How to Trade Three-Drive (Three Indians) Pattern?

6 minutes for reading

Today, we will discuss yet another trend strategy called Three-Drive or Three Indians. It may have other names but the idea of the strategy and its signals remains the same.

From the name of the strategy, we may conclude that it is based on technical analysis. This means that to use it successfully, you need to understand the support and resistance levels, the trend, and, perhaps, the classical candlestick analysis.

What do you need to know before using the strategy?

Define the trend

Let us first discuss the main concepts that the trader will need for using this strategy, starting with the trend.

A trend is a directed price movement. It may be of one of three types:

- Uptrend

- Downtrend

- Flat

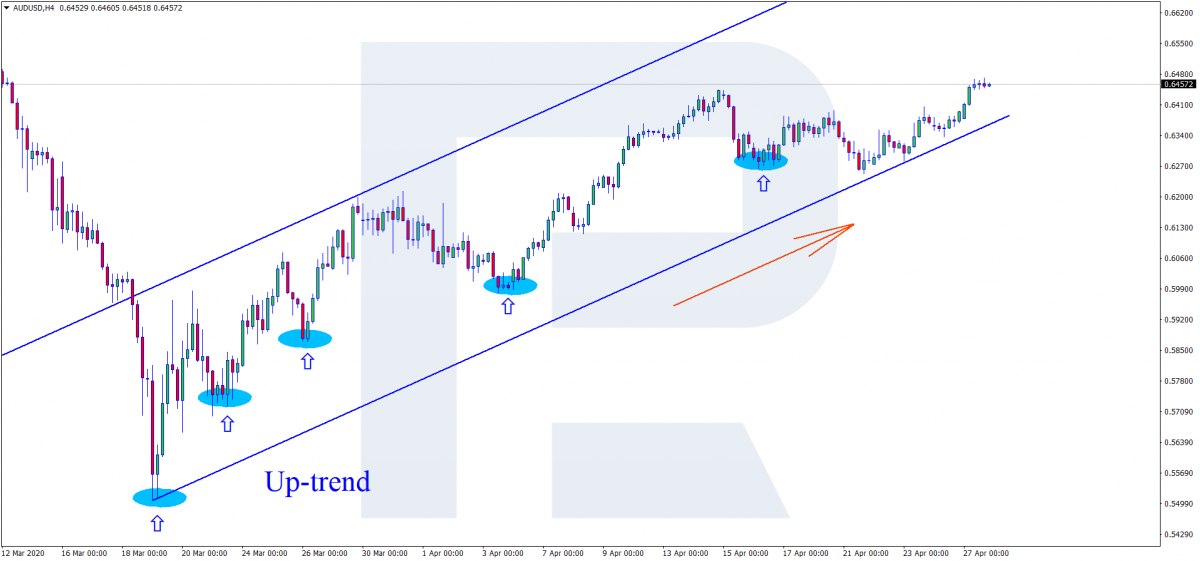

An uptrend is a directed price movement, in which each next low is higher than the previous one. To put it simply, on the chart, we see the price growing, pulling back at times, looking like a wave with increasing peaks.

A downtrend is a directed price movement, in which each high is lower than the preceding one. In this case, the price on the chart also looks like a wave, declining with periodical pullbacks.

