How to Swing-Trade on Forex?

7 minutes for reading

Dear readers, many of you have heard about swing trading but never know that they are swingers themselves (we mean, swing traders but not what you have just thought). In this article, let us look into swing trading.

Some history about swing trading

Swing trading is an approach to financial markets that appeared quite a long time ago. It should be3 noted that this is not a system but a style of trading. This means it can contain several tactics and strategies of market behavior.

The approach was described in the 50s of the last century by George Douglas Taylor in his book The Taylor Trading Technique. This method was designed for the stock market, first and foremost, but became equally popular in other segments. In the term “swing trading,” we can interpret swing either as “moving at a steady pace” and “closing a trade successfully” or as “being suspended,” which stands for high risks.

Like any other approach, swing trading uses the price change for making a profit on market operations. The position may remain on the market from several hours to several days. Swing trading requires professionalism and self-possession.

Such a style allows exiting the trade after accumulating enough profit and stay away while the market demonstrates short-term but intense surges of volatility. If you do not have enough time form trading intraday and do not want to miss the money that has appeared on the market than swing trading is definitely for you.

The principle of swing trading

The main principle of swing trading is moving along with the current trend. In other words, a swing trader avoids the periods of correction on the market but tries to take part in all impulse, swinging movements.

In general, the rule is: buy after the pullback, lock in profit after the trend reversal. One of the signals to close the trader is a breakout of the support line.

A modern swing trader normally studies long0term trades and can hold their positions not for hours but for weeks and even months, which depends on the length of the trend they are following. The length of the trend, in its turn, depends on the market situation.

Tactical instruments of swingers

Tech analysis and contemplation

These are the number one methods for almost all traders. Thanks to it, a trader can find out what instrument to trade. The elements of tech analysis may be different but all of them aim at defining the predominant trend.

For example, the Moving Average indicator can define the support level in an uptrend and the resistance level in a downtrend. To define the aims of movements and the correctional levels, a trader may use the Fibo.

Fundamental analysis

Fundamental analysis in terms of tracking the statistics and the news is another way of swing-trading. This method helps track new mid- and even long-term trends. The publications on the unemployment, employment, GDP rates, the interest rate changes, and the quarterly reports of companies require from a trader a quick and adequate reaction if they want to make money.

Working counter the trend

This method is used by only a part of swing traders able to cope with high risks. As a rule, they take a bearish position, finding the maximum of a swing for an uptrend, and exit the market at the end of the correction, after which they take a long position, catching the minimum of the downtrend.

Japanese candlesticks

The candlestick chart is easier to read and interpret than the traditional bar and histogram charts. Traders can use candlestick patterns to define bearish or bullish predominance on the market. This information helps set your priorities in trading.

Strategic elements of swing trading

The strategy of choosing the range

Modern software lets us follow and analyze trends of various scale and length. With these possibilities, a swing trader can construct their tactics and strategy on various timeframes, which may provide profit potential and a load of charts to analyze.

If the trader wants a high income but is not eager to watch chart dynamics, they should choose H4 or D1. For those who want to trade more actively, suitable charts will be H3, M30, and M15.

Having chosen a timeframe for defining your working trend, i.e. the trend along with which you will open a trade, the trader should enter from a shorter timeframe. For example, if your main one is D1, you should enter from H4, for H4, we use H1, H1 — M15, M30 — M5.

The strategy of modesty

Beginner traders normally aim at the profit from 10% to 15% for most instruments, while more experienced swingers prefer modest profits of 1% to 3%. For some, these goals might seem too modest, but here lies the efficacy factor of the strategy, as the main thing in trading on fluctuations is time.

The main attention of the trader remains focused not on the weekly or monthly profit but accumulation. If the average length of a trade is over 3 days, the trader can make several smaller trades during this time, which will give a higher aggregate profit. If the trader is satisfied by a monthly capital increase from 15% to 20%, a profit of 5-10% a week may increase the overall profitability substantially.

Of course, traders should still keep in mind possible losses. The smaller profits may increase the deposit if the losses are even smaller. Instead of a normal Stop Loss of 1-2%, the traders may react quicker on losses, loosing no more than 0.2-0.5%. This is the key component of any trading system as huge losses may virtually exterminate the progress reached with smaller profits.

The strategy of capturing the profit at an impulse

As long as we do not initially know how long the trend will last, the traders may enter a bullish swing trade only after they make sure that the currency pair or other instrument keeps on the initial uptrend.

To do so, they can single out the counter-trend movement. If the price is above the maximum of the previous day, the trader may enter the trade after analyzing the risks and finding an entry point.

