Scalping Strategy with Two Moving Averages (EMA): Description and Rules

4 minutes for reading

In this article, we will discuss a strategy that uses two Exponential Moving Averages (EMAs). Trading strategies with MAs are rather popular among traders because MAs are rather simple and efficient instruments of tech analysis.

You can visit the RoboForex Market Analysis webpage for the latest forex forecasts.

What is scalping?

Scalping (from the Latin "scalpere" - to cut) is a slang name for short-term intraday trading strategies. Their characteristic feature is a large number of trades opened in a rather short time and aiming at a relatively small profit. For scalping, such small timeframes as M1, M5, or M15 are normally used.

Thanks to marginal trading (with large leverage) on Forex, scalping has become a very popular strategy: even a few points of profit may yield a substantial result. Such trading is available to traders with small deposits that cannot afford to trade longer timeframes.

However, unlike long-term strategies, scalping needs more time to be spent trading. You have to monitor the market constantly during the day looking for trading signals and keeping an eye on open trades. All in all, scalping may bring you a large profit but for this, you need a trustworthy trading system, cast-iron discipline, and a lot of time for trading.

Description of the strategy

The scalping strategy with two MAs consists of using tech analysis patterns and important support/resistance levels along with two EMAs: a fast one with period 7 and a slow one with period 14. The strategy is multicurrency and applicable o any financial instrument. The main timeframes are M5 and M15.

Place a fast EMA (7) (red) and a slow EMA (14) (blue) on the chart. In popular terminals, including MetaTrader 4 and MetaTrader 5, you can do this via the Main Menu: Insert - Indicators - Trend - Moving Average. In the setting window, choose periods 7 and 14, the Exponential averaging method, Applied to: Close.

Strategy trading rules

Entering the trade

The reason for entering a trade is a tech analysis pattern forming on the chart or an important support or resistance level broken. Also, candlestick and Price Action patterns may be used. The entry signal will be confirmed by the crossing of two MAs:

- To open a buying trade, the red EMA (7) must close the blue EMA (14) from below;

- Vice versa, to open a selling trade, the red EMA (7) must close the blue EMA (14) from above.

Limiting losses

Using an Stop Loss is obligatory, it is placed right at entering a trade:

- For a buy, an SL is placed behind the nearest local low on the price chart;

- For a sell, an SL is placed behind the nearest local high on the price chart.

Locking in profit

To close your position with a profit, follow the two MAs: if the momentum is good, they let you collect the larger part of the price movement:

- Close a buy when the ascending momentum is over, and EMA (7) crosses EMA (14) from above;

- Close a sell when the descending momentum is over, and EMA (7) crosses EMA (14) from below.

Examples of trading the strategy

Let us have a look at several examples of trading the strategy.

