Best Short-term Strategies: GBP/JPY Range

5 minutes for reading

Trading GBP/JPY might be quite tricky because it is so volatile: its average volatility range exceeds 100 points. However, closer to the Asian trading session the market calms down and sometimes forms a range, pushing the pair out of it by the main trend.

A short-term strategy called GBP/JPY Range uses no indicators; it includes pending orders which shortens your time in front of the terminal. Moreover, working by the strategy, the trader does not choose or forecast the market direction but simply follows the price.

The article is devoted to the idea of this strategy, its trading principles, and to generally checking whether the authors of the strategy have managed to pacify such a volatile pair.

Description of GBP/JPY Range

For trading by the strategy, we use the M15 chart of the GBP/JPY pair. Stick to the closing time of the American and opening time of the Asian sessions. This is 23:00-02:00 terminal time.

Draw horizontal lines through the high and lows of the price in the mentioned timeframe. Then place pending orders for breakaways a bit higher and lower than the drawn levels. If one order gets triggered, delete the second one. If none is triggered over 4 hours, delete both and try again on the next day.

Note that the narrower the corridor, the less it is possible that a strong movement will develop. If the range is quite wide, it is unlikely that the movement will continue after the breakaway. In practice, higher volatility changes for lower, then for higher, and over and over again. It is important that we notice low volatility to catch higher volatility later.

If the channel is wide, volatility is high, hence, there will be no movement after the breakaway. By the rules of the strategy, if the channel is over 70 points wide, you should not trade.

