How to Use Bollinger Strategy for Trading in Forex, Stocks, and Futures Markets

4 minutes for reading

Among the most popular indicators for stock trading, there are the Bollinger Bands. They are very sensitive to market volatility and might act as not only support/resistance levels but as target levels as well. The Bollinger strategy is based exactly on these peculiarities of the indicator. It is applicable to periods from M1 to MN, for any instrument in Forex, stock, or futures markets.

A signal to buy by the strategy

To use the strategy, you need two price charts:

1. The first one reflects your working timeframe.

2. The second one represents a TF 3-5 times larger than your working TF.

Hence, the strategy can be used with such pairs of TFs as MN and W1; W1 and D1; D1 plus H4; H4 plus H1; H1 and M15; М15 plus М5; М5 and М1.

The efficacy of the Bollinger strategy on timeframes smaller than H1 depends on the size of the spread in your instrument. For a signal to buy to appear, the following conditions must be fulfilled:

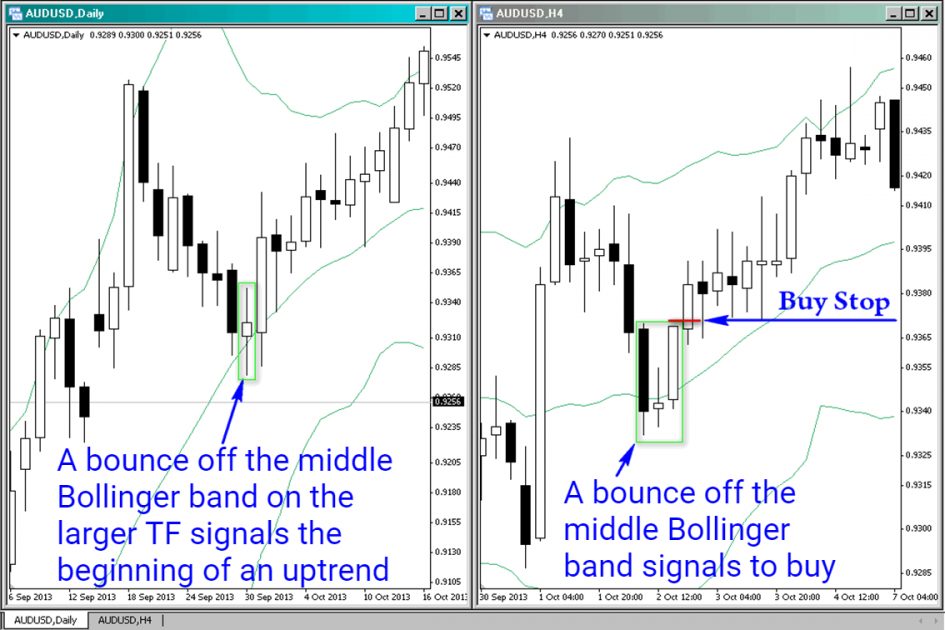

- On the chart with the older timeframe, one of the two events must happen. The first option is a bounce off the middle Bollinger band of a widespread candlestick pattern (Pin Bar, Engulfing, etc.). The second option is the price crossing the indicator band and closing on the opposite side from that where it opened. Depending on the direction of the bounce/crossing of the middle Bollinger band, we set the direction of trading on the smaller TF. This trend is considered actual before it reverses, i.e. the Bollinger band gets crossed in the opposite direction. There are more special conditions: if, for example, the candlestick that is crossing the middle Bollinger line touches the upper line, do not start looking for a trading signal on the smaller TF.

- After you detect the trend on the larger TF, look for a Bollinger trading signal on the smaller one. A direct signal to buy is a bounce off the middle or lower indicator line.

Enter the market by a Buy Stop type order placed a bit above the high of the signal candlestick on the smaller TF.

An example of a signal to buy

A signal to sell by the strategy

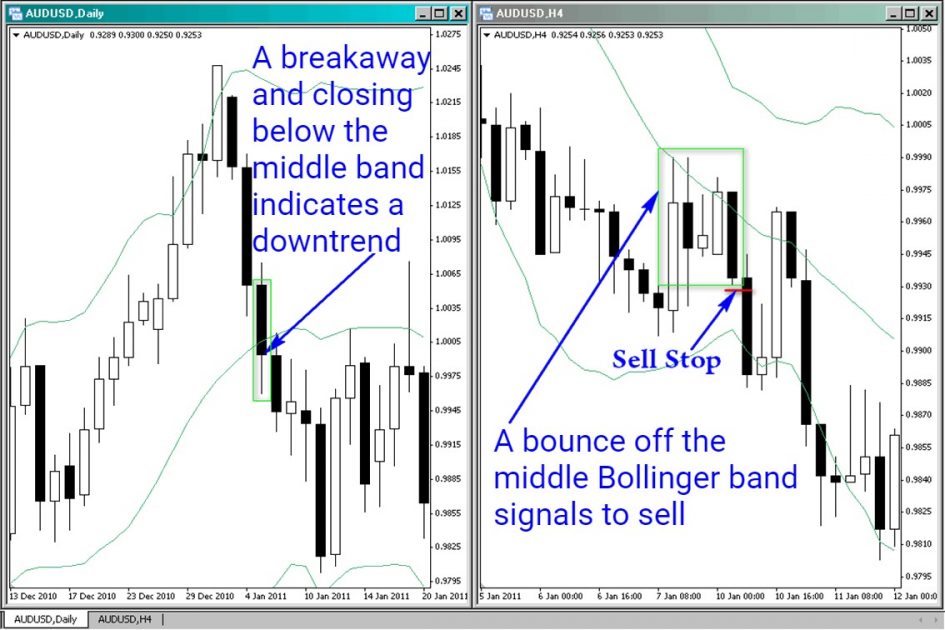

For a signal to sell by the Bollinger strategy to appear, the following conditions must be fulfilled:

- On the larger TF, a candlestick must open above the middle Bollinger band and close below it – or the price must bounce off the middle band downwards;

- After the larger timeframe signals about a downtrend, place a Sell Stop type order below the low of the signal candlestick on the smaller TF.

An example of a signal to sell

Stop Loss and Take Profit by the strategy

When buying, a Stop Loss is placed under the bouncing price pattern on the smaller TF; in case of selling, place it above the pattern (plus spread). You may track the position by dragging the SL after the newly emerging local extremes. Transferring to the breakeven is allowed only in compliance with the position following rules.

The Take Profit is set by the larger TF. When buying, the TP equals the price of the upper Bollinger band of the last closed candlestick. Until the price reaches the level of the upper band of the last closed candlestick, the TP level must keep changing even if you are already in position. However, if on the larger TF the price reaches the TP level while you have not entered the market yet, the signal is considered invalid. Wait for another signal to emerge on the larger TF. With selling, things are the same but inverted.

Money management for the Bollinger strategy

You should risk by a comfortable deposit/lot percentage. This is the rule of thumb. If you still feel uncomfortable, increase your TFs. Personally, I recommend to risk the same percentage of a fixed deposit in each trade; the percentage should be below 2%.

The strategy is good, among other things, because you do not need to make several important decisions, such as:

- Setting the levels that the price must bounce off or the optimum Take Profit level;

- Detect the trend.

However, as long as I do not have trustworthy statistics about the efficacy of the trading strategy, I strongly insist on backtesting. If you have never used this indicator before, train yourself on a demo account and feel the character of the Bollinger bands.