How to Trade by Reversal Strategy

7 minutes for reading

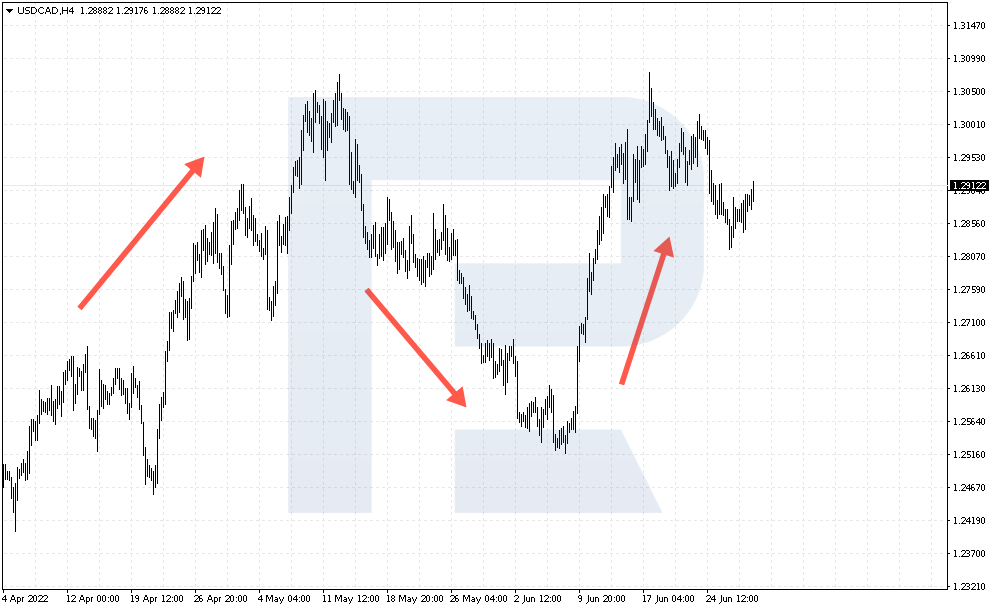

One of the main principles of tech analysis is “Trend is your friend”. Hence, some insist that for better results trading must occur by the trend only. However, any trend eventually comes to an end. A bull trend ends and changes or a bear one, and vice versa – see some examples on the charts.

The strategy we are about to discuss is called Reversal. The name makes it clear that here the trader is to wait for the trend to end and enter the market in the opposite direction. The timeframe is H4, which means the strategy does not require much time spent in front of the computer, tracking the price. The authors note that the method is quite easy to use, and risk management rules allow placing a Stop Loss much lower than the Take Profit.

In the article, we will see how to use the ZigZag and MA indicators to catch the end of the trend and enter by the new trend.

Setting up indicators for strategy

The method is applicable for two currency pairs only: EUR/USD and GBP/USD. These are popular instruments these days; also, movements of GBP/USD will be the strongest. To start trading, two indicators need to be added to the chart:

- Simple Moving Average with period 18

- ZigZag with period 150

Let us discuss each of these indicators for better understanding the Reversal strategy. Also, while the MA is, in essense, a basic instrument known by each trader, ZigZag is not so widespread.

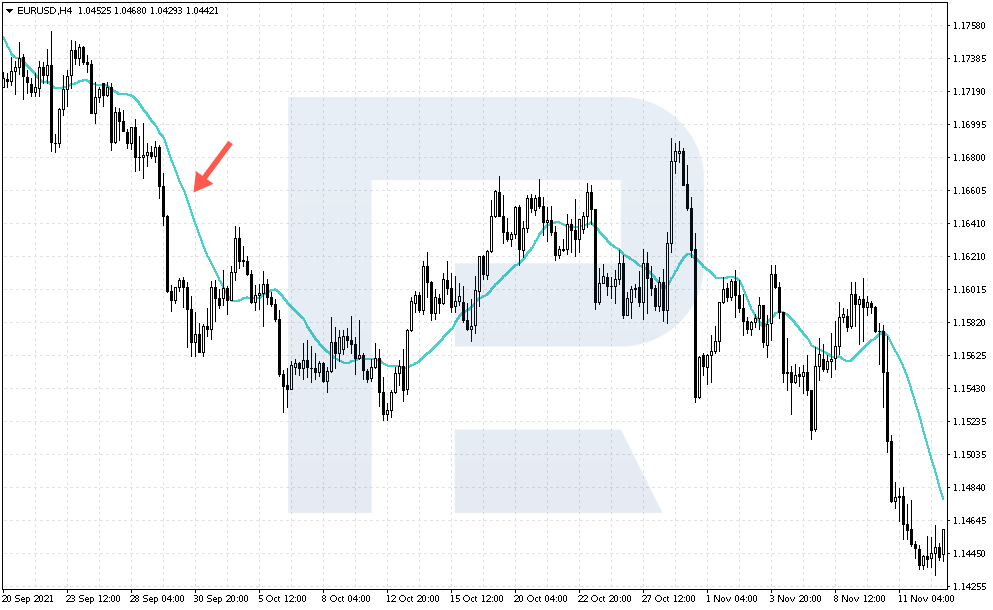

Simple Moving Average

The method is based on the signals given by the SMA. It is super user-friendly: if prices are above the indicator line, it is a signal to buy. And if the price breaks the line from above, look for signals to sell. As a rule, this indicator is used in every trend strategy.

ZigZag

This indicator is usually used as an addition to the Elliott waves. It smoothes out some market movements, simply eliminating minor fluctuations. Also, the indicator helps exclude the factor of subjectivity totally: it is no secret that different traders may assess the same chart differently. With ZigZag, however, the chart shows clear extremes, which makes finding price patterns and levels much easier.

