The market capitalization of Apple Inc (NASDAQ: AAPL) is 965 billion USD, net profit in 2018 was 59.43 billion USD; 132,000 employees generate annual revenue over 260 billion USD, which is higher than the GDP of some countries with a population of several million people.

A Japanese candlestick chart looks like a rectangle with two "tails" on the top and at the bottom. Same as the bars reflects four prices...

The Gap is shown in the chart above as yellow rectangles. This is a practical gap in the flow of quotations reflecting a serious difference between the opening and closing prices in trading sessions. A quick look at the chart captures a large number of such phenomena. This means that if we classify them we may find a lot of opportunities to use them in trading. But first, let us talk about the reasons which a Gap emerges for.

Cloudflare Inc. is an American company founded in 2009. Its business is web safety and web infrastructure, content delivery network services, protection from DDoS attacks and access to DNS servers and resources. Cloudflare stands between website visitors and the hosting provider of the Cloudflare user, acting as a reverse proxy server for websites. According to the data of the SolveDNS website, Cloudflare has one of the highest speeds of DNS search in the world, which allows the client to access the website as quick as possible. Cloudflare provides its services to more than 20 million websites, reducing the response time to less than 100 milliseconds for 98% of users in the developed countries. To imagine this speed, just blink. It will take you 4 times longer than the response time. For businesses, such a speed increases conversion and, hence, profit.

The SWB Grid is an expert advisor based on the RSI, Stochastic Oscillator and Bollinger Bands indicators. One of its features is the possibility of receiving signals to open a trade from all indicators, only one indicator or a combination of those.

A trend is defined as a sequence of maximums and minimums. If we say that there is a bullish trend on the market, it means that every next maximum is higher than the previous one and every next minimum is also higher than the previous one. In this case only, we may presume that the trend is ascending and try buying.