First, we find the lowest point for the SL to be put. If the price falls below this point, the trader may exit the trend to decrease the loss. Then we find the highest point of the previous uptrend, which will be the aim of the profit. If the price reaches it and goes higher, there appears a necessity to consider exiting (at least partially) to lock in a certain profit.

Example of swing trading

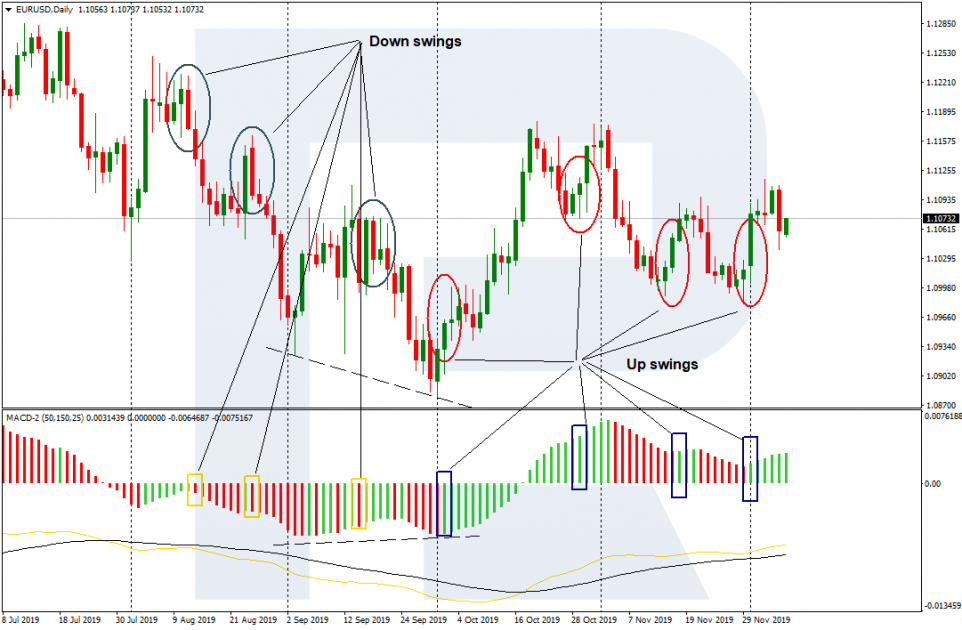

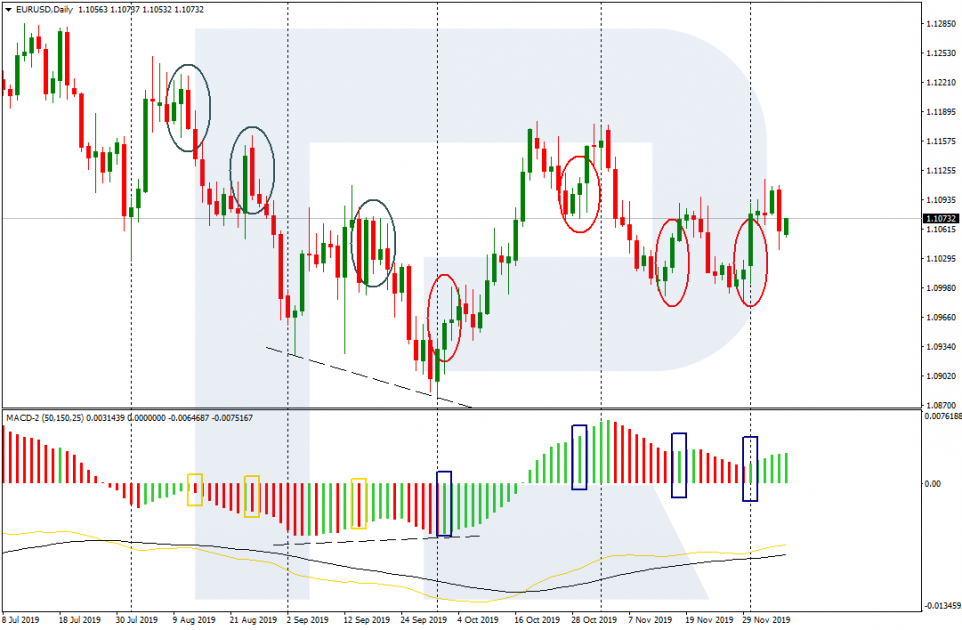

If on the chart we see the following:

