How to Trade AUD/USD Currency Pair?

7 minutes for reading

AUD/USD means the Australian dollar vs the US dollar. It is one of For example majors. This article is devoted to factors influencing the dynamics of AUD/USD quotations and get to know trading methods that suit the pair.

Some history

Australia is a young land discovered by European sailors in the 1600-1700s. In 1770, an English sailor and traveller James Cook research Australia, thus beginning it's colonization by Britain. The first British colony on the continent New South Wales was founded on January 26th, 1788. This day later became a national holiday, the Australia Day.

The Australian dollar, a decimal currency, went in circulation on February 14th, 1966, replacing the duodecimal Australian pound. The introduction of a new national currency was initiated by the CB - the Reserve Bank of Australia. The colloquial words for the AUD are Aussie and the Australian.

The Australian dollar is a popular currency that makes up for 5% of global currency trades. Such popularity can be explained by a rather high interest rate in Australia, free currency market, general stability of the economy and political system.

Trading characteristics of AUD/USD

Trading characteristics of the pair are as follows:

- Trading time: the pair trades all day long except weekend but is more active during the Pacific, Asian, and American trading sessions. At the Pacific and Asian sessions Australia publishes important economic news that can influence the pair, while the activity at the American session is explained by the influence of the USD.

- The volatility of the pair is moderate, mostly showing moves of 50 to 70 points. However, in crises, when stock markets are falling, volatility can increase shortly to 100-200 points a day.

- Spread: the pair is a popular major, and thanks to high demand and liquidity, it has minimal spread. On popular ECN accounts, spread is normally below 1 point.

Which factors influence the AUD/USD quotations?

The dynamics of AUD/USD is some kind of an indicator that compares the US and Australian economies. Here are the facts that have the most influence in the currency pair.

Monetary policies of the RBA and Fed

The policies of the Australian and American Central banks have the biggest influence over the pair. If the RBA decides to start a series of interest rate increases, while the Fed will keep the rate at its usual level, the AUD/USD will have a stimulus to grow. And vice versa: an increase in the rates made by the Fed and the lack of such an increase at the Australian side starts a downtrend in the quotations.

Global commodity prices

Regardless of being young, the Australian economy is among the largest ones in the world. The country owns all sorts of natural resources: gold, iron, diamonds, mineral resources, uranium, and coal. Their export makes a serious part of the country's income.

Hence, the growth of global prices for such commodities as iron ore, industrial metals, gold, silver, coal, etc., makes the AUD/USD quotations stronger. And vice versa, when prices for these commodities go down due to some global economic crisis, AUD/USD quotations also fall. The pair correlates with gold prices quite well: when the latter grows, the pair also grows.

Economic indices of Australia and the USA

Statistical entities on the US and Australia regularly publish information about the economic development of the two countries. The most important indicators would be:

- the unemployment rate

- new workplaces

- the GDP growth

- inflation

- industrial production

- changes in the import and export balance

- public speeches of political leaders and CB heads.

In more detail, read about these indicators in the following article:

How to trade AUD/USD?

To trade the pair, you can use one of these approaches - fundamental, technical, or indicator-based - or all of them together.

Trading fundamentally

The approach is based on analyzing various fundamental factors. Trading can be short-term, based on news, or long-term, either based on expecting changes in the rates or based on the current trend in the demand for commodities.

