How to Trade Three Line Strike Candlestick Pattern

5 minutes for reading

This article is devoted to a candlestick pattern called Three Line Strike, its type, forming principles, and use in trading.

How Three Line Strike forms

The Three Line Strike candlestick pattern is not a frequent guest on price charts. It appears at the local high/low in an uptrend/a downtrend.

The pattern consists of four candlesticks: the first three candlesticks have medium-sized bodies and the same colour, while the fourth one has a different colour, demonstrating a reversal, and a big body that fully covers the bodies of the first three candlesticks.

Some sources describe this one as a trend continuation pattern, but the logics of candlestick analysis suggest that this is a reversal one.

This article is based on the approach of a famous trader Thomas Bulkowski and his book “Encyclopedia of Candlestick Charts”. He considers this pattern to be a reversal pattern: according to his research, the price has a 84% probability of a reversal after this pattern appears on the chart.

When the pattern appears on the chart, this means the current trend is getting weaker as it has encountered strong opposition. The large reversal candlestick that with its body covers up the three preceding candlesticks forecasts a correction that can later turn into a real reversal.

I would say that the Three Line Strike is a type of the Engulfing pattern previously described in the blog.

Types of Three Line Strike

Depending on the place where the pattern appears and the colors of its candlesticks, two types of the Three Lines Strike can be singled out – the bullish and bearish ones.

Bullish Three Lines Strike

It forms after an ascending price movement at the local highs of the chart. It consists of three white candlesticks with middle-sized bodies and a large black candlestick, whose body covers all the three preceding ones.

The large black candlesticks means that bears have captured the initiative and are ready to counterattack. Further decline of the quotes means the beginning of a descending correction. The decline should be confirmed by the price falling below the last low of the bearish candlestick of the pattern.

Bearish Three Line Strike

It appears in a descending movement at the local lows of the chart. It consists of three black bearish candlesticks with medium-sized bodies and one white large candlestick, whose body covers up the bodies of the three preceding candlesticks.

The large white candlestick means that bulls have managed to stop bears and are ready to reverse the quotes. Further growth of the price leads to the beginning of an ascending correction. The ascending movement should be confirmed by growth of the quotes above the high of the last white candlestick.

How to use Three Lines Strike in trading

The Three Lines Strike should be traded at the local extremes of the price chart after a preceding ascending or descending movement. However, it should not be used in a flat.

Use timeframes starting H1 and larger and highly liquid assets: currency pairs, stocks, stock indices, commodity futures.

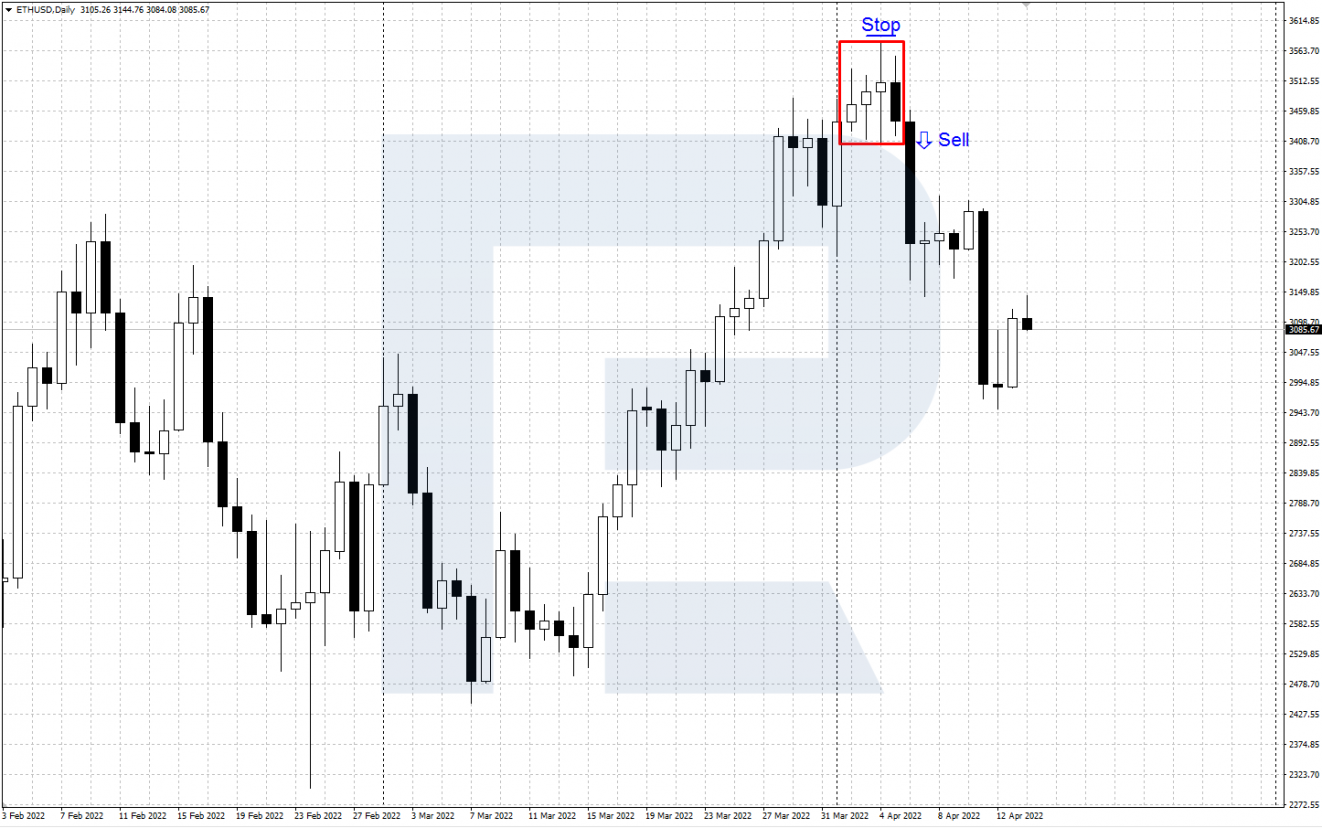

Example of selling by bullish Three Lines Strike

- After growth of the quotes, at the local highs of the chart there appears a reversal bullish Three Lines Strike pattern;

