How to Trade USD/CHF Currency Pair

6 minutes for reading

USD/CHF – the US dollar against Swiss franc – is one of the majors in Forex. In this overview, we will discuss some factors influencing the quotations of USD/CHF as well as learn some ways of trading the pair.

Some history

The history of the Swiss franc starts in the 1700s. At those times, in Switzerland, there were numerous coins in circulation, including foreign ones. Aiming at creating a unified currency, the Swiss government introduced the franc all over the country. The state monetary and credit policy is carried out by the National bank of Switzerland.

Throughout history, the Swiss franc has been some sort of a safe-haven currency. Historically, it had almost zero inflation, moreover, Switzerland legally secured gold reserves behind the national currency. This measure, however, was canceled in 2000 through certain changes in Swiss constitution.

Thanks to a flexible exchange rate and sustained development of the economy, the Swiss franc remains one of the most stable currencies in the world and enjoys active demand as a protective asset. The trust of international investors is the reason for the growth of the franc against other national currencies.

Trading characteristics of USD/CHF

USD/CHF is, again, a major. It is number 4 on the list of the most popular currencies in Forex. It takes up about 5% of the overall daily trade volume.

The main characteristics of the currency pair are:

- Trading hours: the pair trades 24 hours a day except for the weekend. The largest volume is traded during the European and American sessions. This is when important economic indices get published, influencing the pair so that it fluctuates.

- Volatility: is moderate, fluctuating by 50-80 points a day. However, in crises or when stock markets drop, surging by 150 points and more.

- Spread: this is a major, liquidity is high, and hence, spread is minimal. On popular ECN accounts spread is normally below 1 point.

Which factors influence the quotations of USD/CHF?

The behavior of USD/CHF is a kind of an indicator that demonstrates comparative states of the US and Swiss economies. The pair is influenced by economic indicators, speeches of political leaders, and the credit and monetary policies of both countries.

Influences on the US dollar

The US dollar, as the most traded currency in the world, is influenced by lots of factors. One of the most important factors is reports of the US Fed. Decisions on the interest rate might significantly influence the quotations of USD/CHF.

As a rule, the unemployment data and NFP in the USA are published on the first Friday of each month. Traders keep a close eye on this data because they can significantly increase the volatility of the US dollar and thus influence the overall structure of the USD/CHF pair.

The most influential factors are:

- Interest rate changes

- Unemployment rate changes

- Nonfarm Payrolls

- GDP

- CPI, PPI

- Industrial Production index

- Retail Sales

- Trade Balance

- Consumer Confidence index

- ISM

- Public speeches of political leaders and the head of the Fed.

Influences on the Swiss franc

The National bank of Switzerland is the most important factor that can influence the CHF and the whole pair via it. Decisions on the interest rate, speeches on the monetary policy influence the rate. The Central bank is not too happy when the CHF gets too strong (because it is a negative on Swiss export), hence sometimes it even decides on monetary interventions to hold back the national currency.

The most important factors tat influence the Swiss franc:

- Decisions on the interest rate

- The unemployment rate in Europe and Switzerland

- The growth of the GDP

- Inflation rates in Switzerland

- Changes in the import-export balance in the country

- Public speeches of political leaders and the head of the CB.

In more detail, read about fundamental factors and their influence on currencies in our article about fundamental analysis:

How to trade USD/CHF?

For USD/CHF, various methods and approaches can be used depending on your preferences. You can use fundamental factors, tech analysis, and indicator strategies.

Trading fundamental factors

One way is to trade using fundamental factors and events. This might be short-term trading on news or long-term trading on expectations of changes in interest rates or during some world crises.

