Trading Against the Trend: Highlights, Risk Management

5 minutes for reading

Trading against the main trend entails lots of difficulties and additional risks. As a rule, the trader in such a situation tries to catch a correction; however, it would be more efficient to wait for the completion of the current trend and enter a trade in the new trend. Even the most high-quality signal or pattern always realizes if it goes against the main trend. The trader has to be as attentive as possible and control risks if they try to enter trades against the main movement or catch the completion of the latter.

Description

Any trend undergoes corrections and starts reversing at some point. It is thought that the market should "breeze" to accumulate strength and continue moving either up or down. As a rule, if there is a bullish trend on the market, each next maximum and minimum is higher than the previous one; however, as soon as the market demonstrates a new maximum that is lower than the previous one, or a new minimum that is also lower than the previous one, this may be the very moment of strong correction on the market. What is more, even simple reversal patterns can give a good signal of a correction on smaller timeframes.

The logic of trading against the trend

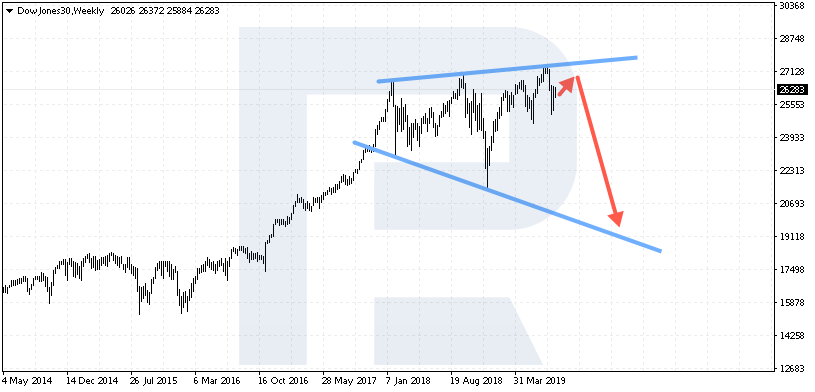

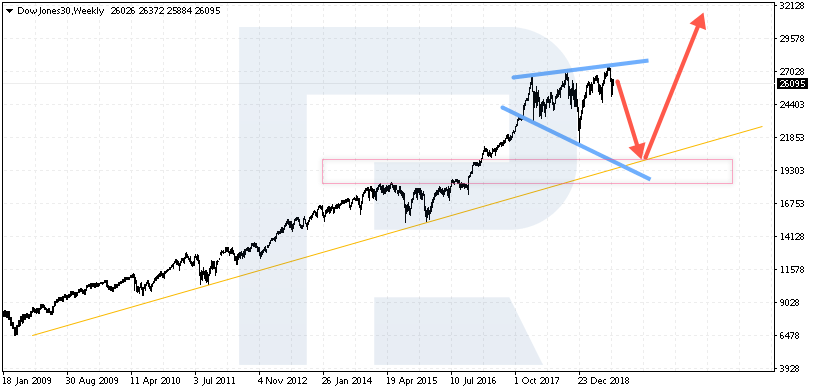

In most cases, experienced traders enter against the trade at the moment of receiving a signal or seeing on the chart a trading idea that suggests a potential strong movement against the current trend. An example of such a situation may be the movement on the exchange index Dow Jones. We may suppose that right now the growth may stop and a decline may begin with the potential aim at 20,000. Such a scenario is confirmed by a Diverging Triangle forming, which signifies descending.

However, such a movement will not be a reversal of the current trend but a correction of the uptrend from a higher timeframe. That is why such a strong movement should not be skipped or «outlasted».

If a trader is buying on the Dow Jones index, it would be logical to close them, try to sell and enter long positions after the execution of the pattern.

What is the difference between trading the trend and against it?

When we are trading the trend, it is important for us to either enter at a correction or at a breakaway of the resistance line, because we suppose that the price is going to be even higher. On the other hand, if we have chosen to trade against the trend, we should enter the market at the renewal of the maximum (in case of a bullish trend). However, it is worth remembering that at the moment of a strong trend usual signals of indicators will form multiple divergences against the trend; in most cases, such signals will be false; graphic patterns may not execute fully either. For example, at the moment of aggressive growth of the Brent prices a reversal Head and Shoulders pattern, signaling to sell, may not execute in the end and simply turn into a Triangle, continuing the growth. Meanwhile, if we control risks and do not average against the trend, it pays away, as seen on the example of the Dow Jones index. It is important to assess the market and feel where a serious correction may begin.