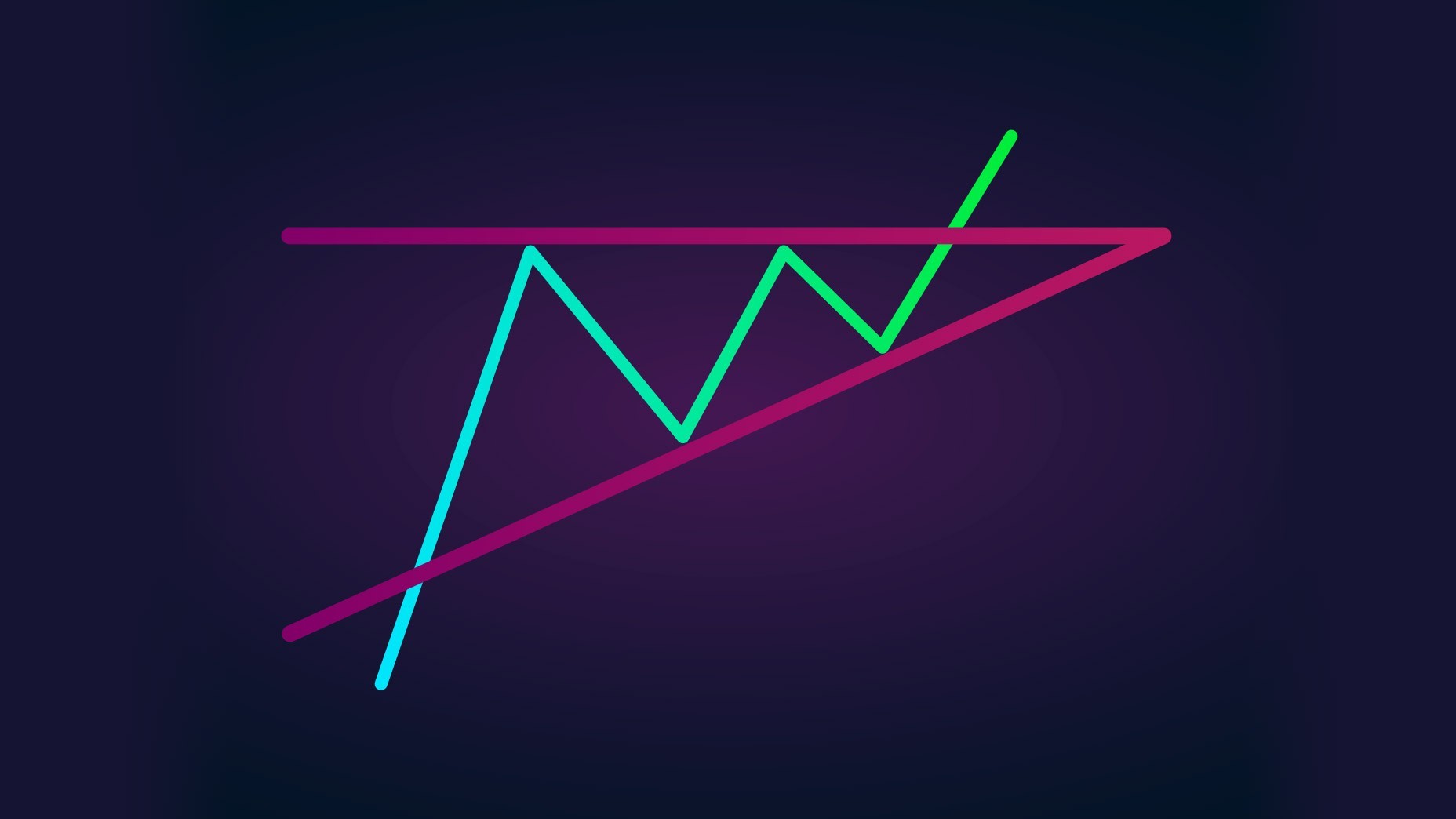

The Triangle pattern appears on different charts rather frequently. Normally, the Wedge is considered a reversal pattern, forming on maximums and minimums of a price chart in an up- or downtrend. A Wedge is quite similar to a Triangle, forming between the two converging support and resistance lines.

One of the most popular indicators (and, perhaps, the one that a trader first comes across starting their way on Forex) is the Moving Average (MA). The Moving Average belongs to the group of trend indicators and shows the average price of the chosen currency during a certain period of time.

The history of the Pivot Points indicator began in the early 30s of the twentieth century when a mathematician and a that-time famous trader Henry Chase decided to create an indicator meant for the security market. The synonym for a pivot would be a reversal, so a pivot point is a level on which the price reverses. So, the basis of the Pivot Point indicator is the idea that the market takes everything into account and repeats itself with time. The indicator was created in such a way that the opening and closing prices may serve as the support and resistance levels in the future.

The author of the Parabolic Sar is J. Welles Wilder. He first used it in 1976. In his book "New Concepts In Technical Trading Systems" Wilder presented several indicators: the Parabolic Sar, RSI, ADX.

This structure of price movement is, in fact, a Wedge pattern. According to the author of the method, a trader should have their unique features and use rare trading instruments in order to be different from the rest of the market players. The Wolfe Waves pattern is able to provide a beginner trader with the keys to a new understanding of market behavior. However, as with any other trading strategy or technical instrument, no matter how successful its trading history may be, much depends on the hands the instrument gets in.

The S&P500 index fell again upon testing its historical maximums. The last two waves of declining were used by investors as a chance to buy with the aim to take at the start of the new ascending trend. However, as soon as the price reaches its record values, the buyers disappear and those who bought earlier lock in their profit, putting pressure on the index.

To succeed in market trading you should learn to analyze and forecast price movements. The market price is influenced by a whole range of various factors, all of which we literally cannot know. A question emerges: in this case, how does forecasting become possible? This question is answered by one of the basic and most necessary types of market analysis — technical analysis.

Stochastic Oscillator chart is drawn in a separate window under the price chart and consists of two lines: %K, quick one, and %D, slow one. Its values vary from 0% to 100%; at the levels of 20% and 80% signal lines, defining the oversold (0-20%) and overbought (80-100%) areas, are drawn.