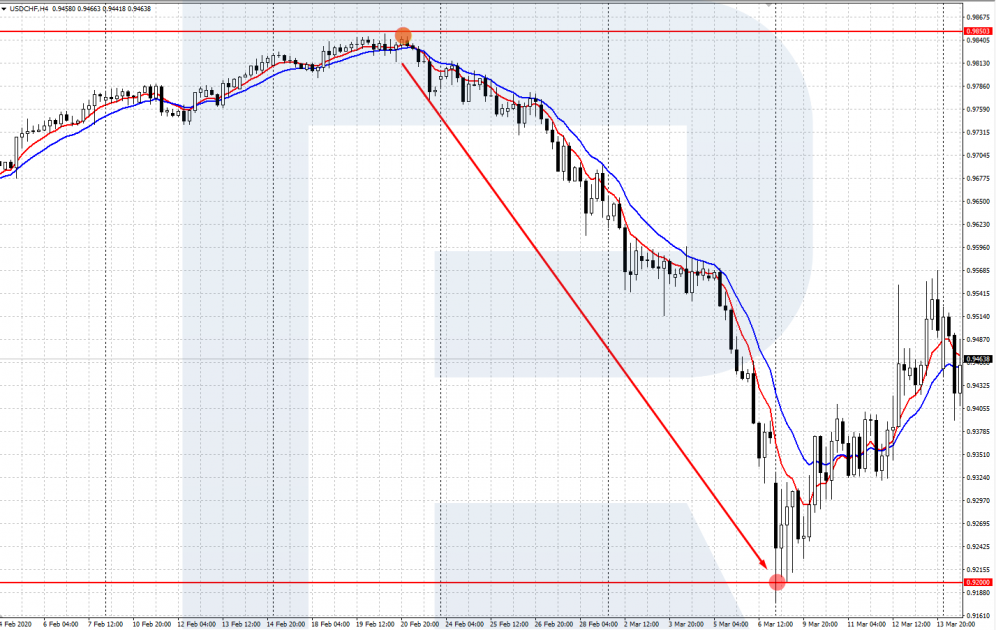

Example:

Using the property of the Swiss franc to act as a protective asset in different crises, you can sell USD/CHF (buying the franc against the dollar) when investors flee for safe-haven assets. After the beginning of the pandemic of COVID-19 in 2020, USD/CHF quotations fell from 0.9850 to 0.9200 during a couple of days.

Trading by tech analysis

In this case, you make trades based on technical factors. Both classic tech analysis and original methods (such as Elliott Waves, Wolfe Waves, Raschke’s, Sperandeo’s, Williams’s, Ross’s strategies, etc.) will do. Also, traders use price patterns, candlestick patterns, Price Action.

Example:

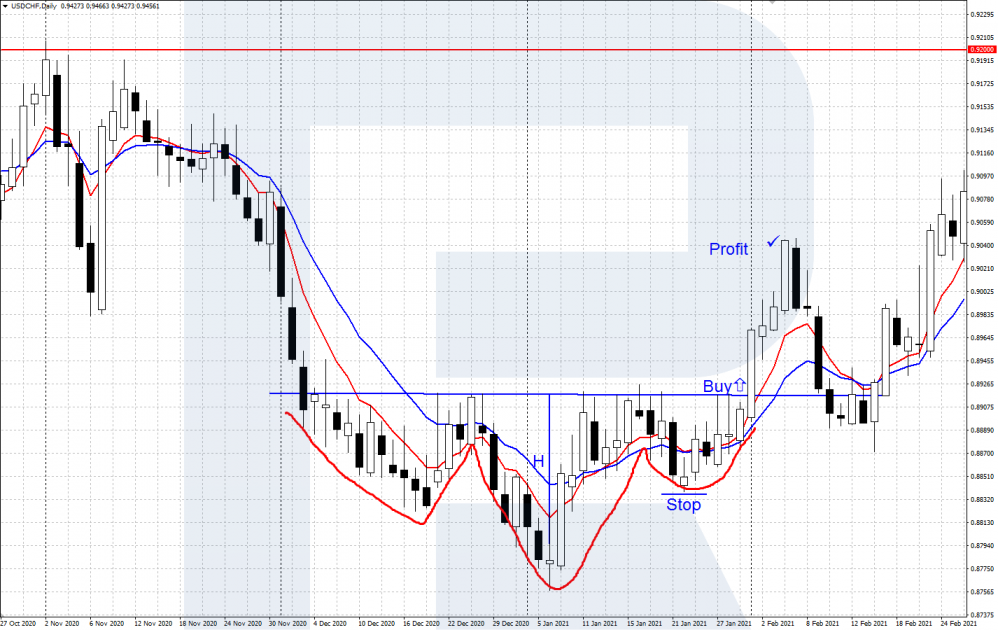

- On D1 of USD/CHF, a downtrend formed a reversal Inverted Head and Shoulders pattern;

- At the breakaway of the neck upwards, open a buying position;

- Place a Stop Loss behind the local low (the right shoulder of the pattern); the landmark for the TP is the height of the pattern in points (H).

Indicator strategies

In such strategies, trades are made based on signals from various trading indicators. This can be one complex indicator or a whole system of them. Based on indicators, you can create automatic trading systems, or expert advisors.

Example:

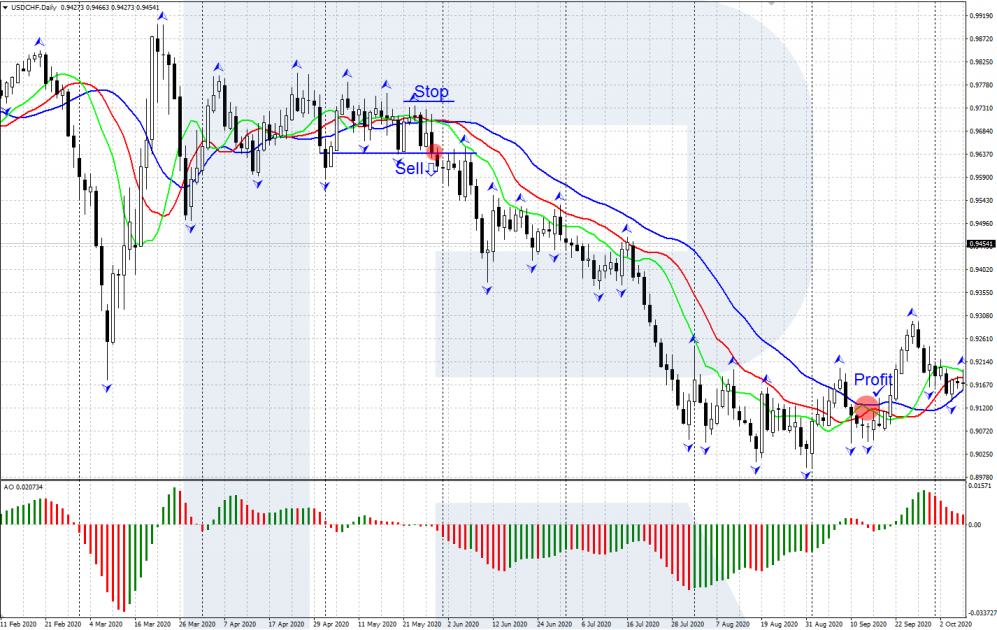

Take a simple indicator strategy called Alligator, earlier discussed in one of our articles:

- On D1 of USD/CHF after a small flat a decline starts; intertwined lines of the Alligator start unwinding and head downwards.

- The Awesome Oscillator starts declining from the zero line; histogram bars are red.

- The price breaks through the level of the nearest local fractal, lying below the three Alligator lines. Open a selling position.

- Place a Stop Loss behind the fractal that lies above the Alligator lines. You can take the profit when the indicator lines get crossed in the opposite direction.

Bottom line

USD/CHF is a popular pair in the Forex market. Thanks to its liquidity, availability, and the minimal spread it is so loved by traders. You can trade it based on fundamental factors, tech analysis, or indicator strategies.

Beginner traders should start practicing on a demo account and switch to a real one only after they get a stable positive result. To trade successfully, you need to be disciplined and stick to your risk management rules.