How to Trade by Psychological Reversal Strategy

7 minutes for reading

Certain traders choose against using indicators in their strategies, considering them lagging. Such traders are sure that all they need for market analysis is the price chart. The price contains all the necessary parameters and factors and represents the behaviour of the mob and major players alike. One only needs to learn how to read and understand charts. Also, some investors think the fact that indicators base in price parameters to be yet one more their drawback.

The trade practice called Psychological Reversal presumes using no indicators. It is based in the understanding of the psychology and behaviour of a group of tra ders. It might seem to be similar to the False Breakaway technique but the Psychological Reversal strategy has strict time limits of market entry.

This article explains how to interpret the behaviour of market players correctly in times of strong movements and how to manage risks by the strategy.

What is Psychological Reversal strategy

The trader works on hourly charts. The idea is to look for strong breakaways of levels and expectations of fast price reversals. For example, if the market is in an uptrend, the price breaks through the nearest resistance level with a large candlestick and soon returns — this is a signal to sell.

Some think that most market players place protective orders behind local extremes, hoping for a soon market reversal. As soon as the price reaches these orders, a movement in the opposite direction happens; traders lose, and later the market, indeed, reverses downwards.

As said above, the Psychological Reversal strategy requires no indicators. However, experience is crucial for finding important levels fast and unequivocally, as well as for assessing the speed of the price return — whether it is enough to open a position.

Use of no indicators means that different traders may set the levels differently. Traders call work without indicators art, and its quality fully depends on the investor's experience.

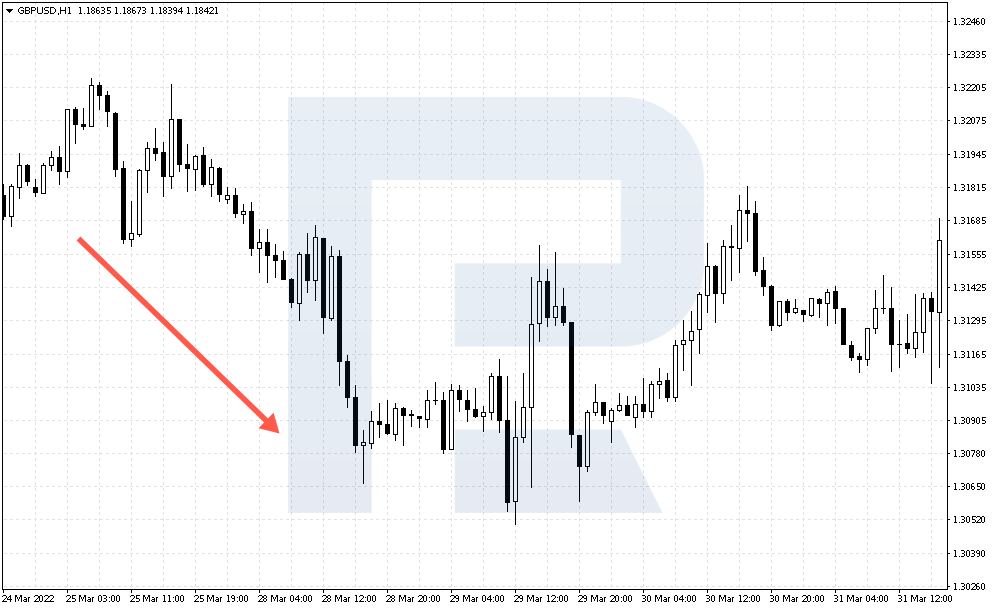

How to buy by Psychological Reversal

The authors of the strategy suggest several rules of opening such a trade.

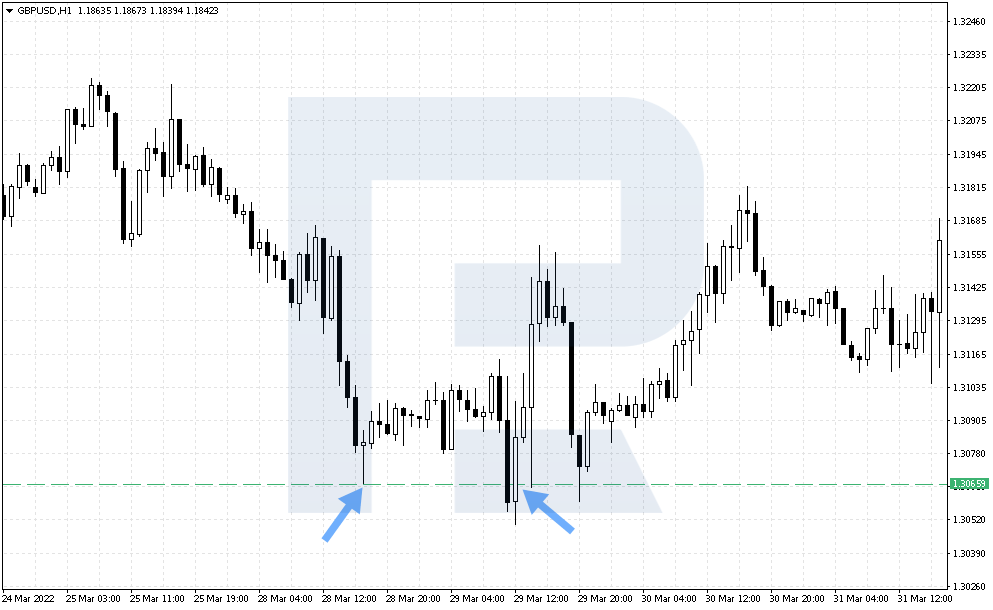

1. The trend must be descending. However, it is enough for the price to demonstrate several times a new low below the previous one and a new high below the previous one.