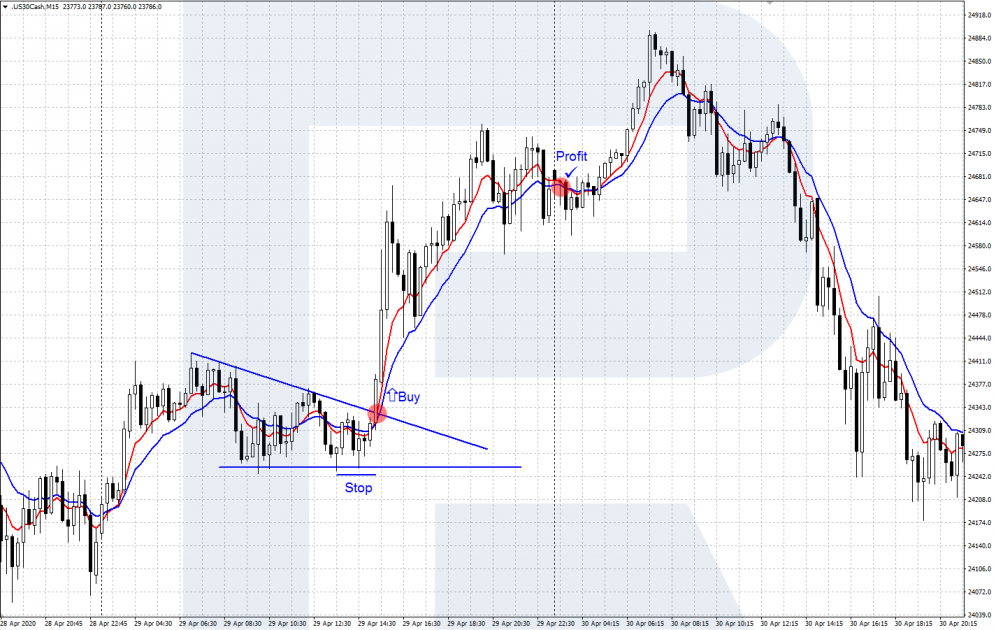

Example 1 - Index

- Instrument: US30Cash

- Timeframe: M15

- Trade direction: Buy

- Entry signal: a tech analysis pattern Triangle + confirmation - EMA (7) crosses EMA (14) from below

- Closing: a vice versa crossing of EMA(7) and EMA (14).

Example 2 - Crude oil

- Instrument: WTI

- Timeframe: M5

- Trade direction: Sell

- Entry signal: a reversal tech analysis pattern Head and Shoulders + confirmation - EMA (7) crosses EMA (14) from above

- Closing: a vice versa crossing of EMA(7) and EMA (14).

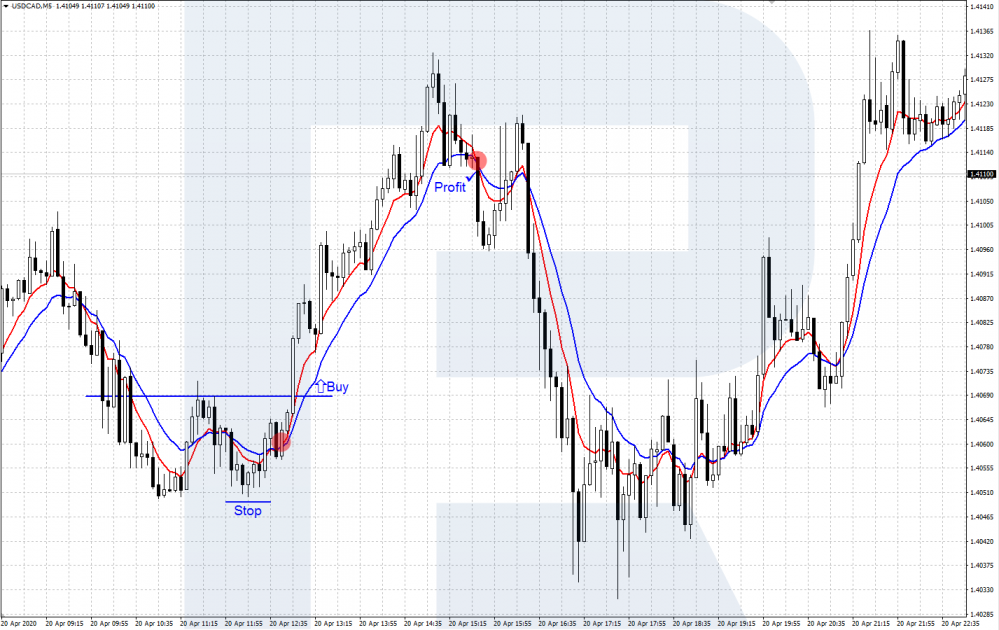

Example 3 - Forex

- Instrument: USD/CAD

- Timeframe: M5

- Trade direction: Buy

- Entry signal: a reversal tech analysis pattern Double bottom + confirmation - EMA (7) crosses EMA (14) from below

- Closing: a vice versa crossing of EMA(7) and EMA (14).

Closing thoughts

Various scalping strategies are actively used for trading on various financial markets. They allow making a good profit even on small deposits but require a lot of time and cast-iron discipline. To succeed, it is important to practice (on a demo account or a small real account) and make sure your strategy works well, and you stick to its rules and control risks.