Not all traders like complicated trading systems with lots of indicators: you can easily misunderstand in which direction to trade. In this case, a simple strategy called Jarroo (described in this article) will help.

All posts

A combination of a trend indicator and oscillator is one of the best possible methods of work. This article is devoted to a trading strategy called MACD – Trading the Trend and the ways to improve it.

Find out everything about pairs trading: basic principles of choosing instruments for it, examples of use in different market types.

The “From Pullback” indicator-less strategy is based on quite a fair supposition that a price move, especially an impulse, will quite fairly continue in the same direction than change it. The strategy applies to Forex, futures, and stock markets.

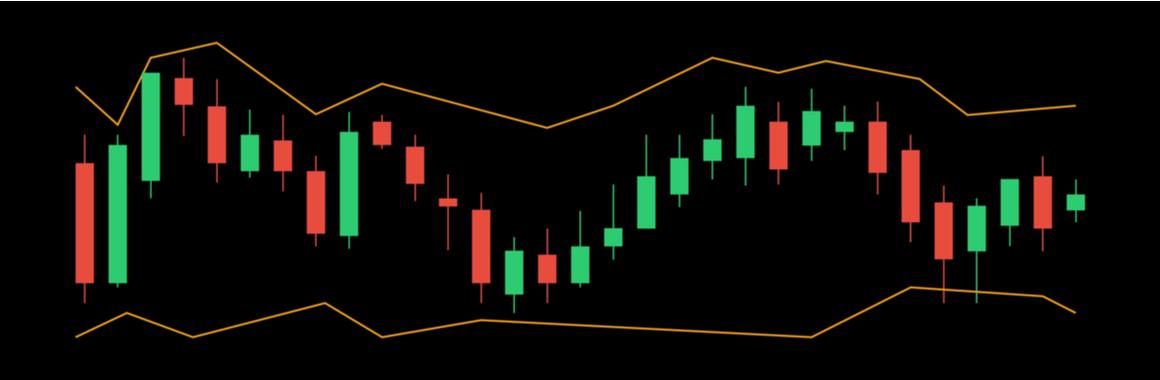

Among the most popular indicators for stock trading, there are the Bollinger Bands. They are very sensitive to market volatility and might act as not only support/resistance levels but as target levels as well. The Bollinger strategy is based exactly on these peculiarities of the indicator.

In this overview, I will present a simple but popular strategy called Two Fingers. The idea of the strategy is to find signals of the main market trend after a correction.

In this article, we will review a popular trading strategy called the Return to Average. The idea of this strategy is that after a serious deviation (growth or decline), the price tends to return to its average.

In this article, the author describes the VSA Method — a method of market analysis created by Tom Williams. The method is based on studying the spread, volume, and closing price of the bar. Also, it helps find the points in which the price escapes flats, and reversal patterns on highs and lows.

In this overview, we will discuss an indicator strategy known as the Puria method. Regardless of such a mysterious name, this is quite a simple and understandable strategy based on signals from four standard indicators.

In this article, we will discuss a strategy using the Renko charts. This is a specific way of representing the price chart that highlights the size of the movement, regardless of time.

Our strategy uses the Ichimoku and Awesome Oscillator indicators. Ichimoku Kinko Hyo is an excellent trend indicator that perfectly shows the current market trend.

A Forex strategy called Supremacy is a trading strategy based not so much on classic tech analysis but on studying the positions of other traders.

The Ichimoku indicator has long been acknowledged as an efficient market instrument for defining the prevailing trend. It frees the trader from the need to detect such important things on the chart as the support and resistance levels as well as the areas that do not suit for trading.

Today, we will speak about another trading strategy meant for minute charts, with a potential profit of 10-15 points per trade. The characteristic feature of this strategy is the use of the ADX indicator on small timeframes: normally, it is used on daily charts, as its author advised.

The Ten Point trading strategy is well-known by a wide circle of market participants and is based on simple entry rules; the percentage of profitable trades is quite high.