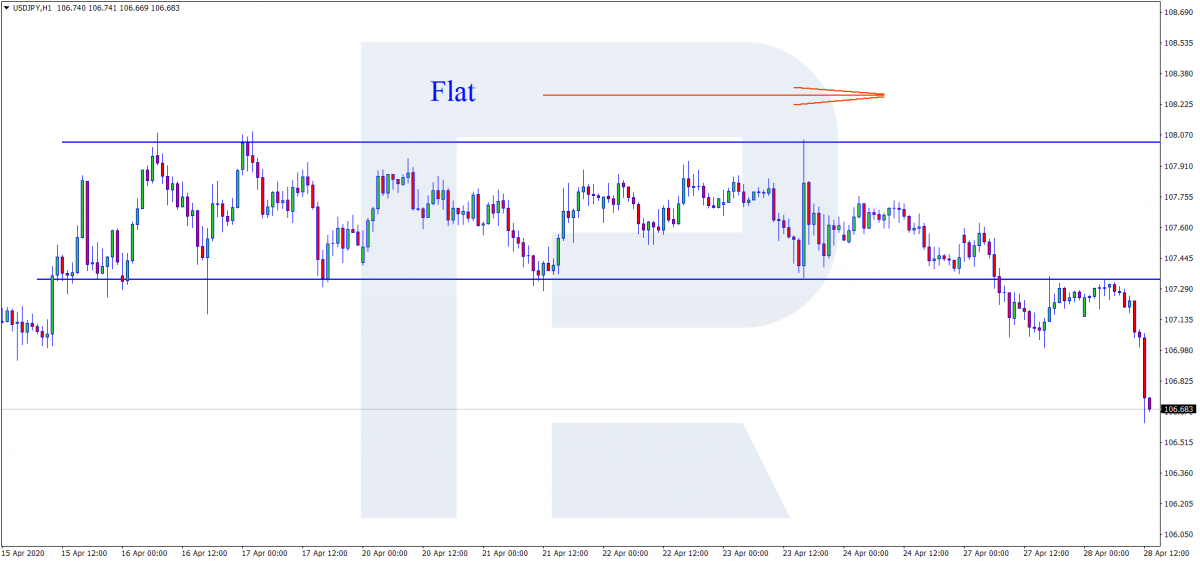

A flat is a horizontal price movement. In this case, highs and lows remain at more or less the same level. About this movement, we may also say that the price is moving in a horizontal channel.

Put support and resistance lines

How to draw support and resistance lines correctly?

There are two main views on this issue. The first idea is that the lines are drawn through the highs and lows. On the chart, it looks like a line drawn through the candlestick shadows.

The second option is to draw the lines through the opening and closing prices. On the chart, it looks like a line drawn through the candlestick bodies. I have my opinion on this topic: as this is a seemingly endless argument, it is much easier to draw the lines based on your experience and market observations. Anyway, if something works for you, this may be understood as correct.

Three-Drive trading rules

This strategy is multicurrency, applicable to all instruments both on the exchange and Forex markets.

Three-Drive works on almost any timeframe, but there are several peculiarities to be accounted for:

- On the charts up to M15, many traders may skip or pay no attention to a signal, thus increasing the frequency of false signals. However, Stop Losses are small on these timeframes.

- The M30, H1, H4, and D1 charts are considered optimal for finding entry points. Most traders use these timeframes as they are perfect for a good trade. The SL size is also optimal.

- The W1 and MN charts are rather large. In their case, waiting for a signal may take too long. Such timeframes are mostly used by investors, not interested in speculative trading. Stop Losses may be huge.

If we scrutinize the charts, we may see that the price always remains in the trend: this is what we will use looking for the entry points by 3-Drive.

