Trading with Scalping Forex Strategy CCI + EMA

5 minutes for reading

Today, we will get acquainted with one more Forex strategy that is often thought to be meant for scalping though it is not. Scalping as it is means a huge number of trades per trading session with a small profit (about 1-4 points each). However, the CCI + EMA strategy in question suggests much larger profits and Stop Losses, so I would call it short-term because the timeframe is small, and so are the Stop Losses and Take Profits.

Let us get started.

Characteristics of the strategy with the CCI and EMA

- The CCI + EMA is a multicurrency strategy that suits for trading CFDs as well.

- According to the author, the best timeframe is M5 and higher; however, you may trade even on H charts.

- The strategy is based on a group of indicators using technical support and resistance levels.

- Applicable to any trading session and any time of the day – provided that the market is volatile.

I would say the CCI + EMA strategy is not meant for beginners as it uses a lot of indicators and Pivot levels that require separate studying. On the contrary, experienced traders will master the strategy easily.

The strategy uses the following indicators:

- EMA10, applied to close (red)

- EMA21, applied to close (blue)

- EMA50, applied to close (green)

- CCI with default settings

- Pivot levels: you may use any indicator that draws levels. Pivot is set for Fibonacci levels and D1.

As we can judge by the set of indicators, the main signal will be given by the Moving Averages. This is why they are marked by different colors. CCI is an additional filter for entering the trade, while the Pivot levels are regarded as horizontal support and resistance levels, near which we will place Stop Losses and Take Profits.

Trading rules of the CCI + EMA strategy

Opening a buying trade

Having added all the necessary indicators to the chart and chosen the timeframe, start monitoring the market and look for trading signals. Though the CCI + EMA strategy is multicurrency, I advise you to skip certain cross-rates with large spreads because sometimes the borders of the spread extend too far, and the position will be closed untimely by the Stop Loss. The assets that you are used to and major pairs will be the best choice.

First and foremost, we are interested in the position of the MAs on the chart:

- EMA50 (green) is above the others.

- EMA21 (blue) is in the middle.

- EMA10 (red) is under the other two MAs.

- CCI is above zero.

Enter a buying trade when the red MA crosses the other two from below, while Cci remains in the positive area (ideally, above 100). Enter your position by the trend.

Place a Stop Loss by the following criteria:

- If the spread allows this, place a Stop Loss 10-15 points below the entry point.

- If the main Pivot level is near the entry point, you may place an SL under this level; with levels S, S1, S2 things are the same.

Closing the position with a profit

- Place a Take Profit at the next upper Pivot level or

- DO not place a Take Profit but keep monitoring your open position and close the order after the EMA10 crosses back the other two MAs.

- Close the trade with a profit two-three times larger than the Stop Loss.

Opening a selling trade

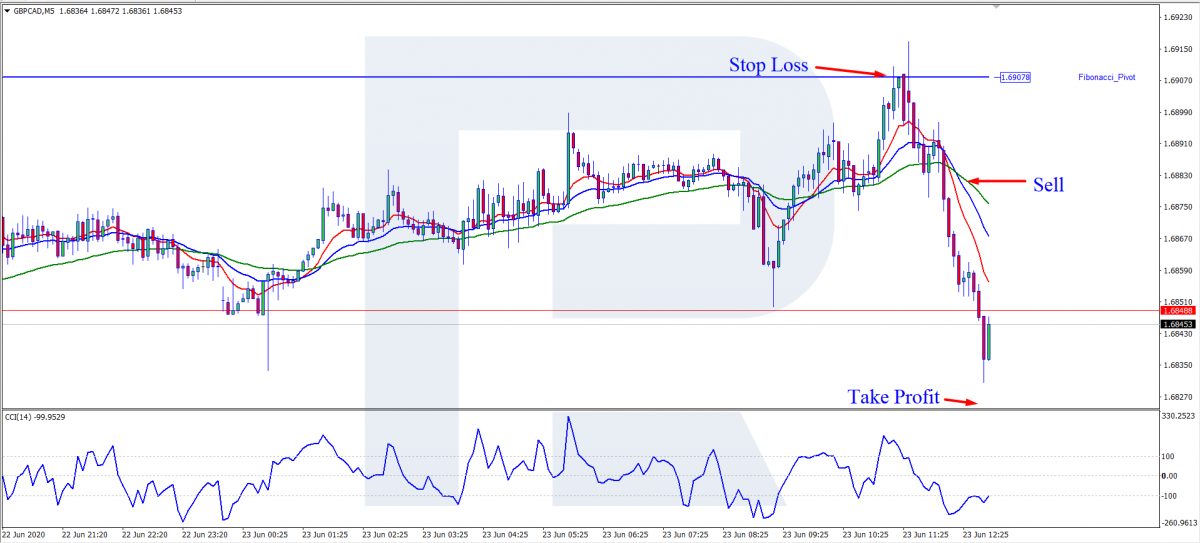

The conditions for opening a selling trade are as follows:

- EMA10 (red) is above the other two.

- EMA21 (blue) is in the middle.

- EMA50 (green) is below the other two.

- CCI is below zero (ideally, below 100).

Enter a selling trade after EMA10 fully crosses EMA21 and EMA from above. CCI must remain below zero (ideally, under 100).

Place a Stop Loss by a similar principle as in the case of buying:

- If the spread size allows it, place an SL 10-15 points above the entry point.

- Place an SL behind the nearest Pivot level. It might be your main daily level; if so, hide your SL behind it or behind the nearest R1, R2, or R.

Closing your trade with a profit

- Place a TP at the nearest Pivot level.

- Monitor your position and close it manually after the EMA10 closes the other two MAs from below.

- Close the trade when the profit amounts to two-three spreads.

As we see, there is nothing too hard to enter a trade. Trading is based on three MAs and CCI as confirmation of entering a position.

When trading, keep in mind that MAs tend to change their direction and signals. So may do CCI.

To my mind, Pivot levels are the main problem of the CCI + EMA strategy. I do not mean that they work somewhat wrong. The thing is that they are calculated on daily timeframes while you trade on M5. In some cases, the distance to the level on M5 may be just huge, which would perplex traders with poor experience in trading in financial markets and drawing Pivot levels.

Closing thoughts

I have spent several days studying the CCI + EMA strategy and got an ambiguous opinion. If you correct entry points a little bit, you may successfully use the strategy for major currency pairs. However, it does not suit trading cross rates because of large spreads: the SL may be triggered but the next moment the price will go in the right direction. Anyway, you may easily use the CCI + EMA strategy intraday, if you stick to your risk management.