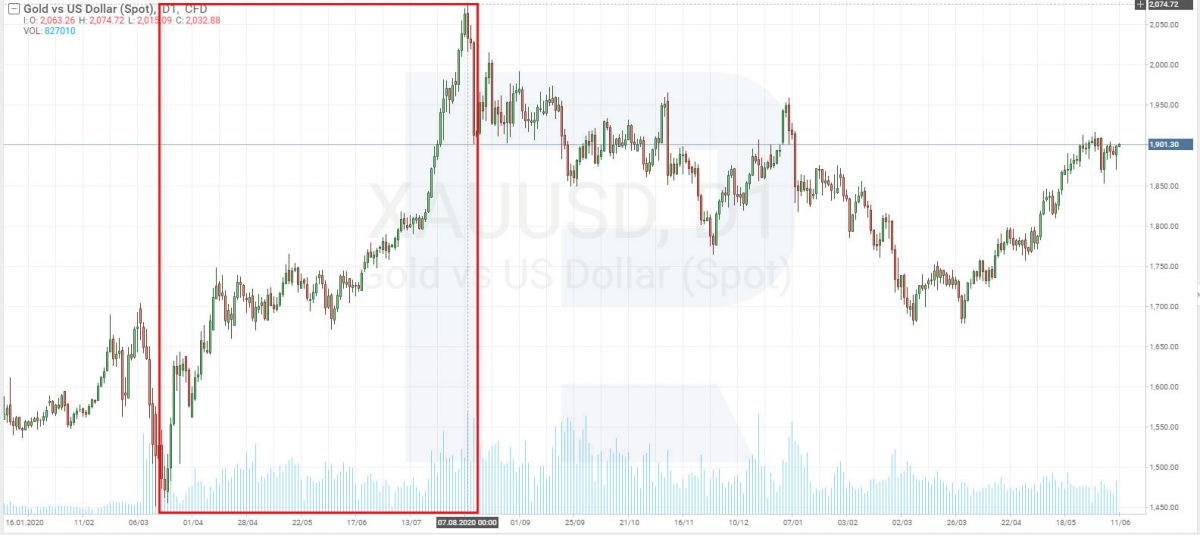

The confirmation is the growth of gold quotations, so that they reached the high of over 2,000 USD per troy ounce in August 2020 at the breakout of the second COVID-19 pandemic.

Trading metals in crises may be called medium-term trading. Your position can stay open for several months; hence, consider swaps and the practical side of using large leverage.

Which strategy to choose in crisis?

In crises, many strategies give false signals, and traders face Stop Losses triggering regularly. In this case, traders tend to choose various scalping strategies that suit them personally.

Personally, I consider scalping to be the hardest of all types of trading. To use it, you need serious preparation, an ability to make fast decisions, and to work automatically. Beginners hope for fast money and ignore risks but in practice, one losing position left open and unattended, can get you rid of your capital overnight.

In skillful hands, short-term (scalping) strategies can yield great results. For a scalper, economic and political crises, their length and intensity are irrelevant. Quite on the contrary, increased liquidity and volatility allow reaching the goal faster.

Assessing risks, or what you should not do

In this article, I simply cannot leave out some risks entailed by trading in crises. Keep in mind that risk management makes your trading easier and keeps your nerves safe. Protective orders are an intrinsic part of capital insurance, no matter if you have 100 USD on your deposit or a million. You are definitely not up to losing it.

Switching between trading strategies constantly, testing new strategies on real accounts are no doubt bad ideas not only in crises but in normal conditions, too. Diversifying risks by trading several currency pairs and metals is, vice versa, a good way to protect your money from various risky situations.

Also, in crises, beginners try to find new instruments hoping for a quick profit. The market is unpredictable, and the traders get nothing but negative impressions. Hence, stop trying to study new currencies “quickly” and opt for those you are well acquainted with. Classic pairs (majors) will help you decrease risks. An instrument you understand will always be the best option.

Closing thoughts

Forex analysts and experts have long come to a conclusion that the price goes in cycles. Quotations react to financial crises by similar scenarios; however, every situation, especially when it is not man-made, is unique, so keep this in mind when planning your trading in crises.

There are always risks in the market, both when things go well or badly; analyze the situation thoroughly, check the news, and follow your risk-management rules, and then you will make correct trading decisions less painfully.