A buying trade by Three-Drive

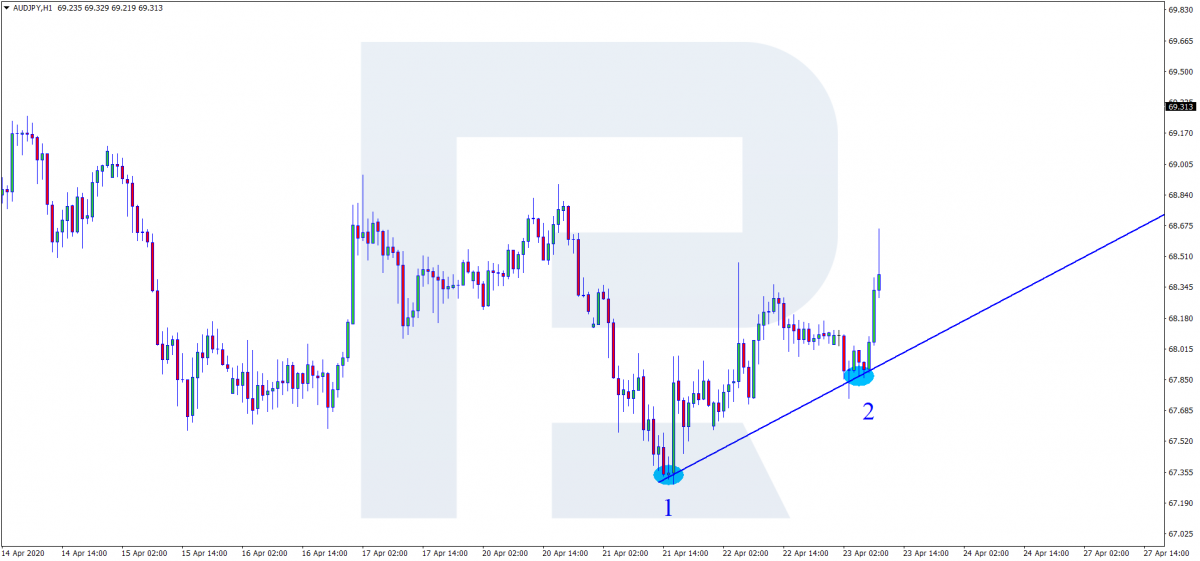

The trading rules of the strategy are rather simple. On the chosen timeframe, find an emerging trend, in this case, an ascending one. After two growing lows form, draw a long line through them on the chart.

Then wait for the third touch. An additional signal will be a reversal pattern, such as a Hammer or Harami. After the candlestick that has touched the support level closes, open a buying trade.

In the classical variant, a Stop Loss is placed behind the low of the second touch. A Take Profit is placed behind the level of the nearest high.

In the SL size goes counter your money management rules, you may go another way. In this case, the SL is placed behind the low of the candlestick, after which the trade was open. In the picture, it is marked Stop Loss 2.

You may use no Take Profit as we open the trade in the trend, which means our potential is not limited. Transferring the SL to the breakeven, you may make a rather large profit. The trade is then closed manually.

A selling trade by Three-Drive

On the chart, look for a downtrend beginning. Normally, it happens on the highs. Draw a long line through the highs (the second one being lower than the first one).

Wait for the third touch. On the chart, it was not just one but a bunch of reversal candlesticks touching the line. In this case, you may leave the instrument and skip the trade.

However, we will go on and open a trade. There are several reversal patterns formed near the resistance level, and we may call it an additional signal to open a selling trade.

Classically, a Stop Loss is placed behind the high of the second touch and a Take Profit – at the nearest low.

Bearing in mind that we have several reversal patterns, we may make the trade safer by a short SL, placing it on the high of these candlesticks. In the picture, it is marked Stop Loss 2.

The rules of entering the trade by Three-Drive

- Opening the trade at the third touch, make sure that the candlestick closes above the support level (for an uptrend) or under the resistance level (for a downtrend).

- Always trade the trend.

- A perfect signal is three touches of the level by the candlestick shadows.

- A clearly formed reversal pattern is an additional signal. Such patterns would be:

- Shooting start

- Hanging man

- Hammer

- Inverted hammer

- Pin bar

- Gravestone Doji

- Dragonfly Doji

- Trading on small timeframes (under M30), try to define the general trend on larger timeframes (such as H4) and open your trades in this direction. On H4, the trend may be ascending, but on M15, it may be different.

Summary

This strategy, in its different variants, has long been acknowledged on the market. Like other strategies, it requires attention and some knowledge of tech and candlestick analyses.

There are many ways of using Three-Drive apart from those simplest ones discussed in this article. Of course, there might be errors and mistakes. They may be minimized if we use Fibonacci levels, indicators, or other strategies as filters.