2. An hourly candlestick breaks through the previous low. This must be a very clear area off which the price has already bounced.

3. After the downward breakaway, the price must return to this level within 1-2 hours, which will be the signal of a correction of the bear trend.

4. Buying may occur at the low which the price has broken away.

5. Take Profit is placed at the distance from the level to the low of the breakaway down. The position cannot be moved for the next 24 hours.

6. The authors have not specified how to place the Stop Loss but work without it becomes too dangerous. So, there are two options of placing Stop Losses.

The first one is to place the SL under the low broken away by the price. In this case, it will be the size slightly bigger than the Take Profit. The second option is to place the SL under the low the breakaway of which is just expected. For example, 10-15 points below, depending on the size of the Take Profit. In this case, of course, the risk of the SL being triggered on the correction is higher.

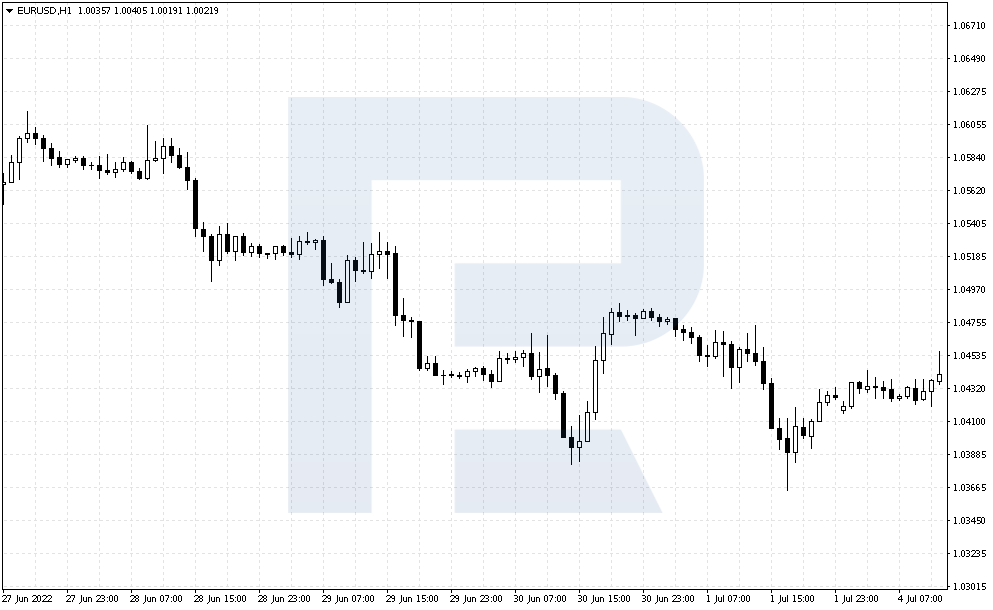

Example of buying by Psychological Reversal

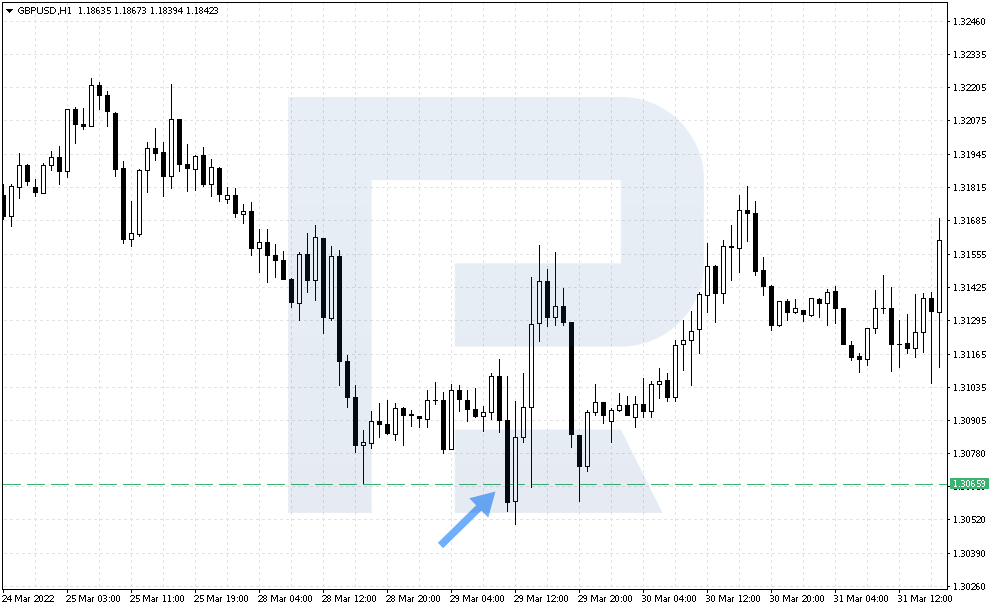

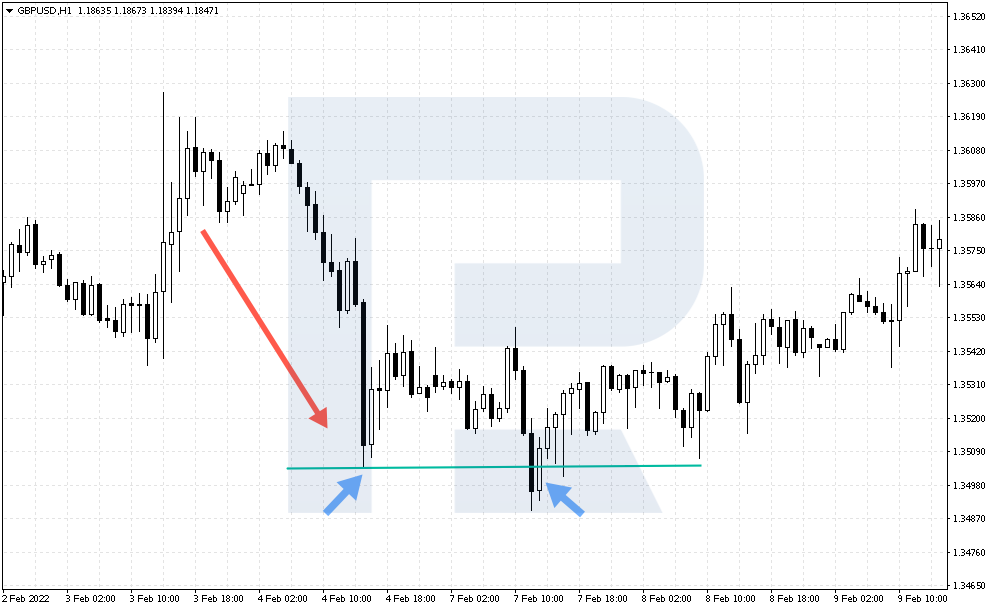

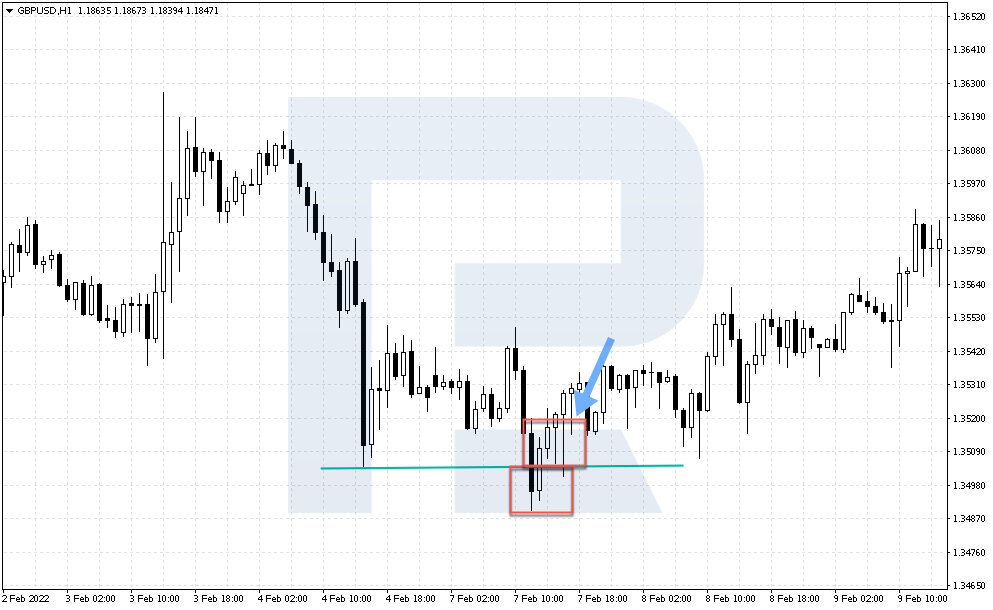

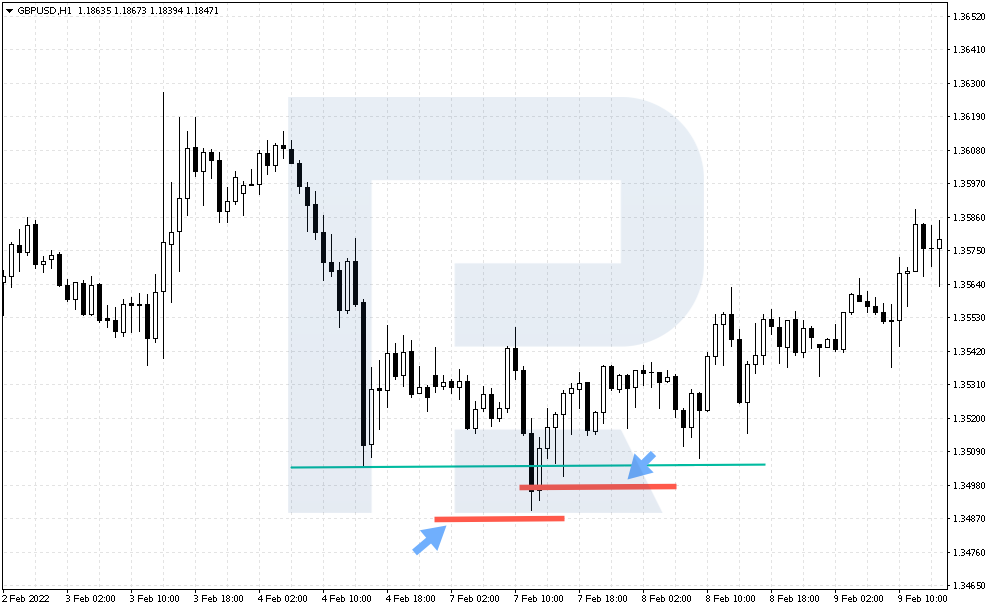

On H1 of GBP/USD for 7 February 2022 the price is declining from the high, and the overall movement resembles a downtrend, in which each next high or low is lower than the previous one. The price tests 1.3504 and quickly bounces off it. We mark this level as a strong support area.