Now let us add the indicators to the chart. Fortunately, they both are available on popular trading strategies. On MetaTrader 4, they are added this way:

Insert → Indicators → Trend → Moving Average.

Insert → Indicators → Custom → ZigZag.

How to buy by Reversal strategy

After adding all the instrument to the chart, let us look into the details of opening long positions:

1. ZigZag values reach their lows. The indicator helps define important levels on the chart. If the indicator values reach the lows, a good bounce upwards is likely to follow.

2. Price breaks through the SMA upwards. Check out the Close price of the candlestick: if the price turns out to be above the MA, the breakaway is true, so a buying trade can be opened at the opening of the next candlestick. This is the second signal by the strategy, which is necessary to avoid entering the market at each low shown by ZigZag. When the price breaks through the MA from below, this will be a signal for the beginning of an uptrend.

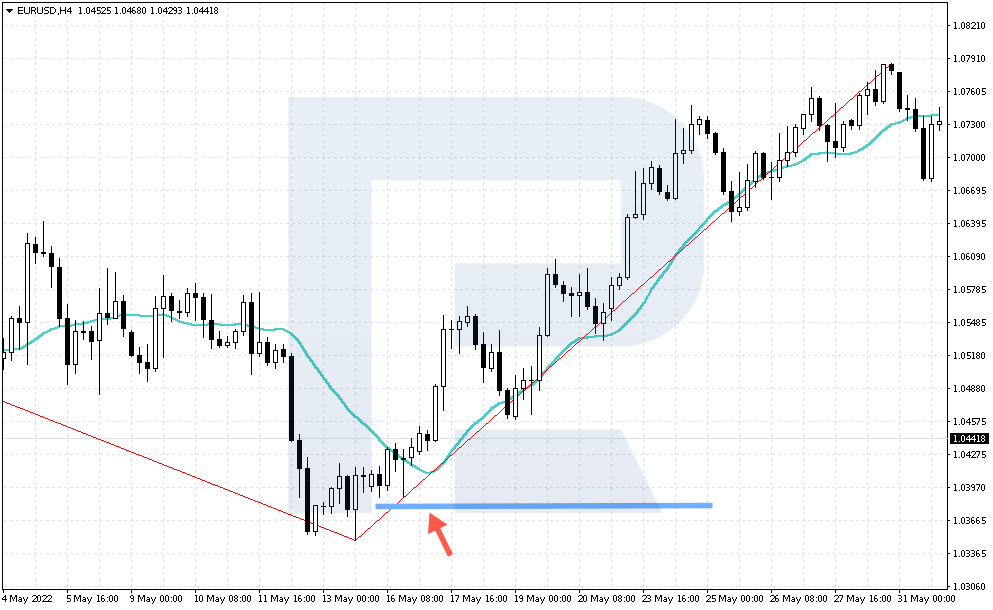

3. Place the Stop Loss 50 points away from the entry point. In most cases, this will be under the local low demonstrated by ZigZag.

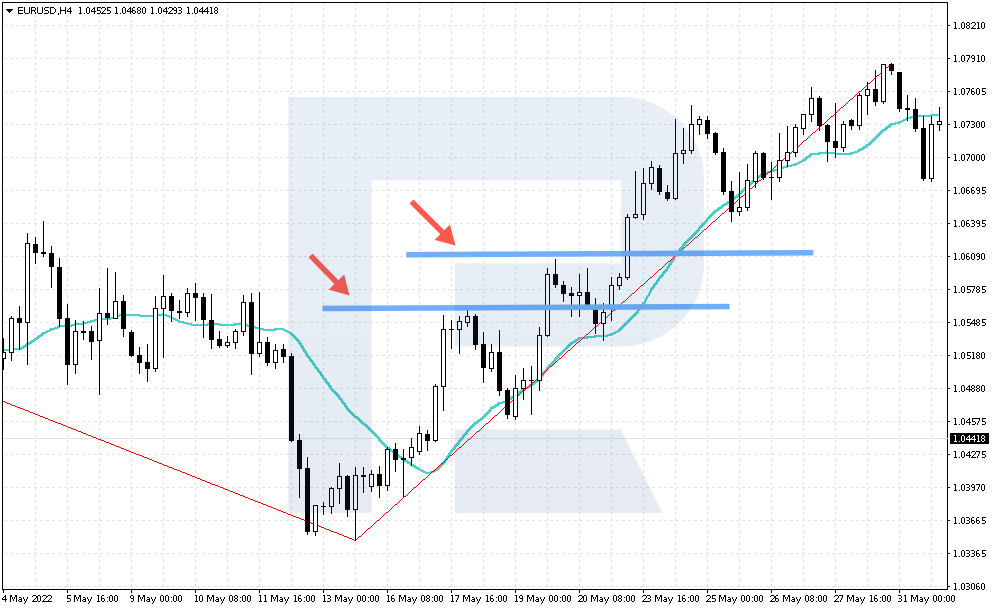

4. Place the Take Profit at the distance of 150 to 200 points. As long as the trader enters the market at the very start of the new trend, the movement can be very strong, that is why the size of the profit is so impressive.