Trading strategies

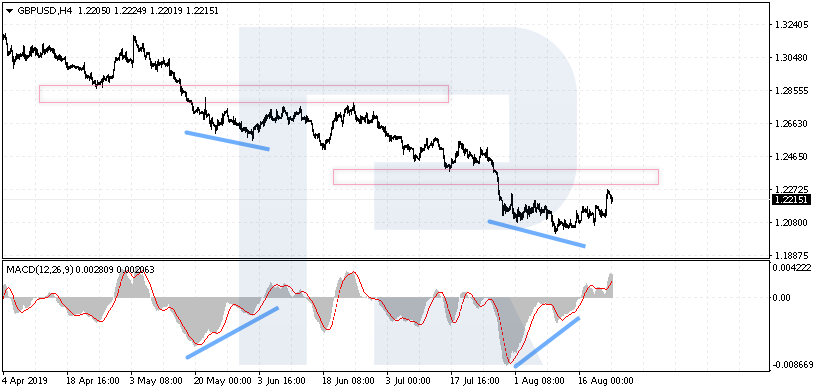

Such strategies are numerous, and any experienced trader can pick up a suitable option, using their experience and knowledge of technical analysis. As the simplest example, we may take the Moving Averages for trend definition on the daily timeframe and the MACD signals counter the trend on an H4.

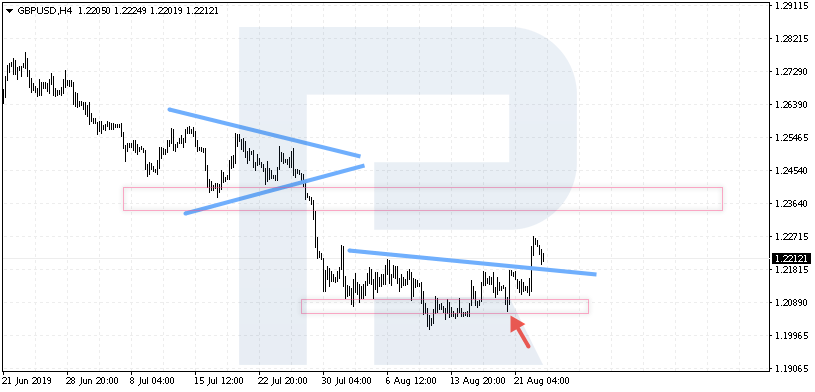

Let us take the GBP/USD pair; the trend is descending, so on H4 we should be looking for signals to buy only. As we may see, there emerged two signals that executed but no strong movement against the current trend appeared. The bounces just provoked growth and testing the resistance area, but falling continued.

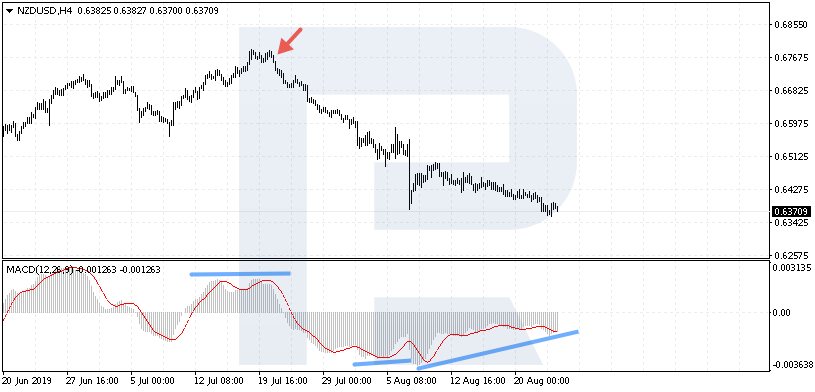

Another example will be the NZD/USD currency pair; here, the trend is also descending, but a divergence to buy does not provoke a correction, instead, a signal along with the trend pushed the market significantly down. That is why risk management is so important for trading against the trend, and the protective Stop Loss should not be moved in the hope for a soon market reversal in the necessary direction.

Back to the GBP/USD: as we remember, the trend is descending, and at the very bottom a reversal Head and Shoulders pattern has formed. The market is trying to execute the pattern, and, opening a position from the level of the right shoulder, a trader could make a profit, though they would enter counter the main trend.

However, it should be noted that moving upwards, the market corrects significantly; at the same time, the Triangle pattern, going along with the trend, executed well and reached the desired level rather quickly.

Main risks of trading against the trend

Among the main risks, we should single out the high probability of a pattern or a signal against the market is not executed by the market in most cases. Be it a divergence on the MACD or the growth of the RSI above 70 on the bullish market – all of them might give false signals to sell while the market keeps moving upwards. It is really important to place protective Stop Losses and abstain from averaging the current position, keeping in mind that we are standing counter the current trend.

Summary

Trading against the main trend is not always the right decision, and sometimes it may be quite risky, especially for a beginner trader. Of course, as the example with the Dow Jones index shows, buying on maximums is not always recommended; instead, sometimes a trader could try to enter against the main trend if there are serious reasons for it. It is also worth remembering that such a trading option will rather yield a short-term correction than make a