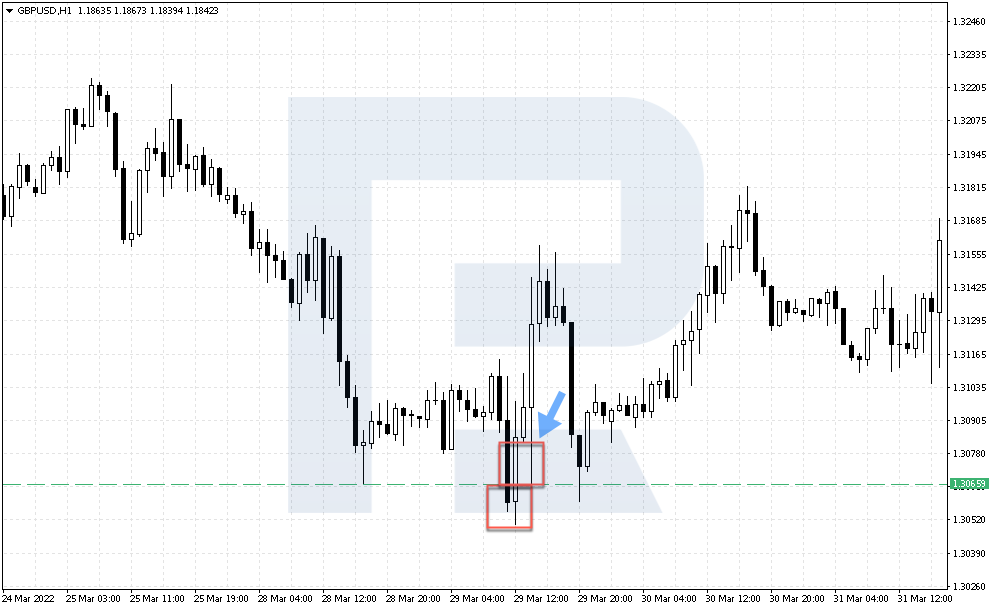

Then we need to keep an eye on a breakaway of this level and assess the behaviour of market players. The level is broken 21 hour later, after which the price returns to the level on the next candlestick already. This signals a trend correction, which means we may buy.

In this case, the TP is 15 points, equalling the distance from the level to the deepest point of the price decline.

The SL is placed either 1-2 points below the low of the candlestick on which the breakaway happens – or 10-15 points below the level. In both cases, the price would not reach the SLs because 3 hours later it tests the level and goes up.

How to sell by Psychological Reversal

1. The trend must be ascending. However, it is enough for the price to demonstrate several times a new low above the previous one and a new high above the previous one.

2. An hourly candlestick breaks through the previous high. This must be a very clear resistance area off which the price has already bounced.

3. After the upward breakaway, the price must return to this area within 1-2 hours, which will be the signal of a correction of the bull trend.

4. Selling may occur at the high which the price has broken away.

5. Take Profit is placed at the distance from the level to the high of the breakaway upwards. The position cannot be moved for the next 24 hours.

6. The authors have not specified how to place the Stop Loss but work without it becomes too dangerous. However, above there have been presented two ways of managing risks.

The first one is to place the SL above the high broken away by the price. The second option is to place the SL 10-15 points above the level.