Example of buying by strategy

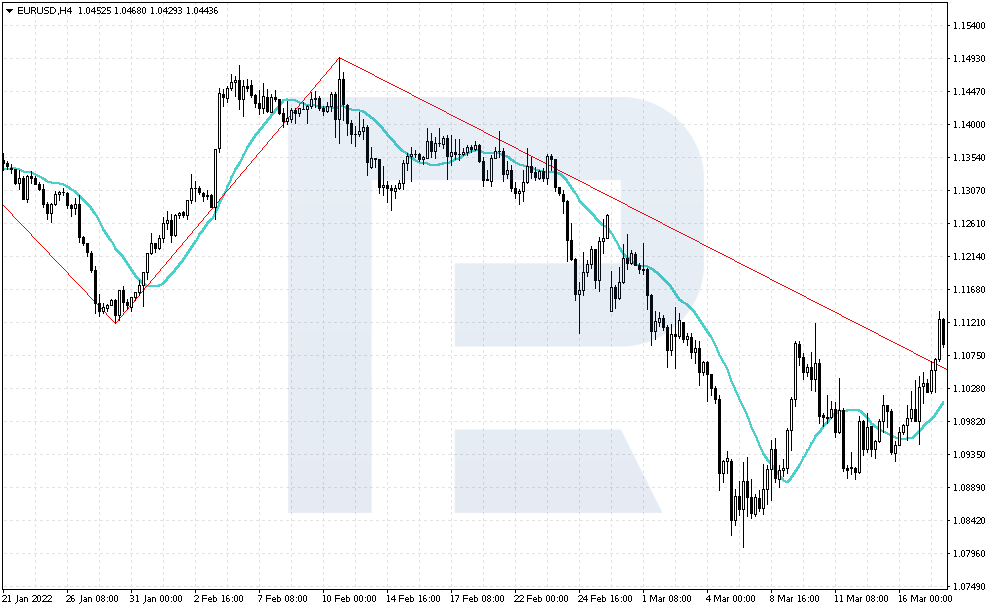

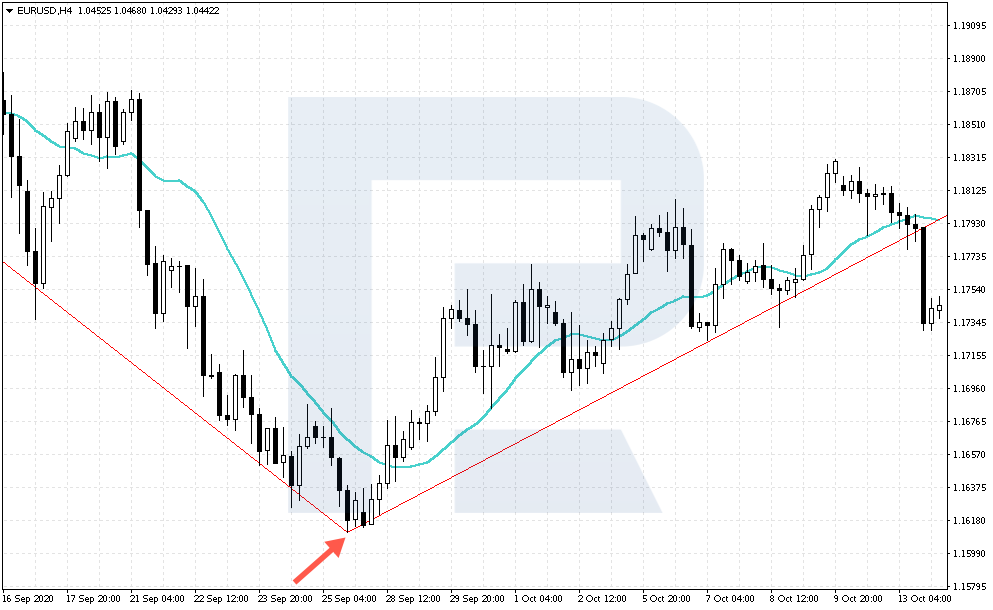

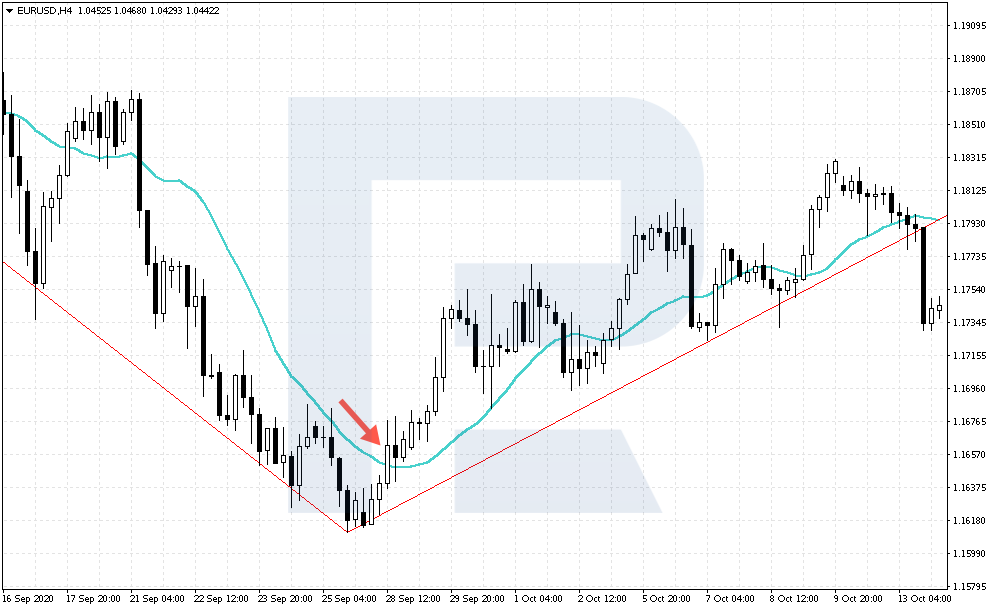

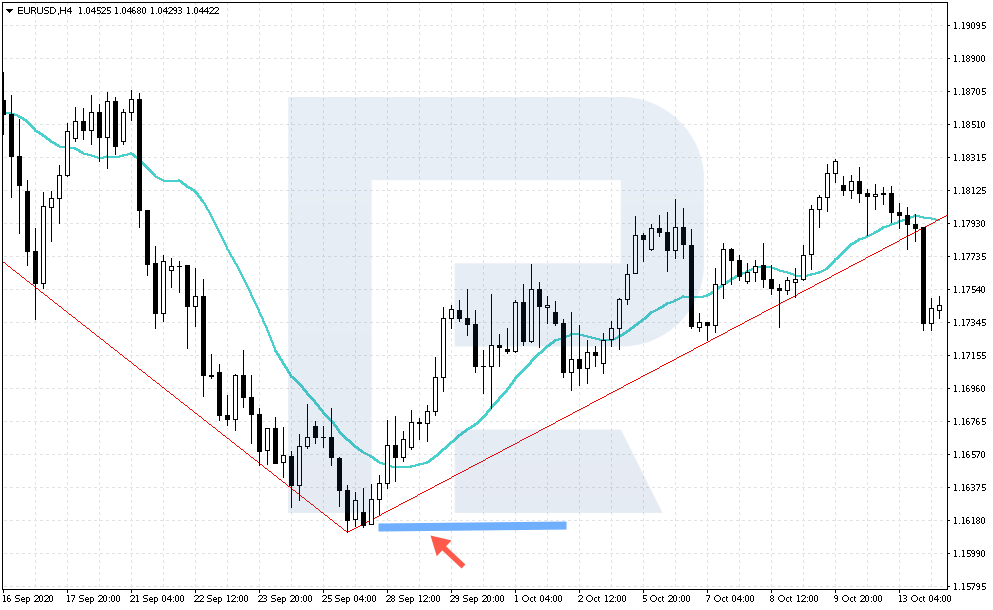

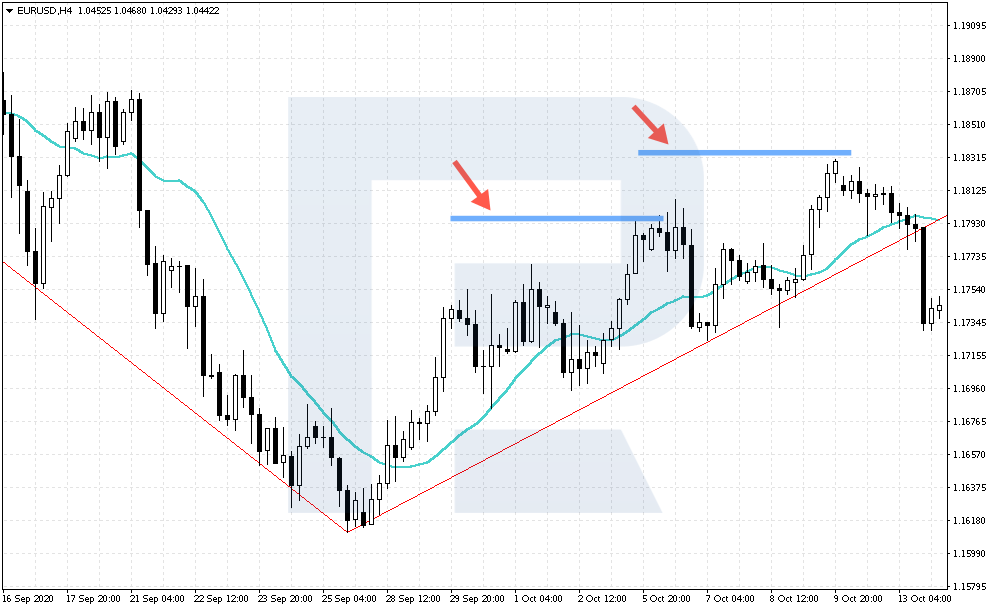

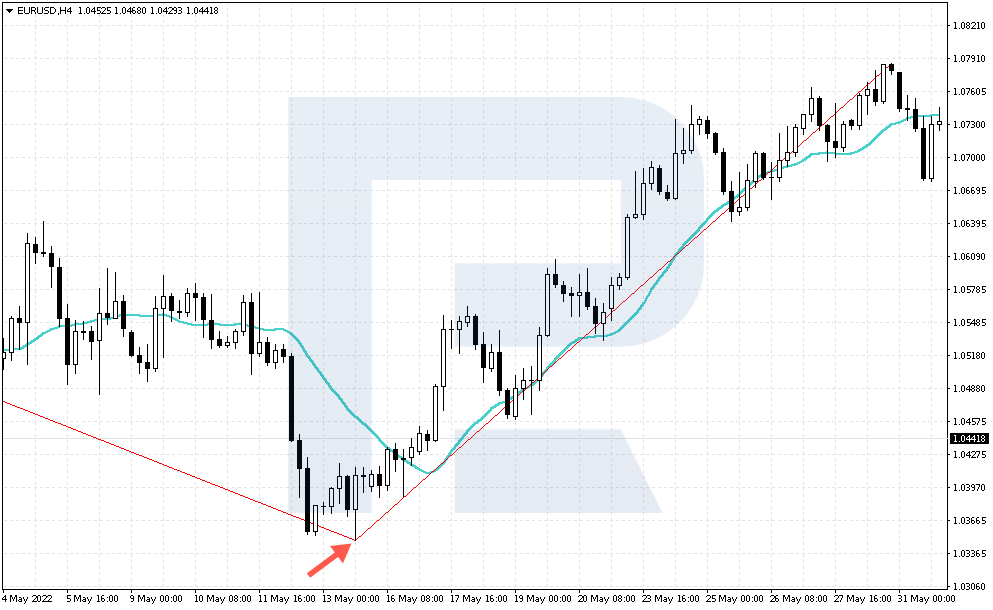

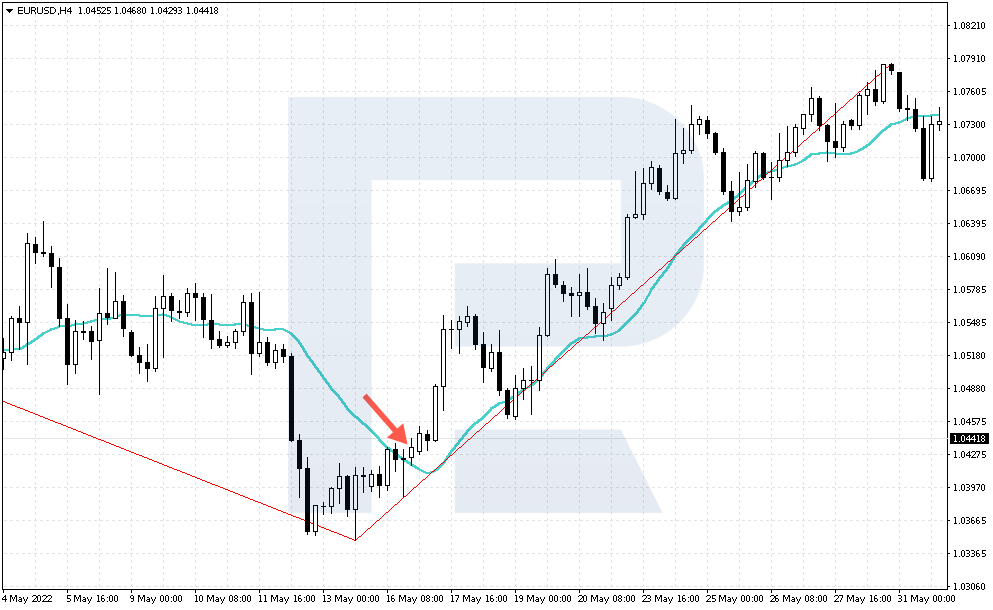

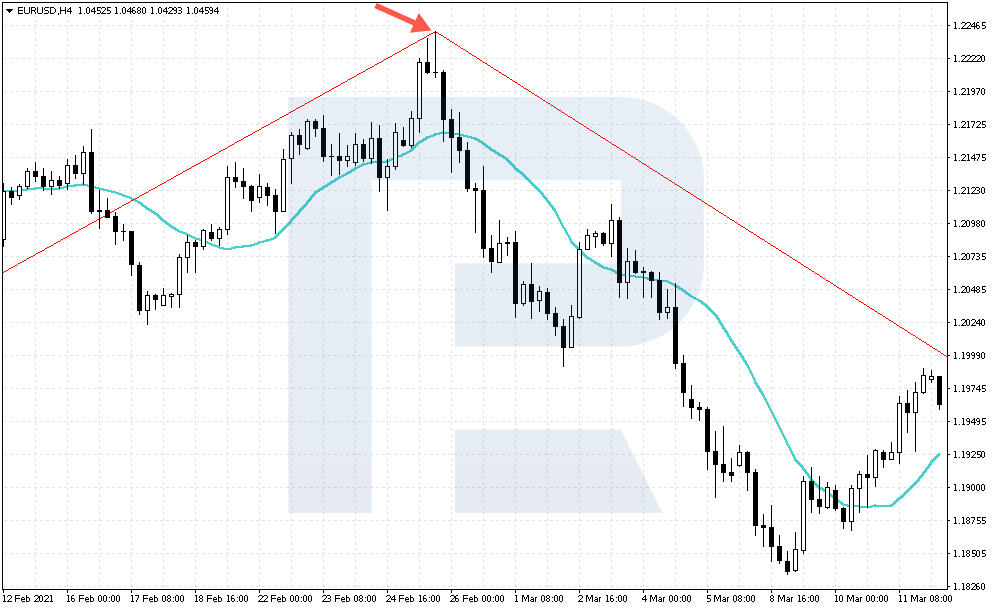

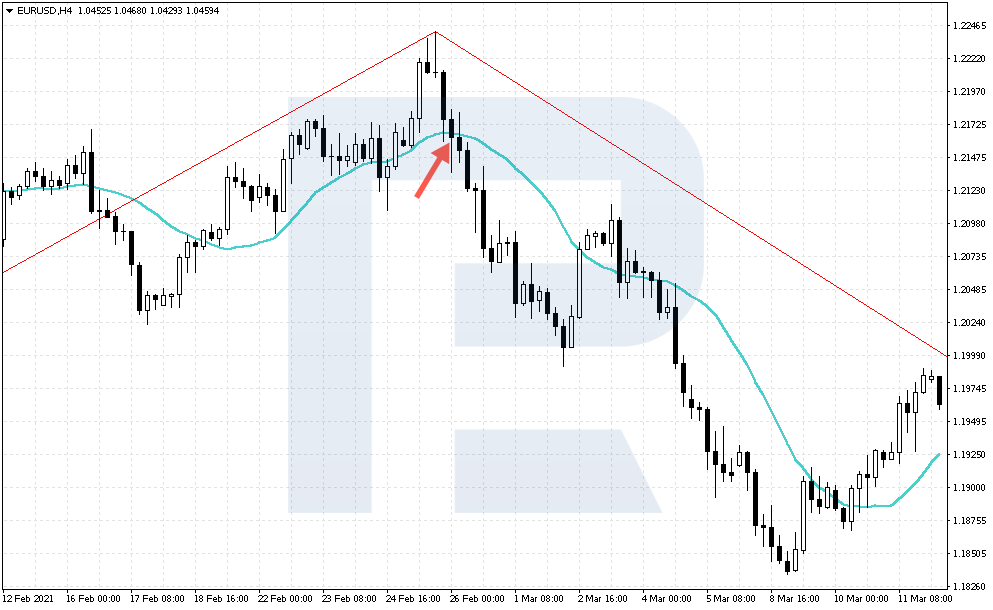

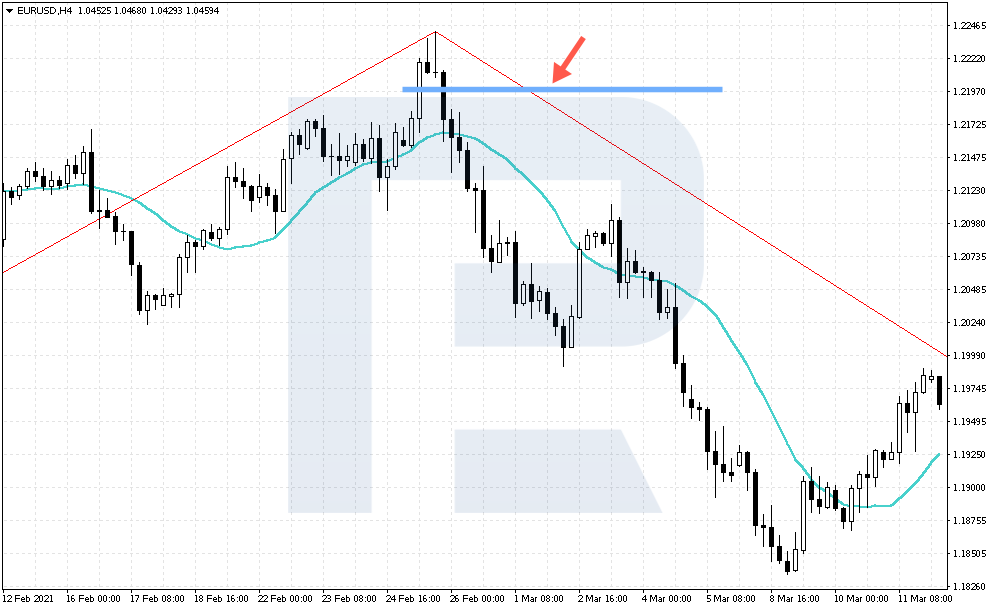

As an example of a long position, let us take the EUR/USD chart for 16 May 2022.

ZigZag demonstrated the low of 1.0349. This was the first signal to open a buying trade. After this low was reached, the price, indeed, started going up. Let us look at the second indicator now.

Price broke through the SMA (18) from below at 1.0434. Note that this line had been tested several times but the price bounced off it twice. A buying trade should be opened at the beginning of the next candlestick at 1.0430.

Place a Stop Loss at 1.0380, which is 50 points below the entry point. This is below the SMA line but does not reach the ZigZag low. However, the return of the price back under the SMA will most likely cancel the signal, so the SL is reasonable.

It took the pirce 69 hours to reach the first goal of 150 points. The second goal was reached 11 hours after the position was opened. The maximum price could have been 358 points. Note that ZigZag demonstrated the high from where the price started falling again.

How to sell by Reversal strategy

1. ZigZag values reach their highs.

2. The price breaks through the MA from above. Check the Close price of the candlestick. If the price turns out below the MA, the breakaway is valid. Open the selling trade at the next candlestick.

