Turtle Strategy: the Oldest Way of Trading

7 minutes for reading

Nowadays, there are plenty of strategies and trading systems. Some are simple, some are very complicated, with lots of indicators. You can also work out your approach to market analysis, using the instruments of tech analysis, such as trendlines or support and resistance levels. Anyway, a good system is not necessarily complicated, with a long list of rules.

A good example is the Turtle system, designed by Richard Dennis in the 1980s. What is more, having a bet with his partner, he gathered a group of beginners and helped them become professional traders. However, it is not to forget that even a high-quality trading system does not guarantee you a profit. It is important to comply with the rules of money management and follow your strategy.

Unfortunately, not all traders make a profit on the same charts and the same timeframes. This shows that the success of trading does not fully depend on the chosen system - much depends on the personality of the trader. One trader will doubt and skip a trade, while another will enter the market even after a series of losing trades.

Description of the Turtle trading system

The system is a trend strategy for daily charts. This is not surprising: earlier, many traders used the Moving Average, trying to catch strong trend movements. For example, a divergence on the MACD is a good signal, working perfectly in a flat, but as soon as a strong trend begins, the prices simply move in one direction, and such a trend may be very quick. In this situation, the MACD signals may not be very efficient, and the MAs will make us hold the positions in the direction of this movement as long as possible, which will bring us a good profit.

The main approach of the Turtle strategy is simple: you only need to let the profit grow and close losing trades. This looks like a simple rule, but not many can follow it. What is more, psychologically, any person maximally hopes for a positive result.

For example, if a beginner trader loses part of the profit, they may be very disappointed and will try to close the position with a minimal profit as quickly as possible, even if the system does not give any exit signal. And if the beginner receives a losing position, they may hold it for a long time, hoping for a soon reversal.

On the other hand, the system is logical: opening a trade in the direction of a strong trend, you simply need to be patient and wait, because the movement may be very strong and swift. If we are on the right side of the market, we do not care how far the prices will go from the entry point: the longer you wait, the larger profit you make.

Strategy signals

The idea of the method is in the breakouts of price ranges. It is extremely important to open absolutely all trades that the system offers because you never can tell in advance how well the signal will work. When the trader is trying to catch the trend, one or two trades may become critical. The same was with Dennis's teaching system: not all of his students showed a profit, though they were in the same conditions.

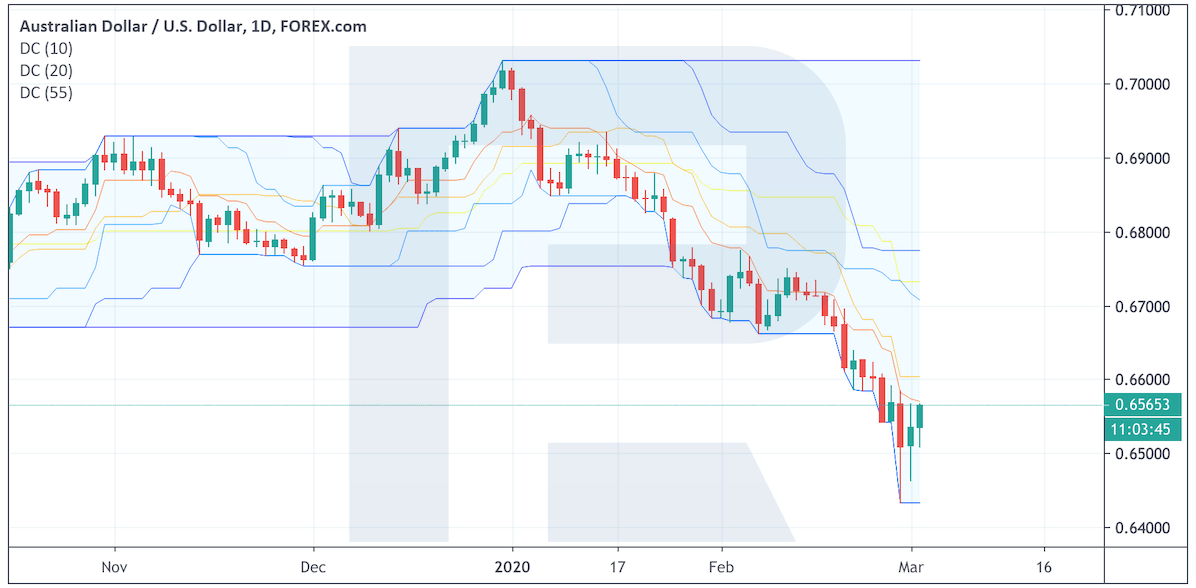

The strategy is based on the breakouts of 10-, 20-, and 55-day timeframes. For them, you can use the Donchian Channels indicator, adding it to the chart with the parameters 10, 20, and 55. This way, we will get three price channels at once. The breakouts of these levels will give entry and exit signals.

Some traders look for the indicators that already show when to enter the market at the breakout of these channels, as well as mark the entry point right on the chart; however, such breakouts may be found without indicators. What is more, the more experienced you become, the less time it will take.

Opening trade with Turtle strategy

As a rule, a trade is opened right after the channel is broken out. We may not even wait for the candlestick to close, it is enough for the prices to start testing the channel border. As soon as the prices break out the border of the 20-days channel, we open a buying trade. It is important to remember that if the previous signal turned out profitable, the trade is skipped. Conversely, if the previous trade was losing, we enter the market.

Most likely, the author's idea was that if one trade turns out losing, the next one is likely to be profitable. However, many investors think that no matter how many losing trades you have had, it has nothing to do with the current trade. On the other hand, there is an opinion that the more losing trades you have had, the higher the probability that the new trade will be profitable.

You can enter after a profitable trade as well, but here, we wait for the breakout of the 55-days channel. If we have entered the market at the breakout of the 55-days channel, we exit it at the breakout of the 20-days one.

The ATR indicator is necessary for figuring out the size of the Stop Loss. At the opening of the position, we look at the indicator value and multiply it by two. For example, if at the opening of a position with EUR/USD the indicator value is 100, the SL should be 200 points.

Closing trades with Turtle

The position closes when the prices break out the 10-days channel. Thus, if we have opened a selling trade, we close it at the breakout of the 10-days high. And if a buying trade is open, we close it at the breakout of the 10-days low. This is the right moment of the system: we enter the market at the confirmation of a strong trend and exit at a quicker signal as the breakout of the 10-days channel happens quicker than of the 20-days one.

It is important to remember that the system works in a good trend, and when the trend on the market is strong, there are always corrections and pullbacks, which may cause psychological pressure to the trader who will be tempted to close trades. However, you should not exit the positions too early, you should be patient and follow the rules of the system. What is more, the price may start correcting at once, right after a breakout of a border of the channel.

Bottom line

The strategies of trading the trend are considered to be among the best, they can actually give a good profit. However, not every trader is ready to wait patiently and skip losing positions, as an entry along with the trend may get into a correction. What is more, this system uses daily charts, so you will have to wait for really long and place large SLs. Anyway, this type of trading will perfectly suit those traders who do not want to track the market all the time, preferring to look at the chart once a day.

The Turtle system features clear rules of entering and exiting the market, understandable to beginners. It is important to comply with them strictly, as well as with the market management rules, such as the risk of 1-2% per trade. Anyway, you should remember that any system is to be tested first and, perhaps, customized to get the best results in the long run.