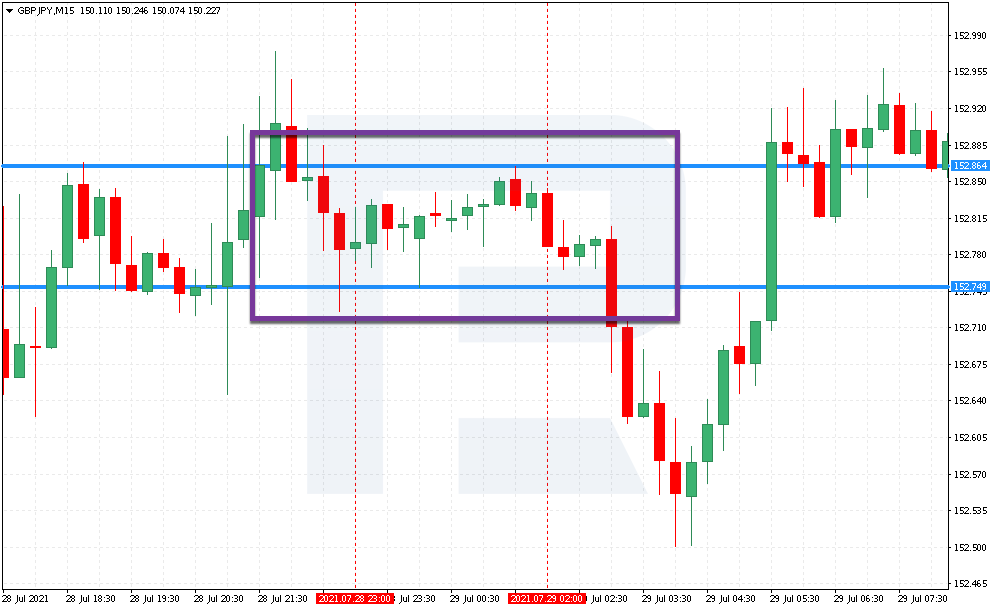

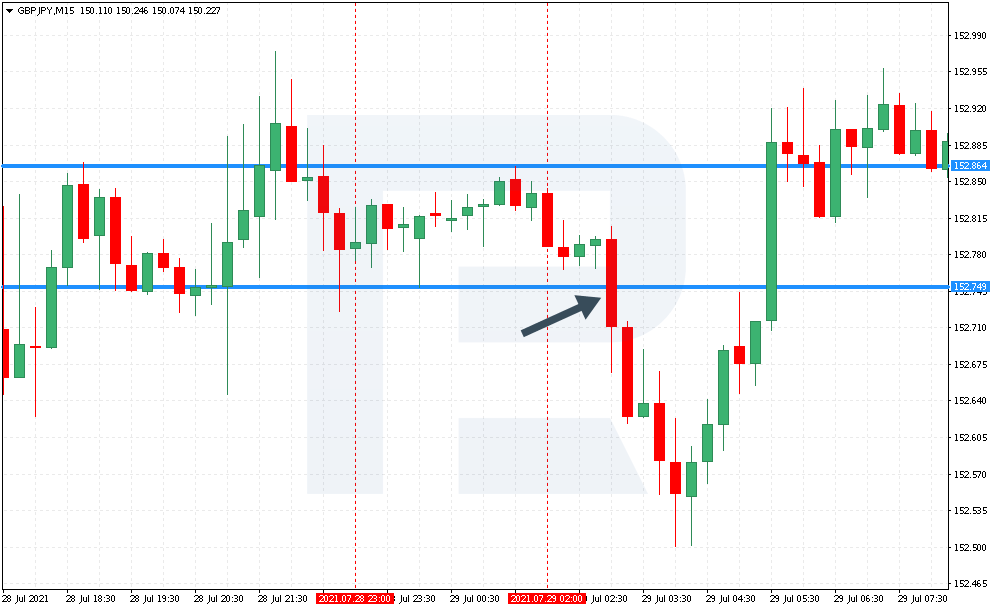

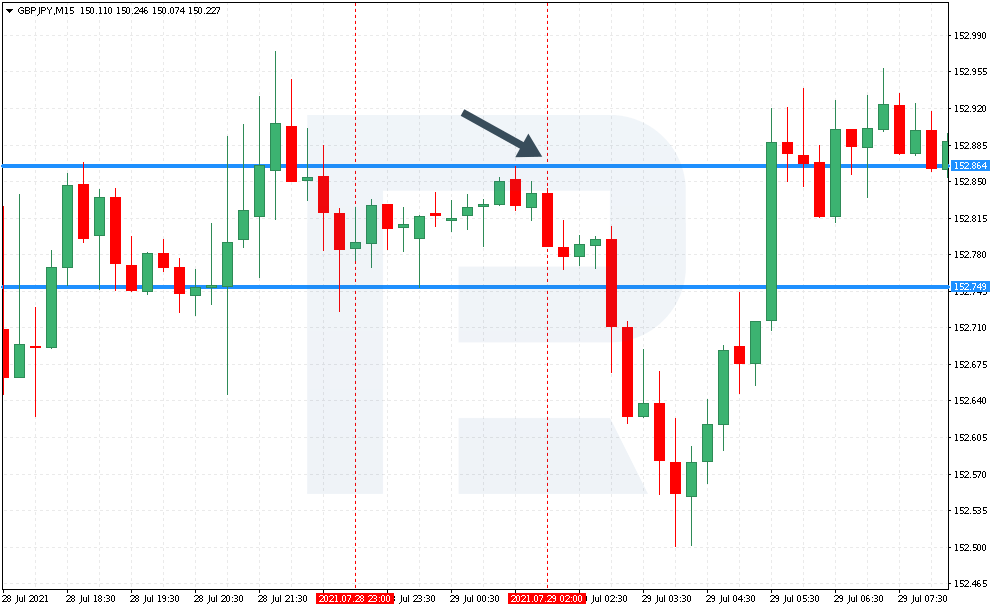

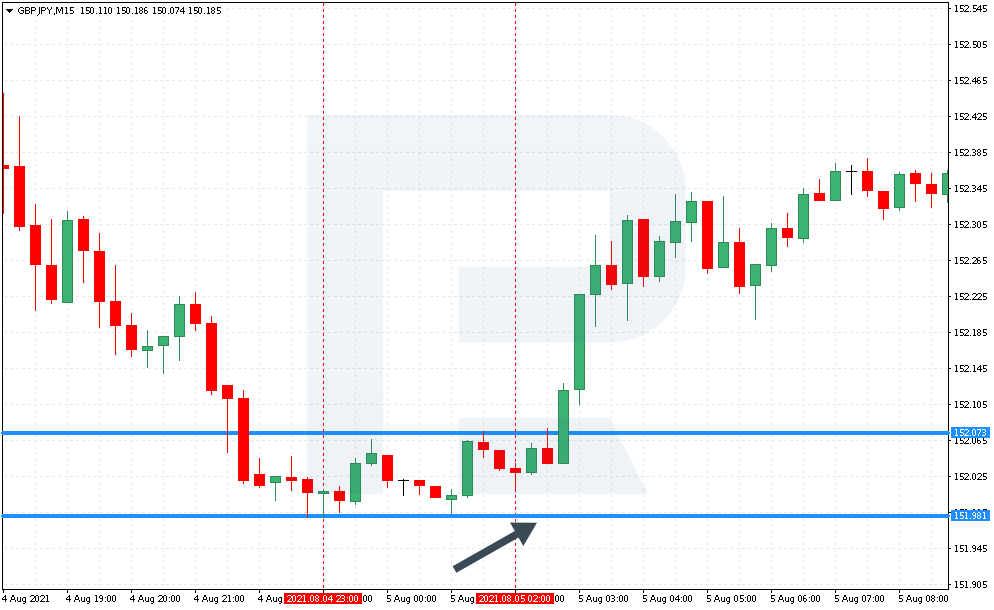

Selling by the GBP/JPY Range

As an example of a selling trade, let us take a breakaway of the channel downwards. We mark the beginning of the channel at 23:00 (11 p.m.); the low of the channel is at 152.74, the high is around 152.86. At 03:00 (3 a.m.) the lower border of the channel was broken, and the price went down. Place a Take Profit at the level of two ranges. This time, the movement was strong and triggered the TP at 152.50.

In this strategy, we need a Sell Stop pending order as it opens a selling position below the current market price. By the strategy, we must place it 2 points below the low of the range. In our case, it is 152.72.

Place a Stop Loss behind the high of our range to avoid random price movements against our position. Hence, we place it at 151.95.

An important condition is to close the position if before the aggressive American session starts the price does not reach an SL or a TP. It is said that in such a case, the market will not keep going by the strategy, so it is better to quit to avoid unnecessary risks.

