How to Trade by Puria Method Strategy?

4 minutes for reading

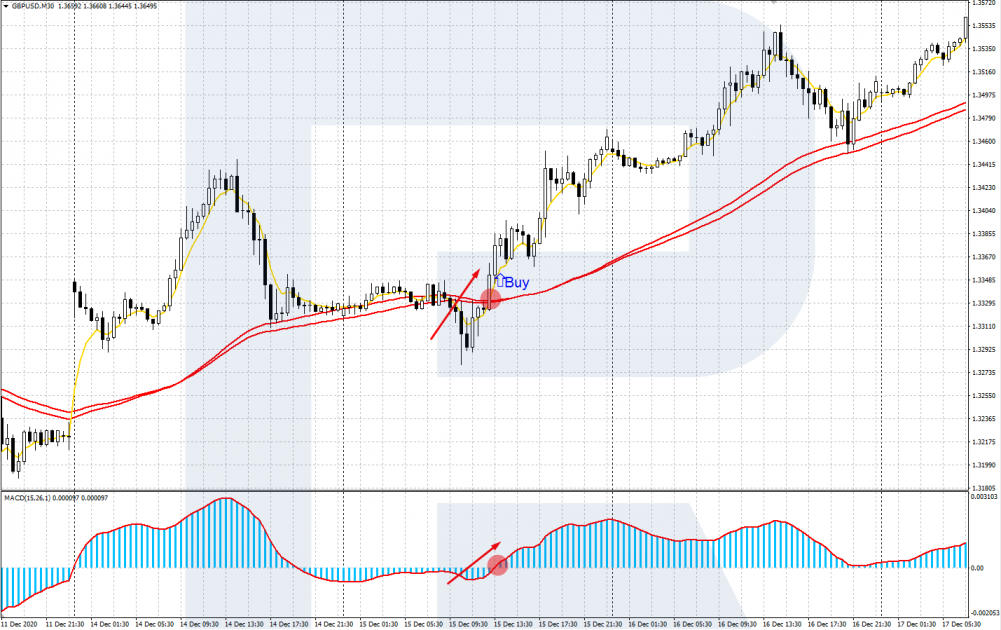

In this overview, we will discuss an indicator strategy known as the Puria method. Regardless of such a mysterious name, this is quite a simple and understandable strategy based on signals from four standard indicators.

What is the Puria strategy based on?

Puria is an intraday indicator strategy aimed at buying/selling currency pairs during a trading day. In other words, it is meant for making small but regular profits. Each trade opened by the trading strategy is aimed at earning 15-25 points.

The trades are first and foremost based on finding a crossing of three Moving Averages. Two slow Weighted MAs (red ones) with periods 75 and 85 are sometimes crossed by a yellow signal EMA with period 5. Trades are opened in the direction of the crossing, an additional filter for signal confirmation being the MACD (15, 26, 1).

This strategy does not imply using tech analysis, it is based solely on signals from indicators. You can use any currency pairs and their cross rates; what will depend on your instrument is just the size of your profit. Timeframes recommended for trading are M30 and H1, though some traders try M15 as well. Anyway, this is a good strategy for indicator intraday trading.

Setting up the indicators

To trade by Puria, you will need four indicators installed on the chart:

- Moving Average 1: period 85; MA method: Linear Weighted; apply to: Low; style – choose red.

- Moving Average 2: period 75; MA method: Linear Weighted; apply to: Low; style – choose red.

- Moving Average 3: period 5; MA method: Exponential; apply to: Close; style – choose yellow.

- MACD: fast EMA – 15, slow EMA – 26, MACD SMA – 1.

To save this set of indicators in MT4 and MT5, right-click the window with the indicators installed and choose Template/Upload Template/Puria.

Trading by Puria

With this strategy, we recommend using the following currency pairs (with a certain timeframe and profit size):

- NZD/USD: timeframe H1, profit 25 points.

- USD/CAD: H1, 20 points.

- GBP/USD: M30, 20 points.

- CAD/JPY: M30, 20 points.

- EUR/CHF: H1, 15 points.

- CHF/JPY: H1, 15 points.

- AUD/JPY: M30, 15 points.

- USD/JPY: M30, 15 points.

- EUR/JPY: M30, 15 points.

- EUR/USD: M30, 15 points.

- EUR/GBP: H1, 10 points.

- USD/CHF: M30, 10 points.

- AUD/USD: M30, 10 points.

The Stop Loss recommended for all positions is 15 points. I suppose, you can resort to a more flexible approach, implying a Stop-to-Profit ratio of 1:1, which means your SL will equal your profit. Your trading will remain profitable thanks to a large number of trades. At times of increased market volatility, you can add 10-15 points to your profit.

These are basic recommendations. Each trader should test the strategy with those currency pairs or other instruments, on various timeframes, with different SLs and profits. The strategy is open to experimenting, so you might discover more efficient settings.

Signal to buy

- The price chart rises above the slow MAs.

- The fast yellow EMA (5) crosses its red counterparts from below.

- The MACD histogram crosses the central line from below. At least one bar of the histogram must close above zero.

- Open a buying position with the SL and TP set according to the recommendations above.

Signal to sell

- The price chart drops below the slow MAs.

- The fast yellow EMA (5) crosses its red counterparts from above.

- The MACD histogram crosses the central line from above. At least one bar of the histogram must close below zero.

- Open a selling position with the SL and TP set according to the recommendations above.

Closing thoughts

The Puria Method Strategy is an easy way to trade intraday using signals from four indicators. However, keep in mind that no matter how profitable the strategy promises to be, market conditions are prone to change, so a positive result is never guaranteed. Before trading for real, test the Puria strategy on a demo account and make sure it is efficient for the current market conditions.