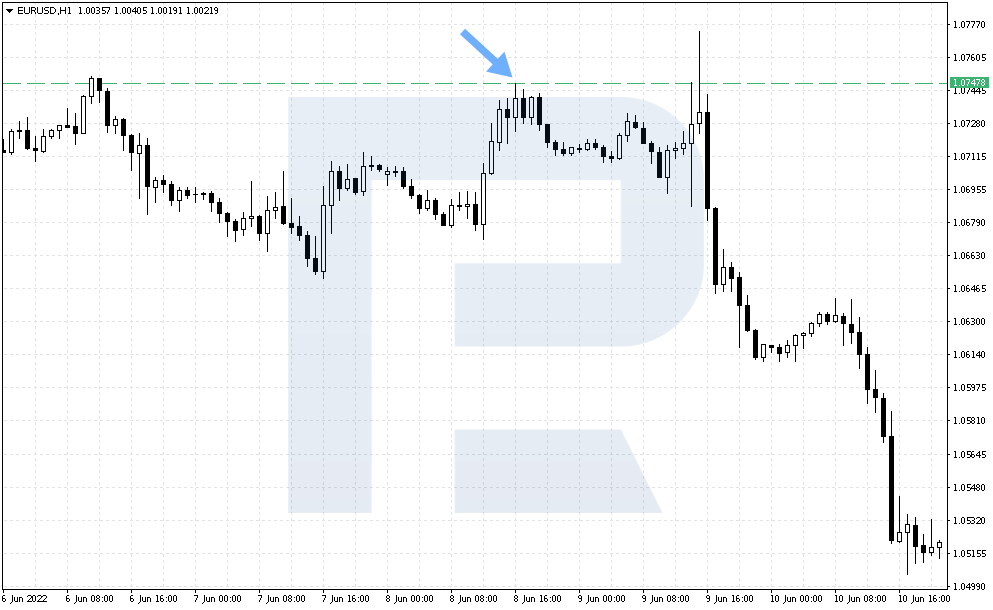

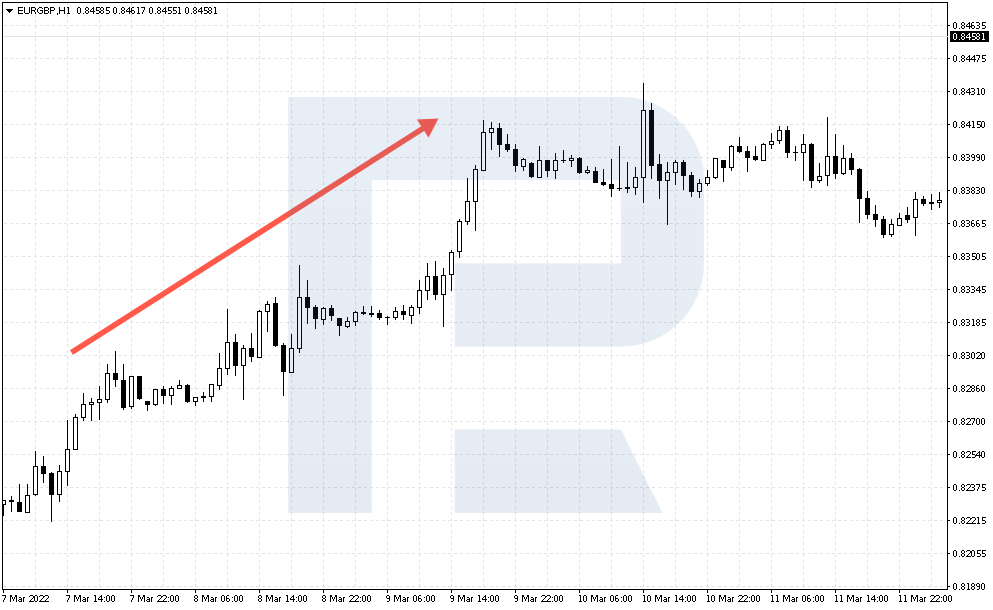

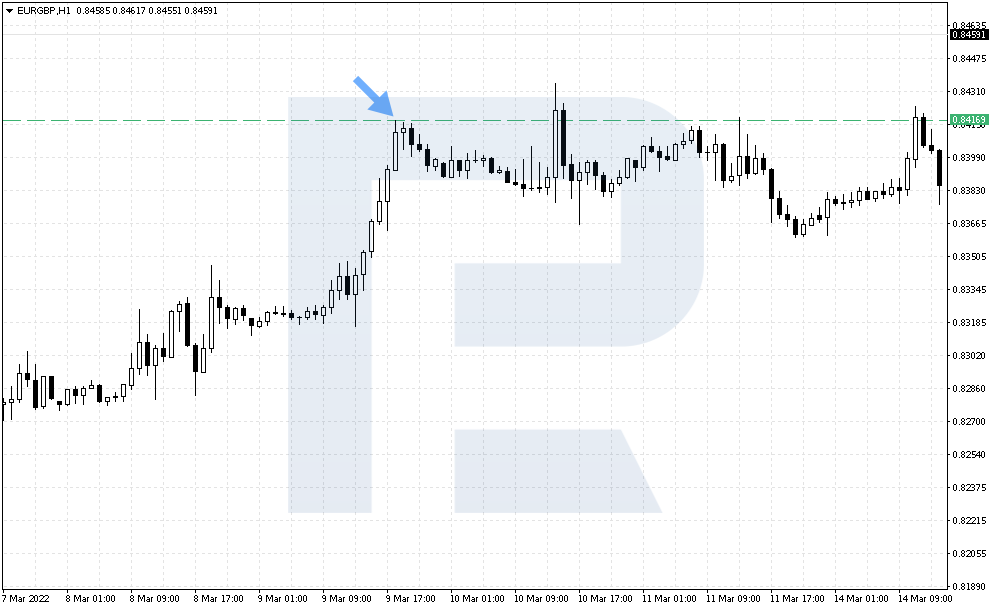

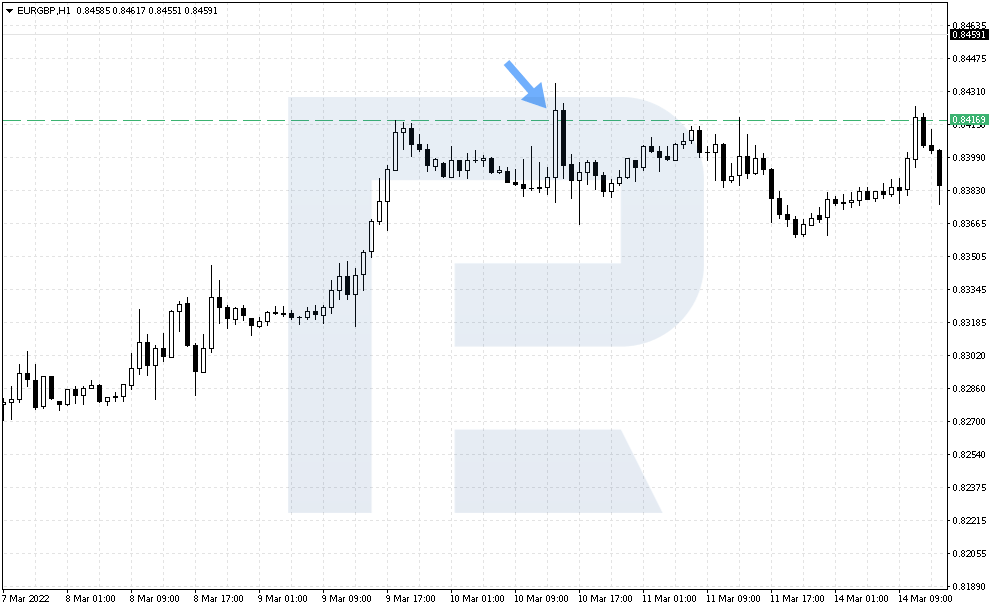

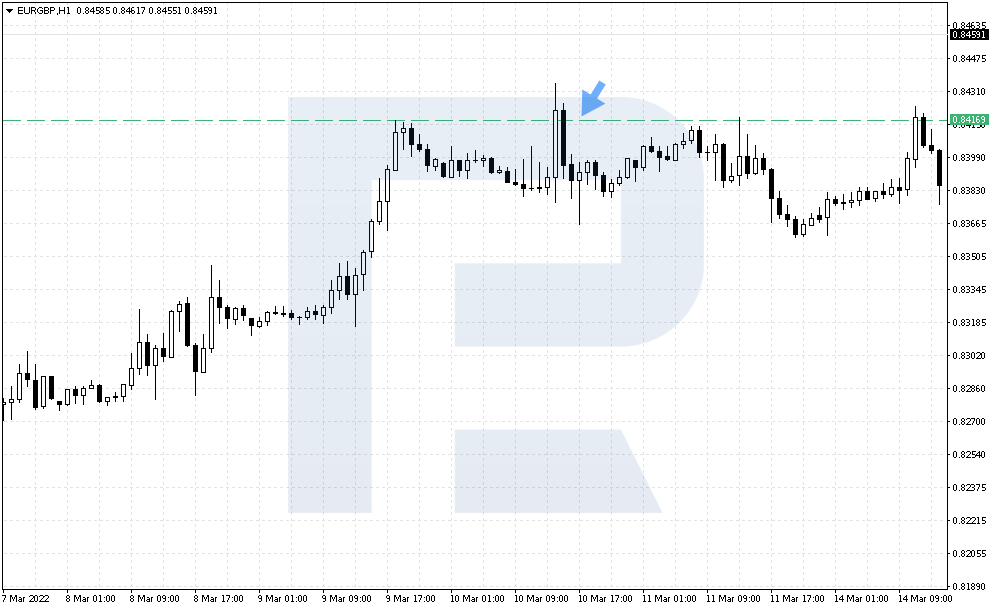

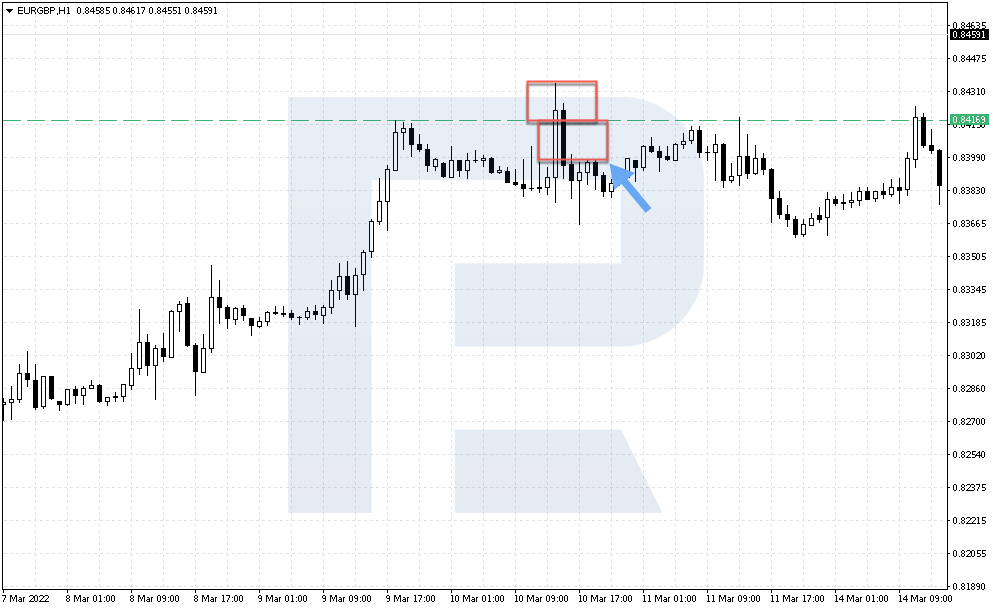

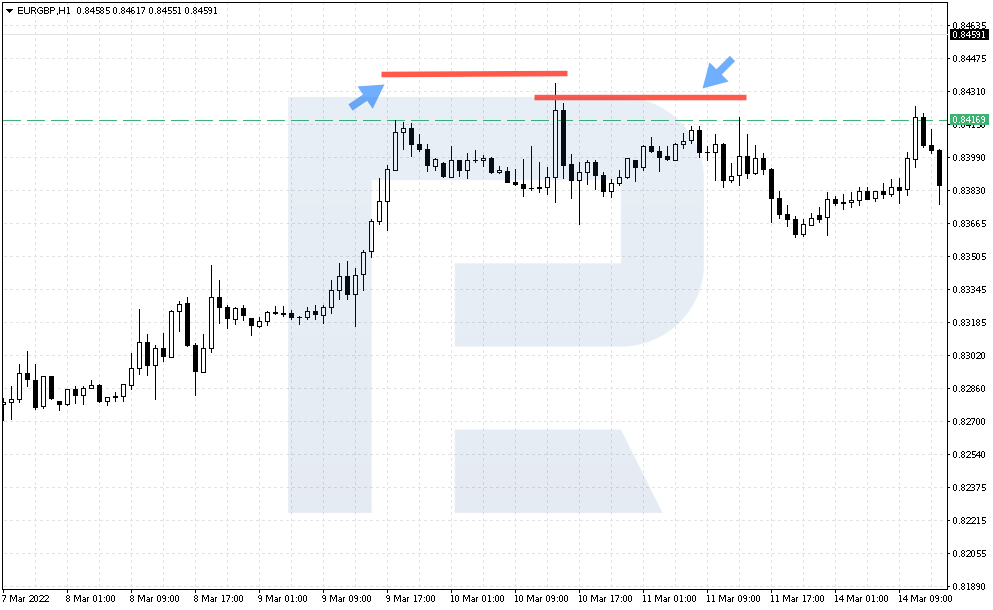

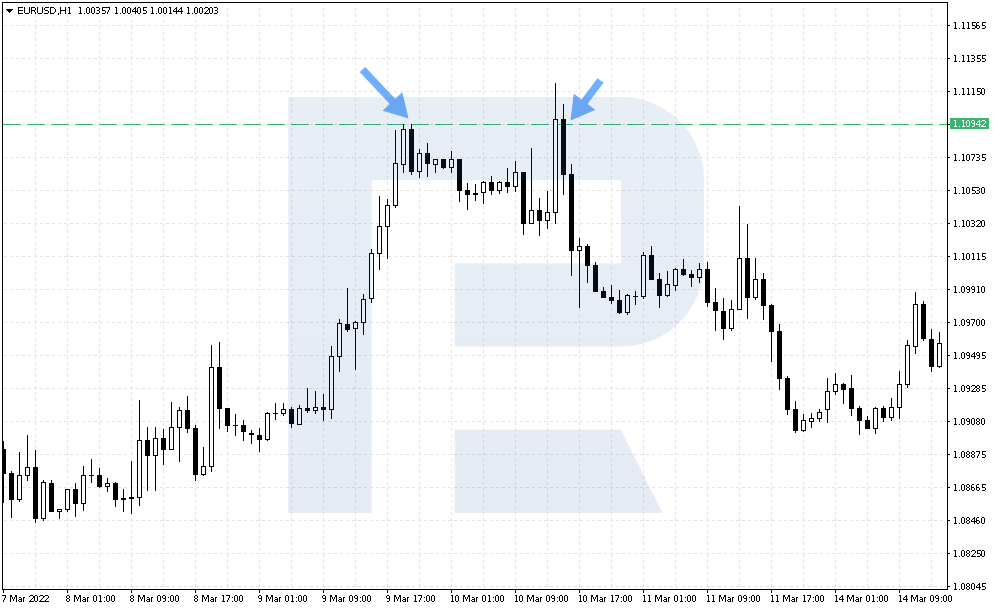

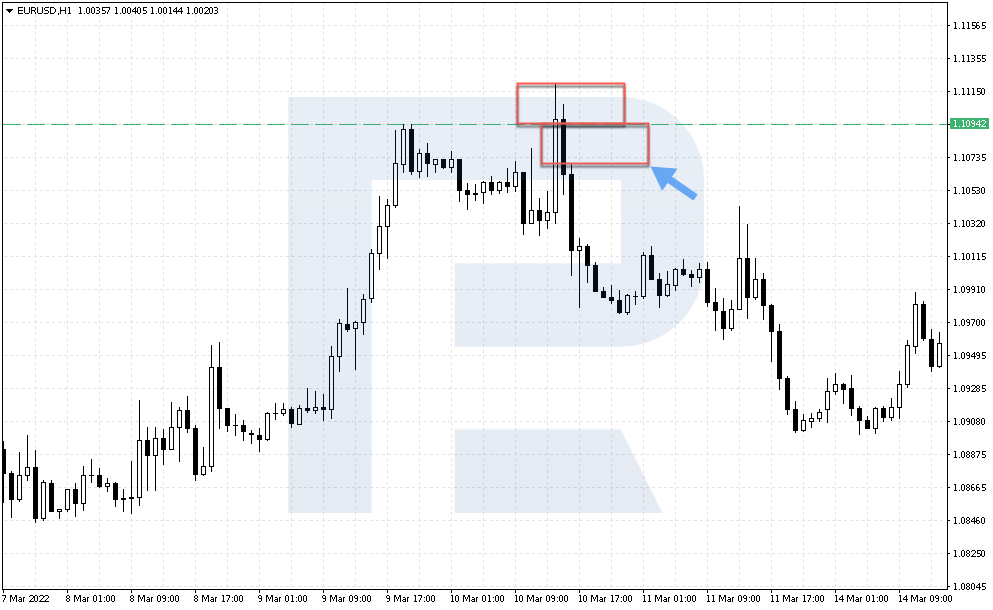

Example of selling by Psychological Reversal

