How to Trade USD/CNH

6 minutes for reading

The USD/CNH (US dollar against the Chinese yuan) is quite a specific currency pair in Forex. This article is devoted to its trading peculiarities and formation of its exchange rate.

You can visit the RoboForex Market Analysis webpage for the latest forex forecasts.

Some info about China and yuan

People’s Republic of China is an Eastern Asian country, number three in the world in terms of area and number one in terms of population. Since 1949, the country has been ruled by the Communist party of China.

The Chinese economy is based on both planned distribution economy and market economy alongside numerous foreign investments. Today China is the country with the second-largest GDP after the US. Many experts expect it to become number one quite soon.

China is the largest manufacturer and exporter of various goods. Thanks to a wide spectrum of economic connections, the Chinese yuan is quite a demanded currency. It is necessary for economic operations with the country. It is included in the special drawing rights basket of the IMF, which makes it a reserve currency.

Inside the country, the yuan is called “people’s money”. The monetary policy is carried out by the Central bank of the country, People’s Bank of China. All changes of the official exchange rate of the yuan are tracked and regulated by the Bank and only partially depend on market conditions.

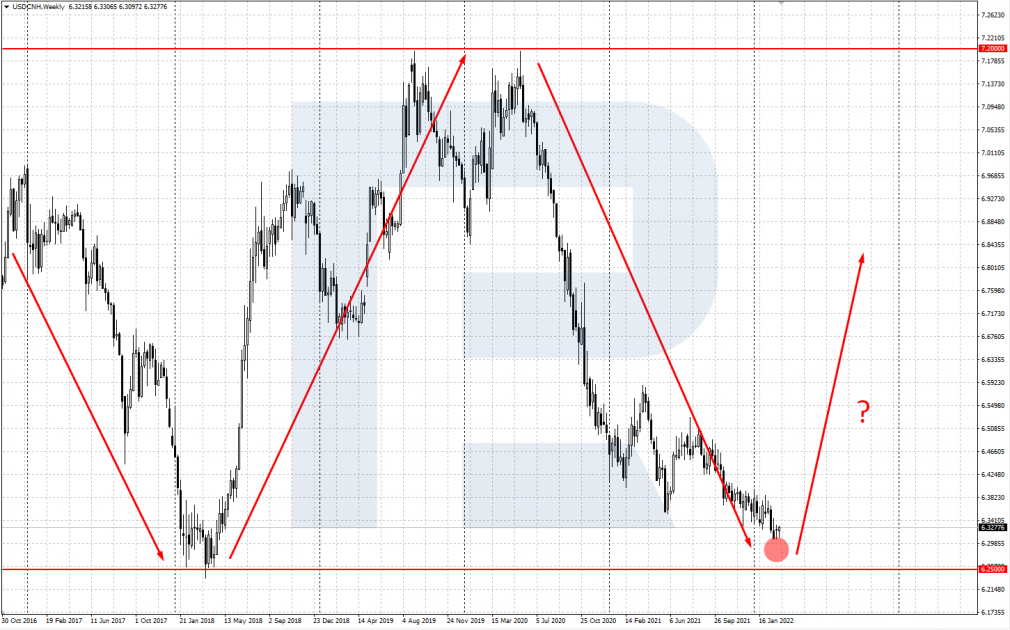

Before 2005, the exchange of the yuan used to be strictly bound to the US dollar rate: 1 USD = 8.27 CNH. Now the rate is bound to a special currency basket comprised of currencies of 13 countries. The yuan is traded in Forex but its fluctuations are limited by 2% of the exchange rate set by the Chinese Central bank. Since 2010, the USD has been fluctuating between 6 and 7 CNH .

USD/CNH peculiarities

The peculiarity of the yuan is that it has two parallel exchange rates: its official domestic rate (USD/CNY) and international one (USD/CNH). The rate with the ticker CNH was introduced by the Central bank of China and the government of Hong Kong to attract international investors. The official yuan rate (CNY) is firmly regulated by the government and meant only for use inside the country.

People’s bank of China publishes the official exchange rate (Central Parity Rate) every day. This is the ratio of the yuan and the currency basket. USD/CNY and USD/CNH fluctuations cannot exceed 2% of it. When the border of the range is reached, the Central Banks intervenes, regulating further movements of the currency.

Trading characteristics of USD/CNH

- Trading time. The pair trades 24 hours a day except weekend, with the main activity during the Asian and American sessions.

- Volatility. Volatility is high, about 150-200 points a day. However, the range is limited by the Chinese CB.

- Spread. The spread is moderate as this pair is not the most volatile one in Forex. On popular ECN accounts, spread is normally about 3-4 points.

How to trade USD/CNH by fundamental analysis

Firstly, the trader should keep an eye on the monetary policy of the Chinese regulator: this is the key factor that forms the exchange rate.

Thanks to the robust growth demonstrated by the Chinese economy, the yuan has all the chances to grow against the dollar. According to economists, it is now seriously undervalued. China holds back the rate because it is highly oriented on export: it is more profitable for the country to have a low exchange rate of its national currency than to stimulate demand for its goods.

Hence, the Chinese CB prevents the national currency from growing too much. The current range is between 6 and 7 CNH per 1 USD, so take these levels as the landmarks for long-term trading.

Inside this range, local influence can be caused by some economic indices and data from the US and China. The yuan has been growing confidently since 2020: the quotes are declining gradually from the upper border of the range. Now the economic situation is changing: the US Fed has initiated a cycle of raising interest rates, thus supporting the dollar. Meanwhile, the Chinese CB can be holding the lower border of the range. So, there are reasons to count on a local reversal upwards.

How to trade USD/CNH by tech analysis

This method implies using price patterns, support/resistance levels, Price Action patterns, and other instruments. USD/CNH demonstrates lengthy directed movements, so trading the trend suits it well.

Example of trading USD/CNH by tech analysis

- On H4 of USD/CNH the price formed a trend continuation pattern – a Triangle – in a downtrend.

- A selling position is opened at a breakaway of the lower border of the Triangle.

- Stop Loss is placed at the upper border; the landmark for Take Profit is the height of the pattern in points (H).

How to trade USD/CNH by indicators

This approach implies using signals of various trading indicators for opening and closing positions. The trader can use one complex indicator or a set of simpler ones.

Example of trading USD/CNH by indicators

This pair tends to demonstrate stable trends, so for this example we will take a classic indicator called Alligator. It has been described in one of the articles of the blog.

- On D1, after a bounce off the upper border of the price chart, USD/CNH started a decline, and the Alligator showed a reversal downwards.

- A selling position can now be opened; Alligator lines are following the current trend.

- Stop Loss is placed behind the local high; Take Profit is closed when the Alligator lines are crossed backwards.

Closing thoughts

The USD/CNH pair that has just started its way in Forex is becoming more and more popular. The yuan is gradually becoming more powerful in global economy and has all the chances to shove the dollar away.

Trading this pair is, of course, specific: the yuan exchange rate is regulated by the Chinese CB, so its fluctuations are limited. This drawback is compensated for by quite high average daily volatility and stable trends, which make the pair attractive for traders and investors.

Before trading for real, it is worth choosing your analysis method and practicing on a demo account.