How to Trade Three White Soldiers Pattern

5 minutes for reading

This article deals with a candlestick pattern called Three White Soldiers: what it looks like, what signals it gives, how it forms, what types it has, and, of course, how it can be used in trading.

How Three White Soldiers pattern forms

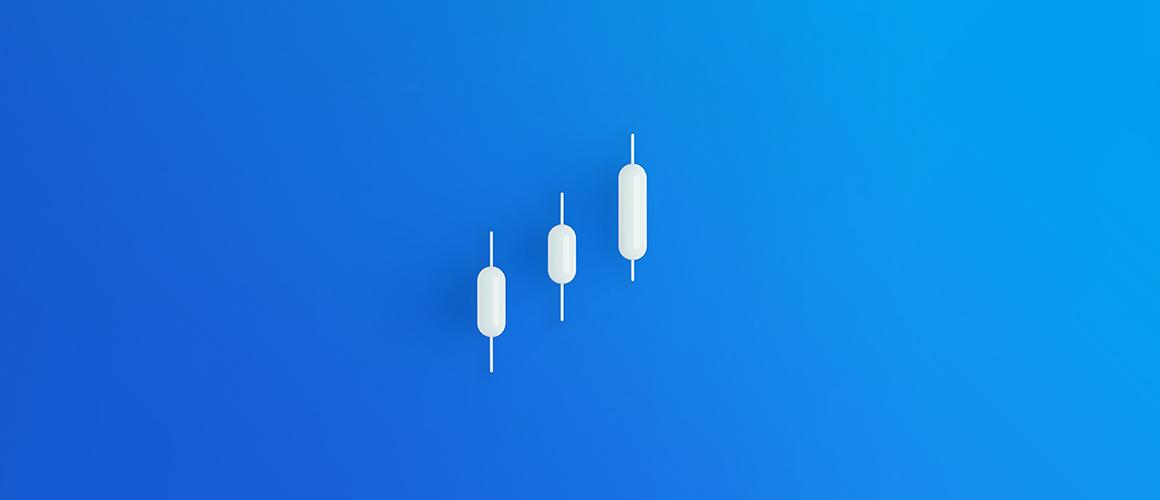

Three White Soldiers is a reversal bullish candlestick pattern that predicts a change of a downtrend to an uptrend. This pattern can be encountered on price charts rather often.

When the Three White Soldiers pattern appears, it gives a signal to buy. The pattern has a bearish counterpart called Three Black Crows that was previously described in our blog.

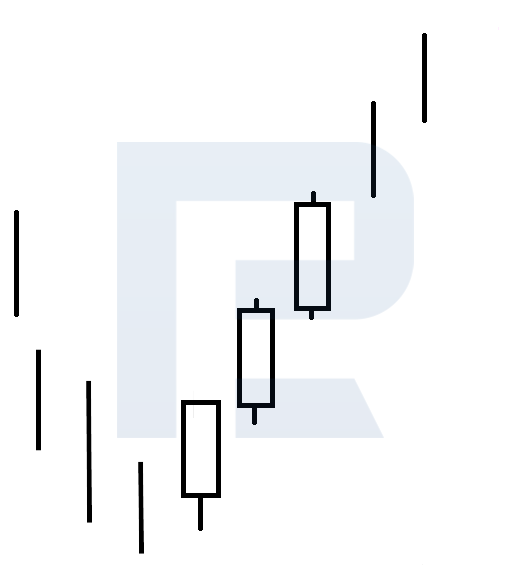

The Three White Soldiers pattern consists of three white candlesticks with large bodies and almost no shadows. The pattern shows that the bulls have managed to capture the initiative and close trading sessions near the daily highs for three days in a row.

Conditions for Three White Soldiers to form

- As long as this is a reversal pattern, it forms on the local lows after a descending movement. This can either be a reversal of a downtrend or the end of a correction in an uptrend.

- Three white candlesticks go one after another and have large bodies.

- Each next candlestick opens at the closing level of the previous one or a bit lower.

- The shadows of the candlesticks are short. Sometimes candlesticks in Three White Soldiers have no shadows at all: such candlesticks are called Marubozu and make the whole pattern stronger.

- The second and third candlesticks must be roughly of the same size. If the third candlestick is obviously smaller than the other two, this means bulls are weak.

Types of Three White Soldiers

There are two more candlestick patterns that also consist of three white candlesticks and resemble Three White Soldiers. These are the Advance Block pattern and the Stalled pattern; however, instead of giving a signal to buy, they warn the trader of the ascending momentum coming to an end.