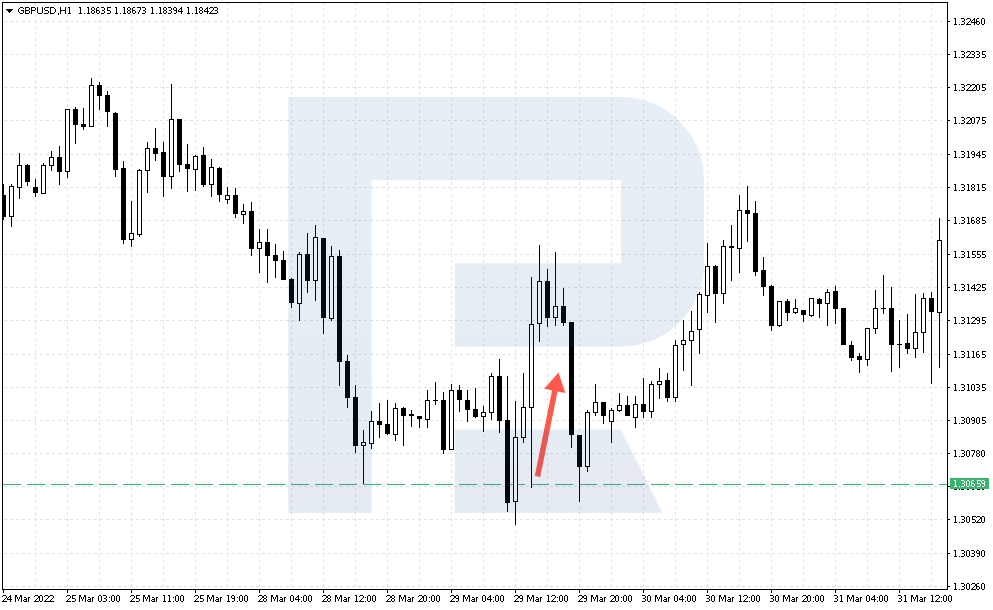

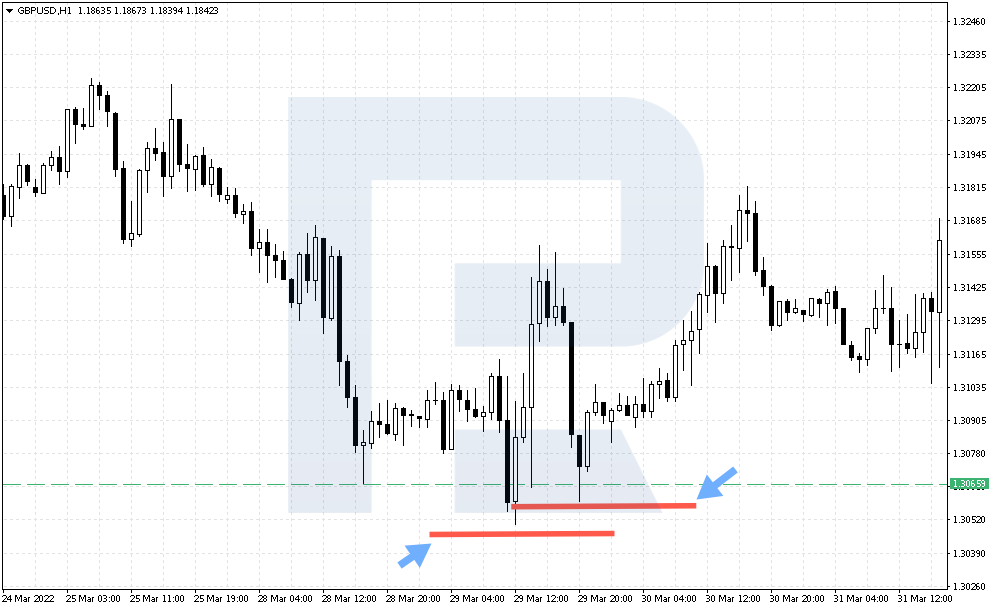

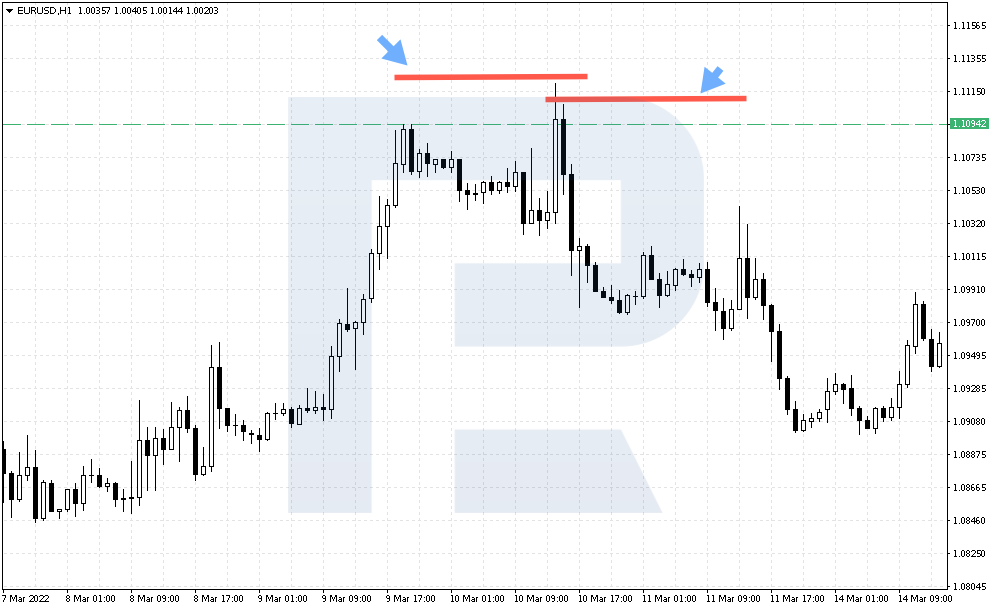

On H1 of EUR/USD on 10 March 2022 the price is moving inside a bull trend. 1.11094 is tested, and the price bounces of it down. We mark this level as a strong resistance area.

18 hours later already this level is broken away upwards, and on the next candlestick the price reverses. This signals the end of the bull trend. Selling may start.

The TP will be 25 points, equalling the distance between the resistance level and the high of the price.

The SL is placed either 1-2 points above the high of the candlestick on which the breakaway happened or 10-15 points above the level. As we see, the price never rose above these levels.

Bottom line

The Psychological Reversal strategy is a curious technique of trading bounces off the level mockingly broken away by the market. Authors state they apply psychology and analysis of trader groups without any indicators.

However, graphic analysis of price levels requires from the trader a lot of practice. Simultaneously, it gives the trader new knowledge and skills that most investors do not have. A serious drawback of the strategy is the need for constant analysis of the market and the open position.