- Enter the market with a selling position right after the quotes start going down, specifically drop below the low of the large black candlestick (the fourth one in the pattern);

- After entering the market, you can place a Stop Loss a bit higher than the high of the pattern;

- Profit can be taken after the price reaches a strong support level, or in accordance with Fibonacci lines.

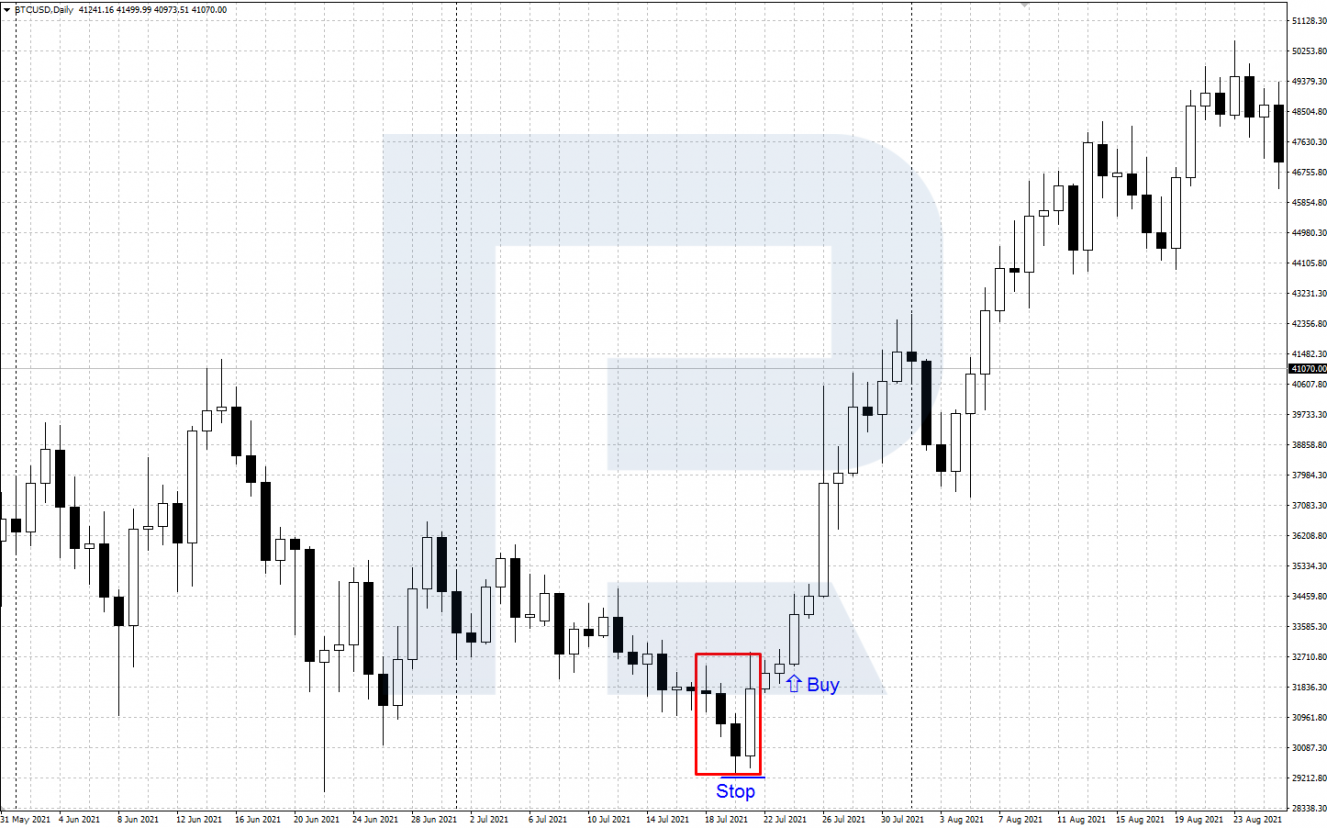

Example of buying by bearish Three Lines Strike

- After a decline, at the local lows of the price chart, a reversal bearish Three Lines Strike pattern forms;

- Enter the market after the price rises above the high of the large white candlestick (the fourth one in the pattern);

- Upon opening the position, place a Stop Loss a bit lower than the low of the pattern;

- Take the profit after the price reaches an important resistance level, or by the Fibonacci correction lines.

Bottom line

The Three Lines Strike pattern forms after a descending or an ascending movement and forecasts a reversal of the quotes. In certain sources, this pattern is considered a trend continuation pattern, yet Thomas Bulkowsli in his research has demonstrated that the probability of a reversal after this pattern appears is 84%.

The pattern can be used for trading either on itself or alongside other instruments of tech analysis and indicators. Before using the Three Lines Strike for real, make sure you back-test it.

Learn more about other candlestick patterns in the articles: