In this review, we will discuss the Relative Strength Index (RVI) indicator. It helps define the dynamics of the price change of a financial instrument on a certain period.

All posts

OsMA (Moving Average of Oscillator) is an oscillator based on the difference between two Exponential Moving Averages and their normalized values.

Andrew's Pitchfork is an instrument of graphic analysis based on the middle trendline and an equidistant channel. Unfortunately, this method of trading and analysis is not very popular among traders; however, it seems to be perfect for drawing a channel quickly and trading bounces off and breakouts of its borders.

In this review, we will discuss an interesting technical indicator CCI (Commodity Channel Index). This indicator helps to find an approaching correction or reversal on the price chart.

The Heiken Ashi (translated as "middle candlestick") indicator is just another way of representing the price chart as candlesticks, different from the popular Japanese candlesticks. In essence, it is an alternative way of drawing a price chart by averaging. The Heiken Ashi indicator is featured by many popular trading terminals, including MetaTrader 4 and MetaTrader 5.

In this review, we will discuss a popular indicator called ZigZag. This indicator makes it easier to interpret charts, showing important price changes, and helps to carry out tech analysis.

The Fractals indicator shows well important levels on price charts, which the trader may use for trading breakouts or placing SLs.

Alligator is a trend indicator that gives signals of a new trend beginning in the market. According to the author, most of the time the market does not move anywhere, and trends emerge during only 15-30% of the time.

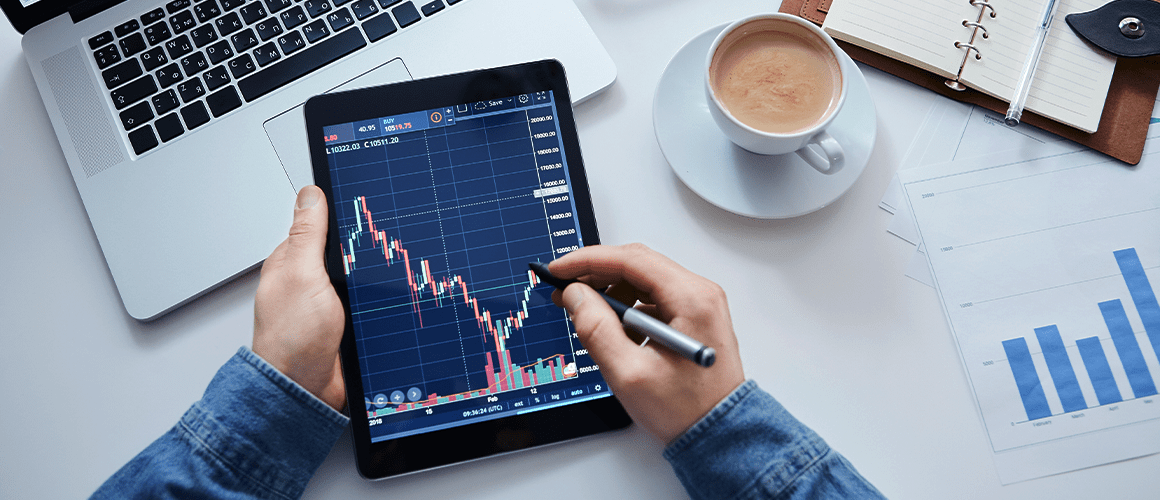

Indicators have long been introduced to the trading systems of many traders. As a minimum, they are of good help in chart analysis, as a maximum, they are the base of the whole trading system. Algorithmic trading, which means automatizing the work and creating trading robots, is also mostly based on the signals of various indicators.

Momentum is one of the simplest and most popular indicators among traders. As its creator, certain sources name a French mathematician Paul Émile Appell. This indicator helps define the trend direction and the speed of the price change.

The Williams Percent Range (Williams %R) is an oscillator of the price movement speed showing the position of the current price in the range between the low and high of the previous periods. The indicator is drawn in a separate window under the price chart and consists of the main line %R and two areas: the overbought and oversold ones.

the ADX, or the Average Directional Movement Index, has not become as widespread as, say, the RSI. It is most likely due to the complexity of its formula; what is more, it is more of a trend indicator, and a beginner is seldom ready to trade large movements with large Stop Losses.

One of the most known and popular trading instruments on Forex are the Fibonacci levels (or lines). They appeared thanks to a famous Italian mathematician Leonardo from Pisa, better known by his nickname Fibonacci (son of Bonacci)

One of the most popular indicators (and, perhaps, the one that a trader first comes across starting their way on Forex) is the Moving Average (MA). The Moving Average belongs to the group of trend indicators and shows the average price of the chosen currency during a certain period of time.

The history of the Pivot Points indicator began in the early 30s of the twentieth century when a mathematician and a that-time famous trader Henry Chase decided to create an indicator meant for the security market. The synonym for a pivot would be a reversal, so a pivot point is a level on which the price reverses. So, the basis of the Pivot Point indicator is the idea that the market takes everything into account and repeats itself with time. The indicator was created in such a way that the opening and closing prices may serve as the support and resistance levels in the future.