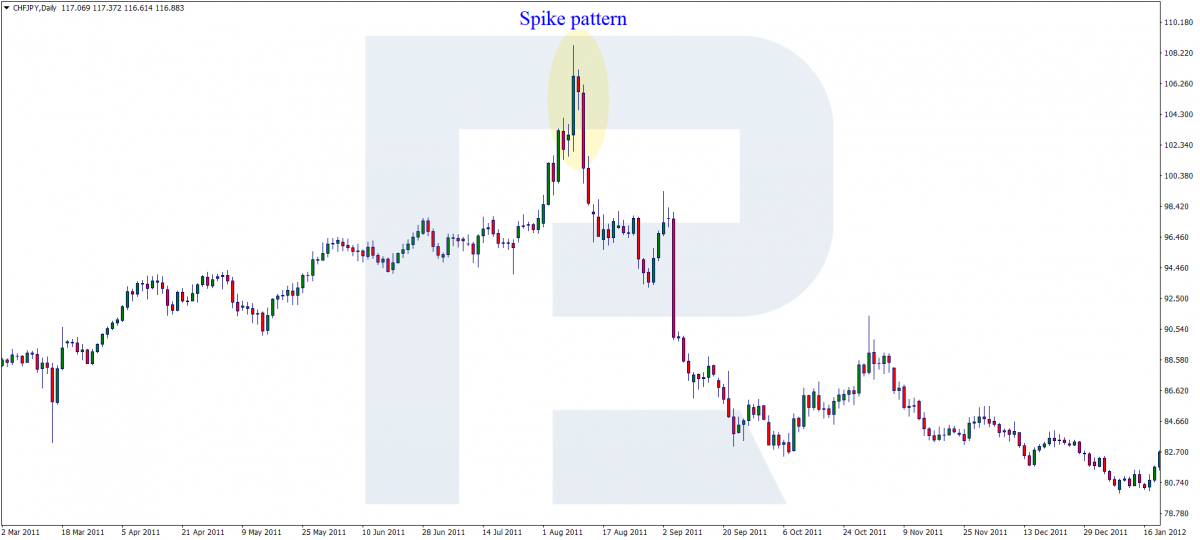

Spike Pattern: Candlestick Model on Forex

5 minutes for reading

Today, we will get acquainted with the Spike pattern. It is rather rare on charts but provides decent trading opportunities. It has been around for quite long but the one who noticed it first was Jack D. Schwager: he described the pattern and designed the trading rules.

This candlestick pattern may form both at the end of a bullish and bearish trends. The point is that it forms after a might up- or downward impulse when the price returns to the initial values upon its ending. If you look at the pattern closer, you will see the following.

A Spike forming at the top of an uptrend

A certain event (some news on the economic calendar or a force majeure, mostly overvalued economically) makes the quotations sky-rocket.

After a precipitated impulse, the quotations stop at the high where a reversal candlestick may form (a Harami, Pin Bar, Shooting Star, and the like). Then on the next candlestick, the quotations return to their initial values which they started growing from. And then the existing trend normally reverses, and the price starts moving in the opposite direction.

A Spike forming at the bottom of a downtrend

As described above, under the influence of some news or events, the quotations drop steeply. At the low, a reversal candlestick pattern may form (a Hammer, Harami, Inverted Hammer, and the like). Then on the next candlestick, the price returns to the place where it started falling from. And then the actual trend reverses, and the quotations start growing.

Why does a Spike appear?

As a rule, the appearance of a Spike is provoked by a human factor: greed, fear, and panic. Greed makes traders open trades after the beginning of the impulse, however, it might not be enough for the growth to continue. Then, after the decline begins, panic and a fear of losing money comes to the scene. The traders start closing orders massively, and after the price returns to the starting point, it goes on falling or growing.

The other situation when a Spike may form is when there appears a trader with an extremely large position volume. In this case, if you look at the market depth, large volumes are bought at all the existing prices, then the depth fills up with applications, and the quotations return to the initial levels.

Additional reasons for a Spike to formation

- There is a directed movement (a trend) on the chart;

- The price is not accumulating near the support or resistance levels (there is no flat);

- The price leaps equally sharply by the trend and counter it;

- The price does not lag between the impulses (after a “spurt” the quotations get back right on the next candlestick);

- A swift impulse may break away a key support or resistance level, after which the price will return;

- The price may break away an equidistant price channel (then the price returns, and the trend reverses);

- There might be a lot of gaps.

On large timeframes, the size of the Spike is normally no less than a hundred points and sometimes – over a thousand.

An example of trading a Spike: a selling trade

On the chart, the price has been growing for a long time; at some point, an important economic or political event happens, or active trading simply begins (the more unexpected the news, the acuter the market reaction).

The price leaps up high and stops on the next candlestick. In our example, the next candlestick is a Hanging Man. Then the quotations pull back. Ideally, a position should be opened at the level of the last low before the impulse; however, in this case, a selling trade will be opened at the closing of the returning candlestick.

Place a Stop Loss in a safe place behind the high. A Take Profit is calculated based on the size of the SL. To increase the profit, bearing in mind that the trade is opened at the very birth of a trend, it would be better to move the SL instead of placing a TP.

An example of trading a Spike: a buying trade

After a lengthy downtrend, the price demonstrates a sharp impulse then stops (on the chart, it looks like a complete Inverted Hammer). On the next candlestick, the price returns to the starting point. Here you may open a buying trend.

Place an SL behind the low. Calculate a TP based on the size of the SL. Some sources advise to make the TP as large as the Spike; however, bearing in mind that the trade is opened at the very birth of a trend, it would be wiser to move the SL instead of placing a TP.

No doubt this is not a perfect option but it will let you earn more points then if you place a fixed TP.

Bottom line

Trading Spikes entail high risks because they form in extremely volatile markets and, most often, on extremely volatile instruments, such as cross-rates or exotic currency pairs.

To detect Spikes precisely, the trader must study candlestick analysis thoroughly and master its use. The reason is that a Spike is formed on several candlesticks and in the end, it may turn out to be some other pattern. In some cases, signals might be false, especially if before the appearance of the Spike the market was quiet. So, market beginners should better avoid such situations and abstain from opening trades at sharp impulses.

Generally speaking, a Spike is a failed attempt to continue the existing trend. In certain cases, even experienced traders may have more troubles with this pattern they they would like to. Study the market and do not let it trick you.