3. Place the SL 50 points above the entry point.

4. Place the TP 150-200 points away from the Open price.

Example of selling by strategy

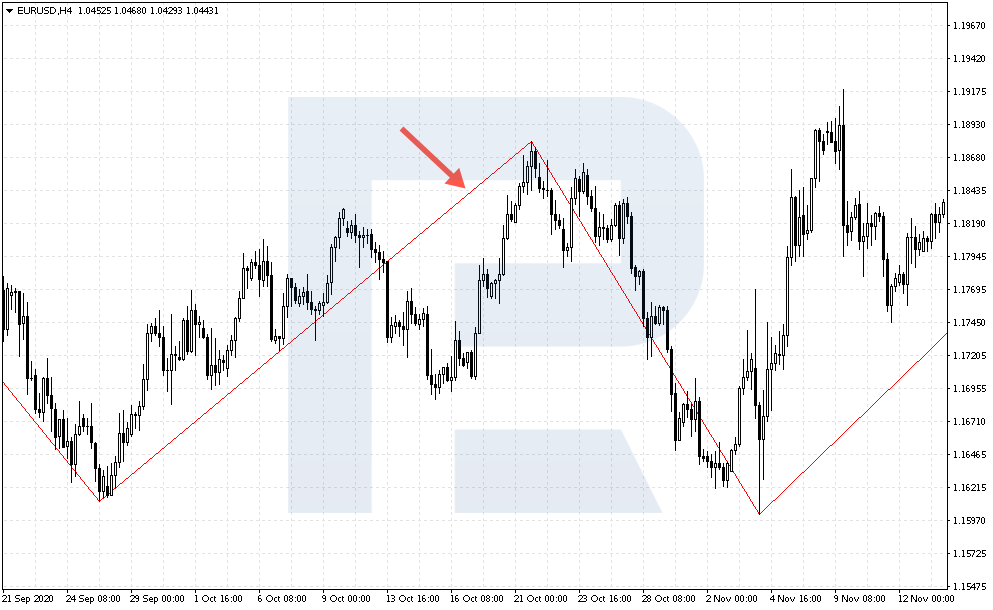

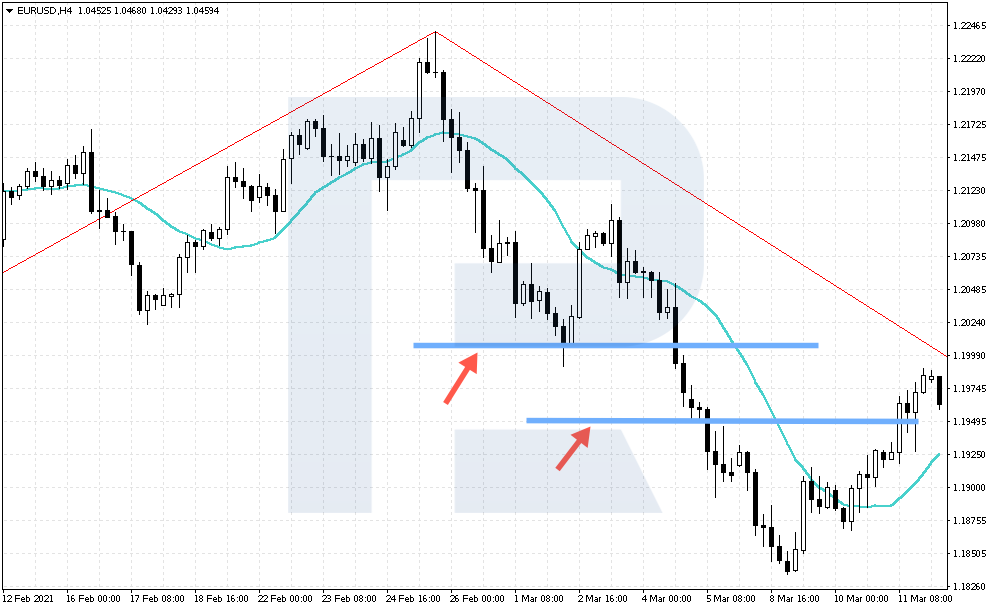

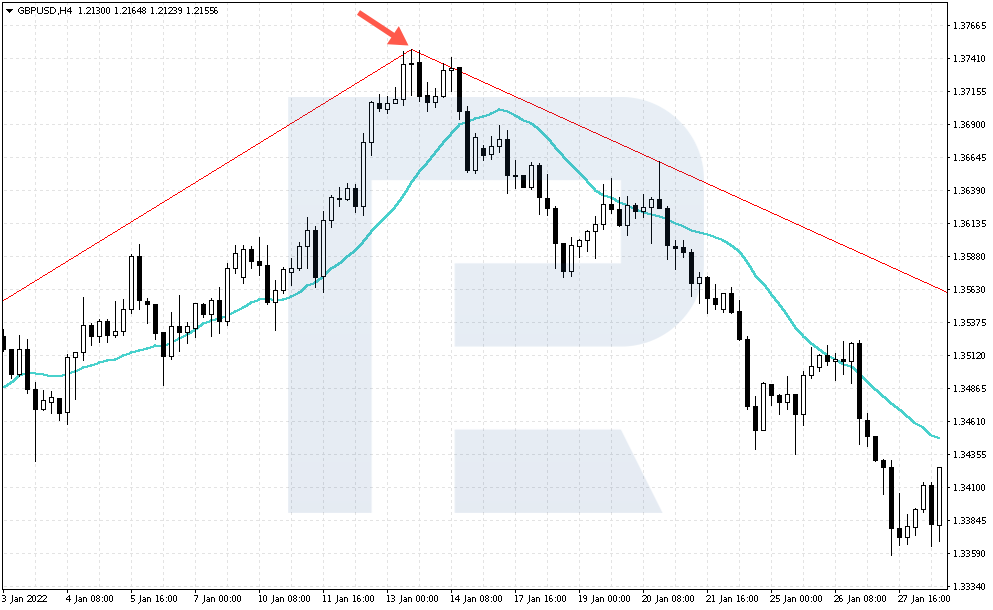

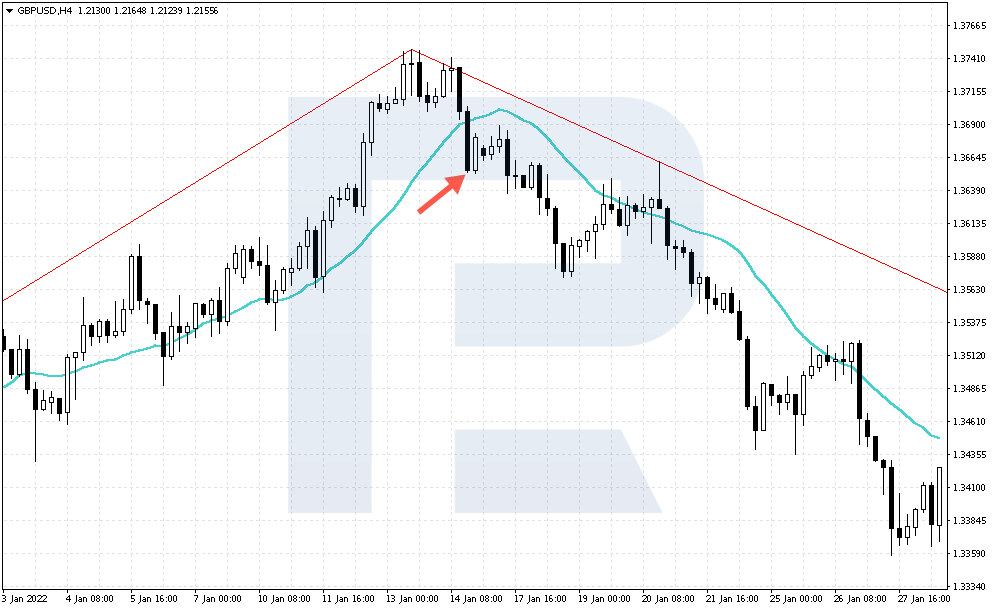

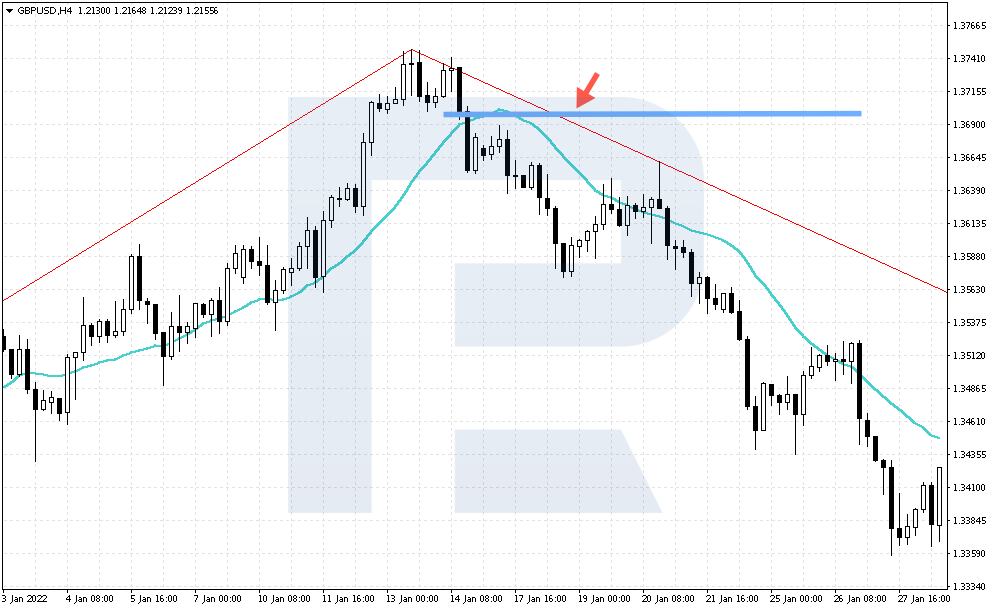

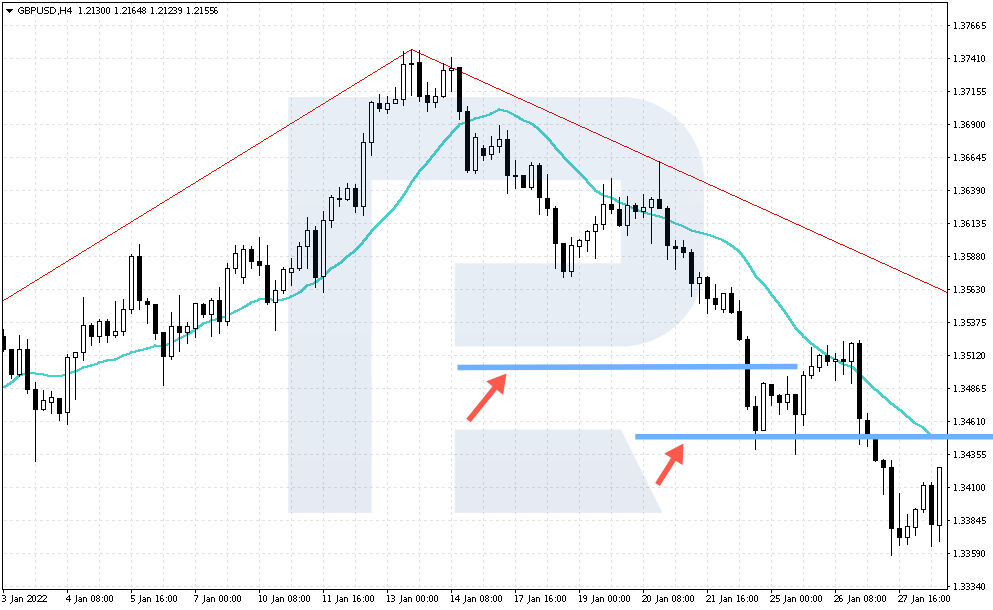

As an example of a short position, look at the GBP/USD chart for 14 January 2022.

ZigZag demonstrated a high of 1.3747. The price tested this level three times and finaly strated going down. Now check the SMA.

Price broke through the SMA (18) line from above at 1.3654. The decline was quite strong. The trade must be opened at the beinning of the next candlestick after the breakaway at 1.3654.

Place an SL at 1.3704, which is 50 points above the entry point. It turns out below the SMA line because of the strong decline. However, we follow the strategy rules and never increase the SL. The largest movement against the position was 37 points.

It took the price 139 hours to reach the first goal of 150 points. The second goal of 200 points was reached 144 hours after the position was opened. The highest profit could have been 300 points before a mighty correction.

Bottom line

The Reversal strategy is an easy way to catch the change of the market trend. The advantages of the method are availability of the indicators: there is no need to look for anything extra and go deep into details. The potential goal is 3-4 times bigger than the loss, which allows for covering several losing trades by one profitable. However, trade occurs on H4 with altered ZigZag values, signals will be scarce, and only two currency pairs suit the strategy. This must be the only serious drawback of the strategy. Apart from this, this is a simple strategy with clear entry and exit rules.