Example:

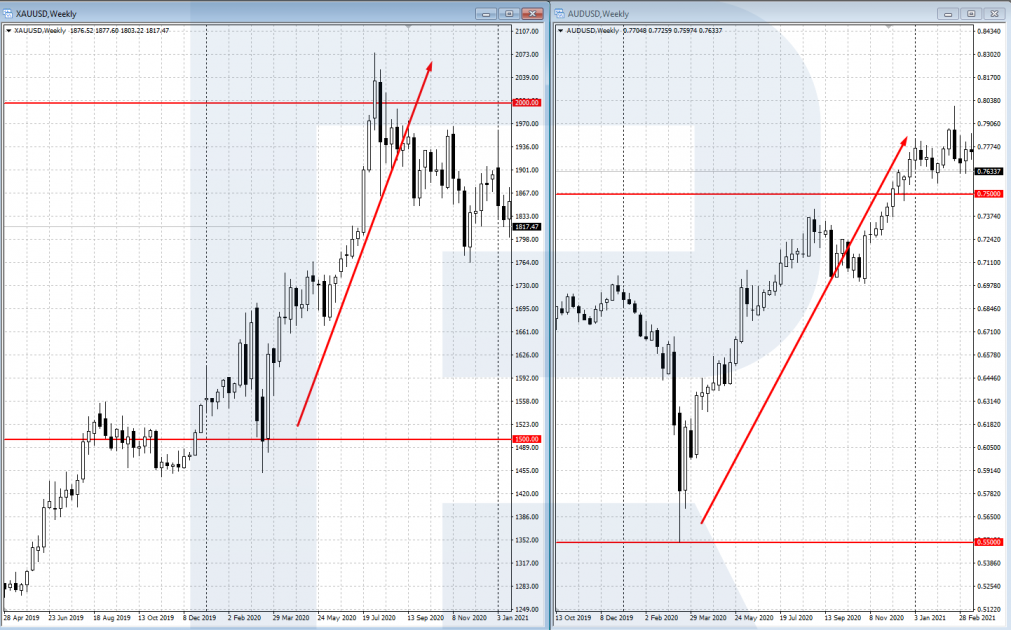

In 2020, after markets fell in March due to the coronavirus pandemic, global commodity prices started growing confidently. Gold demonstrated exquisite growth among other goods, setting a new all-time high at $2,000 per ounce. Knowing that the Aussie correlates well with gold, one could but AUD/USD, expecting that it will grow.

Trading by tech analysis

This trading method is based on analyzing the chart of the currency pair. It uses tech analysis, original methods, price patterns, candlestick patterns, and Price Action.

Example:

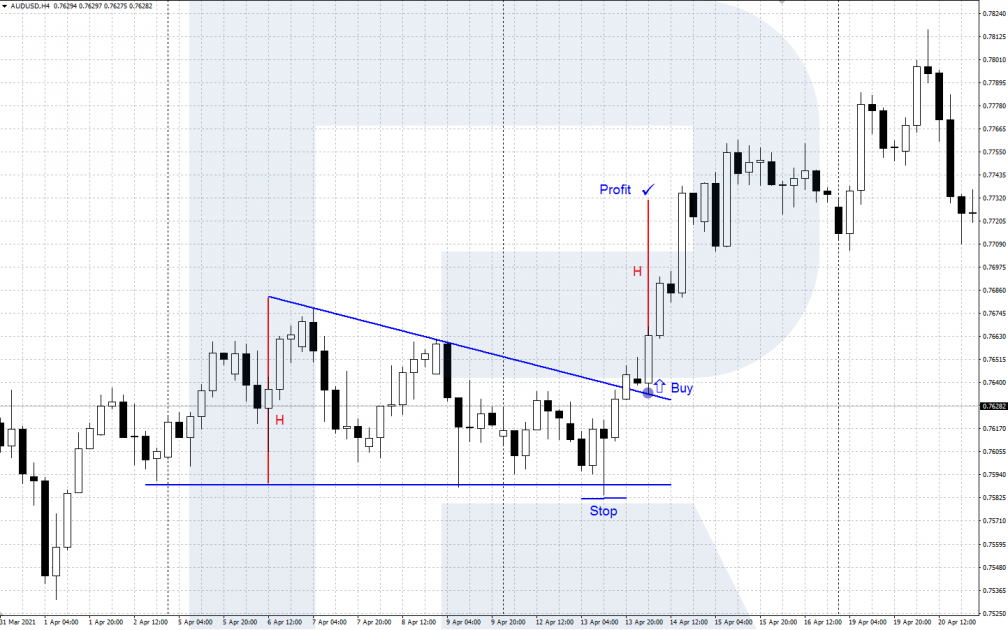

- In April, on H4 of AUD/USD, there formed a trend continuation pattern called Triangle.