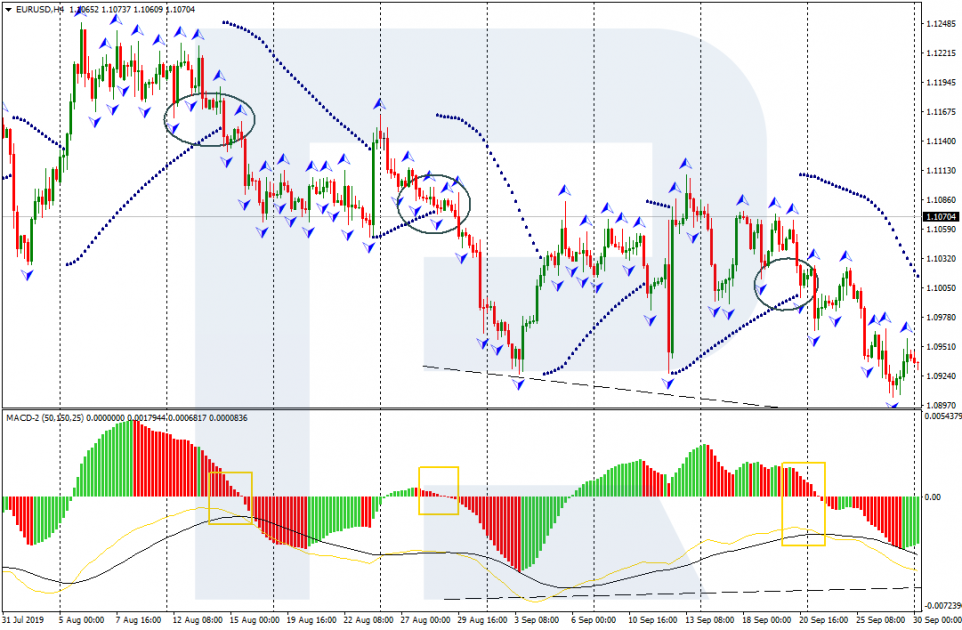

On the timeframe for entering you could see the following in the case of selling:

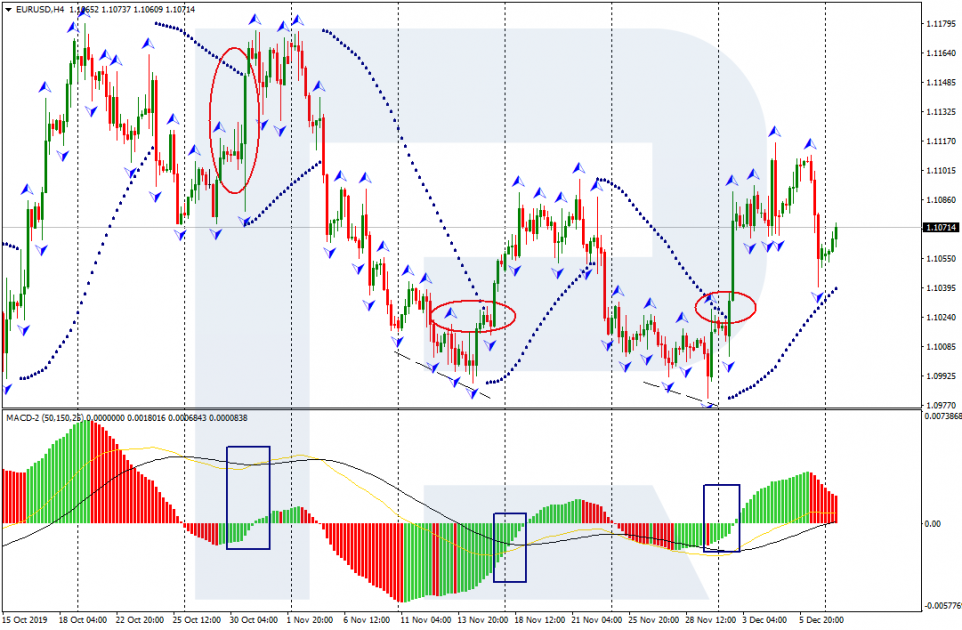

Or buying

In both examples, we used the Parabolic SAR and Bill Williams's Fractals indicators. They help to find the entry point rather easily. They may be used together or independently.

Switch to swing?

Swing trading is one of the best trading styles for both beginners and experienced traders. It suggests a serious potential for making a profit for experienced traders. Swing traders have substantial dynamics for their trades, minimizing the risks. Of course, for large market players swing trading might seem too shallow but it will suit those who do not have a large starting capital. Of course, all this requires the trader to be able to catch a market trend and hold the position for as long as possible regardless of the mood of other players.

The one who manages to master the specifics of swing trading, paying enough attention to bringing market analysis to perfection as well as to developing trader's intuition, may succeed in swing trading.