Advance Block

If the second and third candlesticks of the Three White Soldiers have small bodies and long upper shadows, the pattern is called Advanced Block. As the name of the pattern shows us, the advance of the bulls was blocked and the bears fight back.

The ascending impulse meets serious resistance, and it becomes extremely possible that the quotations will reverse downwards. This pattern is not good for buying because bulls turn out weak. If the trader has open buying positions, they should take the profit in them.

Stalled pattern

For the Stalled, a.k.a. Deliberation pattern, the picture is similar: the third candlestick is noticeably smaller than the first two. This means bulls are weak, the ascending impulse is fading out, and a range or even a reversal might be coming.

The pattern informs the trader that now is not the best time for buying. The inability of the bulls to confidently open the third candlestick demonstrates that their initiative is weakening and further growth is doubtful, so one should avoid buying and close long positions.

How to use Three White Soldiers in trading

- In a downtrend or a correction of an uptrend, Three White Soldiers form on the local lows. The Advance Block or Stalled patterns are not used here.

- All candlesticks have large pronounced bodies and smallish shadows.

- After the third candlestick forms, during the next trading session, open a buying position.

- Place a Stop Loss slightly below the nearest local low.

- Place a Take Profit at important resistance levels or at the distance of 1:2, 1:3 of the SL.

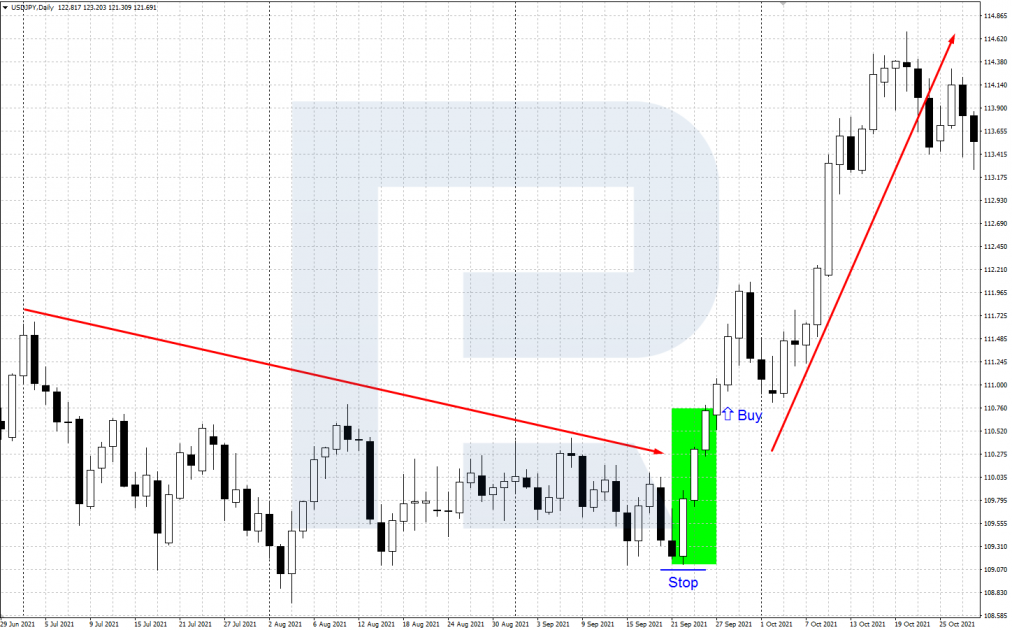

Example of buying by the pattern without indicators

- On D1 of USD/JPY at the local low after the end of a descending movement there formed a Three White Soldiers pattern.

- When the third candlestick is complete, a buying position opens.

- Stop Loss is placed behind the local low.

- Take Profit needs to be closed after the price reaches a strong resistance level or a 1:2, 1:3 ratio with the SL.

Example of buying by the pattern and the MACD

- On D1 of GBP/JPY at the local low in the end of a descending correction a Three White Soldiers pattern formed.

- An additional confirmation is given by the MACD: the histogram crosses 0 from below.

- After the pattern and the MACD signal form, o buying position opens.

- SL is placed behind the local low.

- TP is closed after a signal to sell is given by the MACD or when the price reaches a 1:2, 1:3 ratio with the SL.

Closing thoughts

The reversal candlestick Three White Soldiers pattern forms after a downward movement and predicts an upward reversal of the quotes. It can be traded on its own or alongside tech analysis instruments and indicators.

Before using the pattern for real, test it on a demo account. See more about candlestick patterns in our Blog.