- When the price breaks through the upper line of the pattern, we open buying positions.

- The Stop Loss is placed behind the local low, while the profit is taken at the height of the pattern (H).

Indicator-based strategies

In such strategies, trades are made by the signals of various trading indicators. This can be one complex indicator or a whole system comprised of signals from several indicators.

Example:

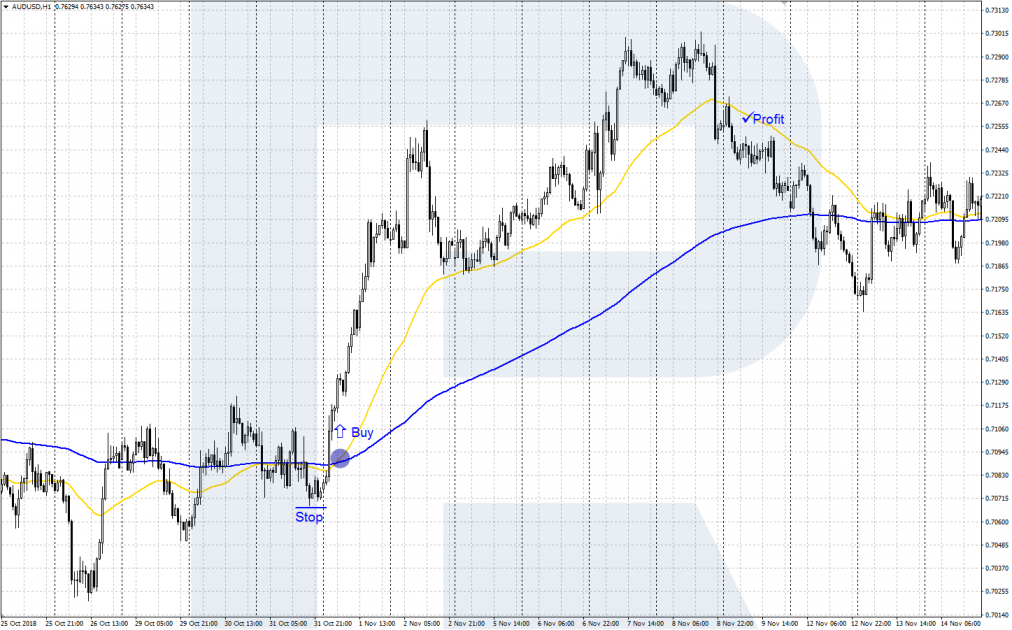

Take a simple Golden Cross indicator-based strategy, described in one of our articles.

- A signal to buy forms when the fast EMA (50) (yellow) crosses the slow EMA (200) (blue) from below.

- After the crossing, open a buying position. The SL is placed behind the local low on the price chart. Take the profit when some evidence of a reversal downwards appears.

Closing thoughts

Australia is quite a young country but it's currency has long taken a good place among Forex leaders. Thanks to its high liquidity, availability, and low spread, the AUD/USD pair remains popular among traders.

Beginners need to decide which trading method suits them and practice it on a demo account first, switching to a real one only when they get sustained positive results.

About us:

R Blog RoboForex - actual news and reviews on the Forex and stock markets, as well as financial markets analytics. The authors of the R Blog publish daily articles on trading and investments so that our readers can get the most complete and multifaceted information that helps to improve their level of knowledge about trading in the financial markets.

Contact us:

Chief editor - Timofey Zuev

Address: RoboForex Ltd, 2118 Guava Street, Belama Phase 1, Belize City, Belize

Phone: +65 3158 8389

E-mail: info@roboforex.com