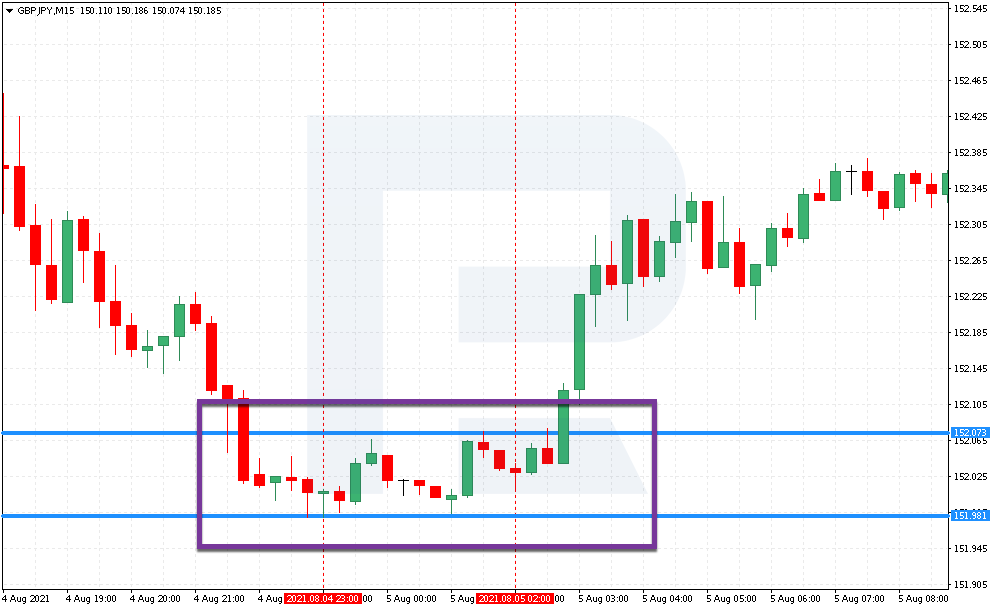

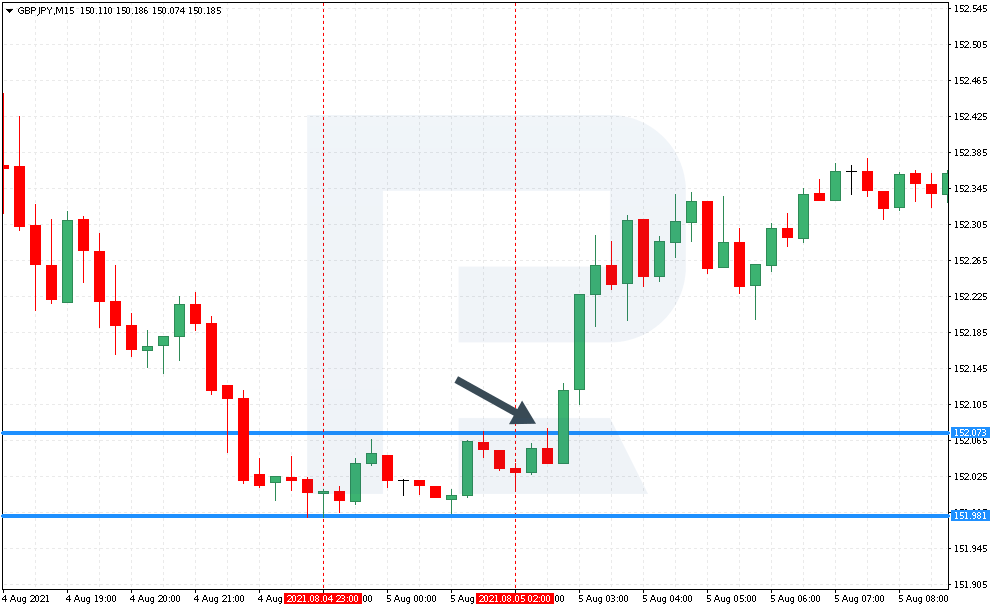

Buying by the GBP/JPY Range

Now — to a breakaway of the range upwards. Mark the beginning of the channel at 23:00 (11 p.m.) where we see the low of 151.91 that the price tested later. The high was at 152.07.

At 02:45 (2:45 a.m.) the price broke through the channel upwards and grew noticeably. The growth was much more than two width of the channel. Hence, the TP is 18 points; place it at 152.25.

In this case, we use a Buy Stop order that opens a buying trade above the current one. By the strategy rules, place it 2 points above the high of the range. This time we place it at 152.09.

Place an SL behind the low of the range to avoid involuntary movements against our position. In this case, we place it at 151.95.

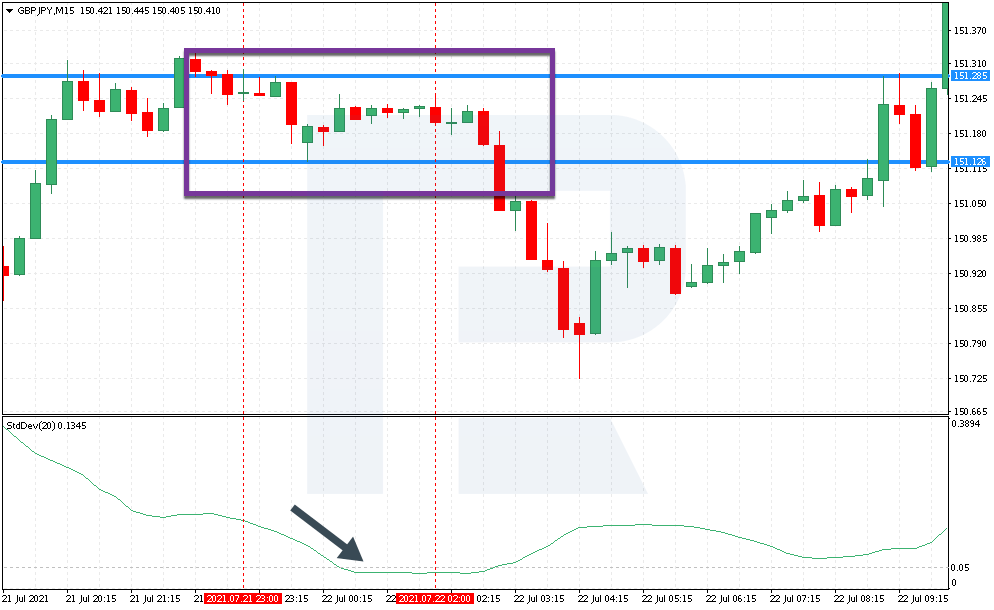

Improving the GBP/JPY Range strategy

Working by any strategy, you can improve and supplement it to make work more efficient: for example, to sift off wrong signals. In the GBP/JPY Range strategy, we are interested in low volatility.

To detect it, try using the Standard Deviation (StdDev) indicator. It shows the standard price deviation from the Moving Average.

The higher the indicator values, the higher the market volatility. If the StdDev value is low when the range in the GBP/JPY Range strategy is forming, this will be a good signal of a breakaway.

To track this signal, add the 0.05 level to the indicator. As soon as it falls below this level when the range is forming between 23:00 and 02:00 (11 p.m. and 2 a.m.), market volatility proves to be low, and after a breakaway the price will show a strong movement.

Closing thoughts

The short-term GBP/JPY Range strategy means trading by the rules with small risks and the potential profit two times higher than the potential loss. Trading by pending orders is a major advantage because it saves the trader’s time. The second advantage is that the trader does not guess where the price will go but opens a trade in the market direction.

A drawback of the strategy is that traders from Europe have to work at night because for them, it only becomes clear whether to place pending orders at about 2 a.m. Still, this is a good strategy for beginners because it is simple and has minimum recommendations.