Signals on Forex: Where to Search, How to Find, Filter, and Create?

6 minutes for reading

What is a signal on Forex?

If we try to describe briefly how a newcomer starts trading, the scenario of the market entry will be more or less the same. First, they study general information about markets, their laws of pricing; then the beginner trader gets acquainted with the trading platform and the work with orders in practice, and then they dive into the world of analysis and trading systems.

At this stage, they have to choose their paradigm, style, the viewpoint for their future work on the market. There are two main paradigms: the Stochastic (which includes forecasting, foretelling, or guessing the price direction) and algorithmic (which includes trading along with an algorithm and money management) ones.

Whatever the side the beginner takes, they will inevitably have to find certain patterns of market behavior signals for situation changes, as well as to make trading decisions. Thus, we may see that the basis of any trading model is the signal.

On Forex, under a signal, we mean a complex of circumstances, indicators, and events that show the trader in which direction they should open a trade, in other words, whether they should buy or sell.

In each paradigm, signals form and look different but many people mix them up. The Stochastic paradigm is based on statistical and fundamental data. In other words, it tries to answer a general question: “Which way: up or down?”, ignoring more detailed ones, such as: “Up or down to which level?”, “Where to put an SL?”, “What is the lifespan of the supposed movement?”, or “What to do after the SL?”.

The algorithmic paradigm, on the contrary, tries to define the level, on which a trade is worth opening, and the levels of the Take Profit and Stop Loss. We can even find the answer, though not very exact, to the hardest question about the perspectives of the movement.

Where to find signals? Signal types

Lagging signals

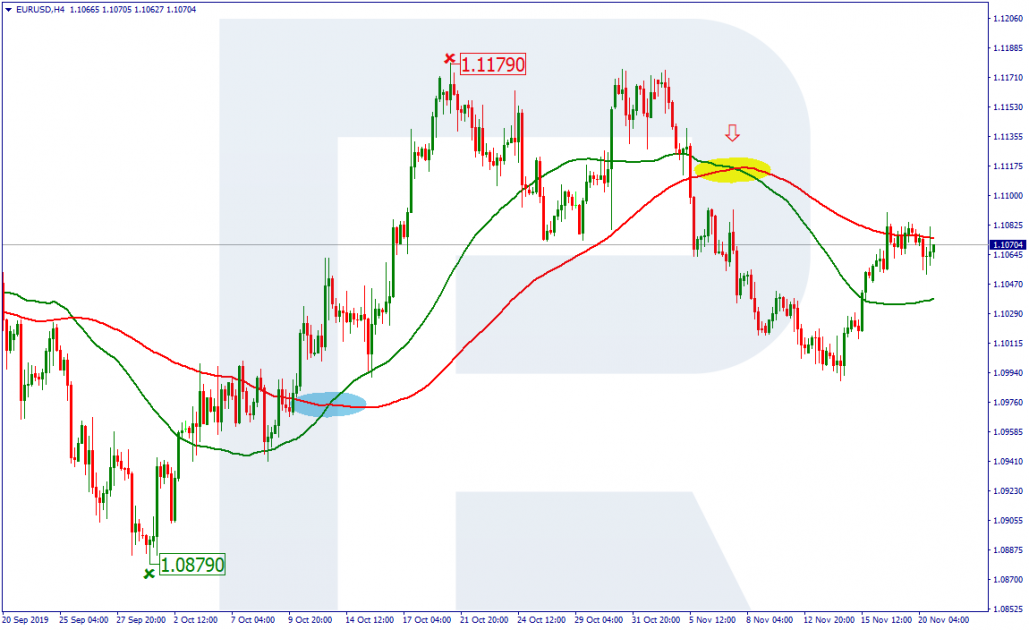

Before discussing where to find signals for trading, we should find out how they form. Let us have a look at a classical example of two Moving Averages crossing.

In this example, we may see that the signal from the technical indicators forms on the chart after the reversal of the trend. Such a signal can be called lagging because it is preceded by a serious change of price dynamics.

For an earlier signal, the timeframe and the number of candlesticks should be in line. This means that on a longer timeframe a smaller amount of candlesticks is better analyzed.

For example, on D1, 5-10 candlesticks are the best, while on H1 – 20-25 candlesticks. However, here we should also pay attention to the level of volatility of the instrument and calculate the potential profit, which means do not overestimate your perspective or, at least, use a Trailing Stop.

With the parameters mentioned, on D1, the TP may be from 100 to 300 points but on H1, it should be better placed between 40 and 120 points. As for the Stop Loss, it should be placed according to the highest/lowest (depending on whether you sell or buy) level in the trend before the reversal.

As leading signals, we may name divergence and convergence (between the price and oscillator dynamics).

Leading signals

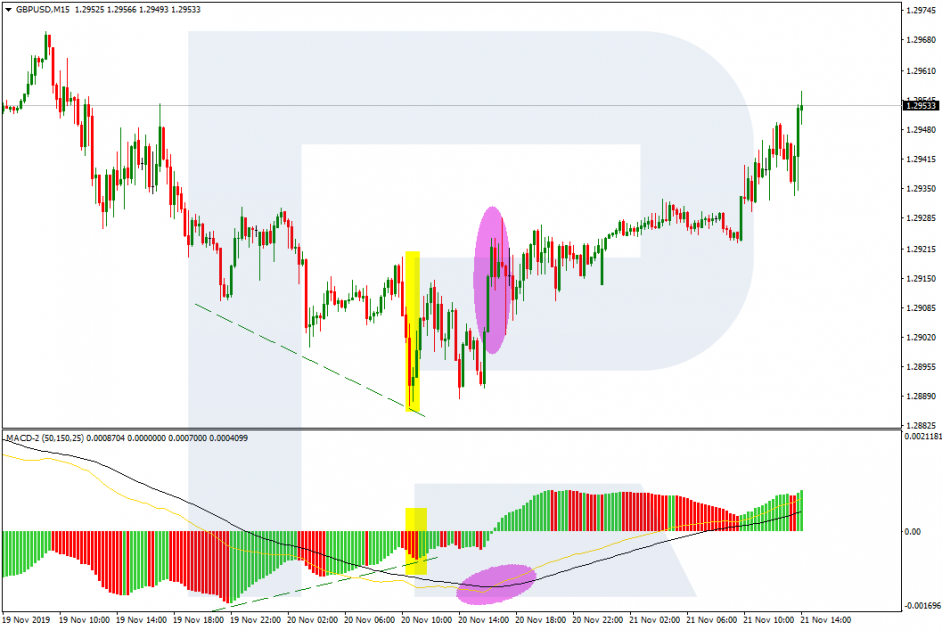

If we look at the picture of divergence, we may see that the red columns of the histogram have warned us of the trend reversal much earlier than the signal lines of the MACD confirmed it, crossing. This is the idea of the leading signal.

In the picture with convergence, the trend has changed virtually at the very minimum of a downtrend while the Cross of the lines formed much later. This is a situation characteristic of small timeframes: from M1 to H1.

By the form of appearance, signals may be:

- strike

- cross

- mixed

Strike signals

Strike signals are those appearing after a breakout of a signal level. This may be a fractal, support, resistance lines, the signal line of an oscillator, the control point on the Parabolic Sar.

Cross signals

Cross signals belong to only those indicators that compare the dynamics of minimum two signal lines of different scale. The standard example is the crossing of two MAs. Such signals form on the MACD, ADX, Ichimoku Kinko Hyo, etc.

Mixed signals

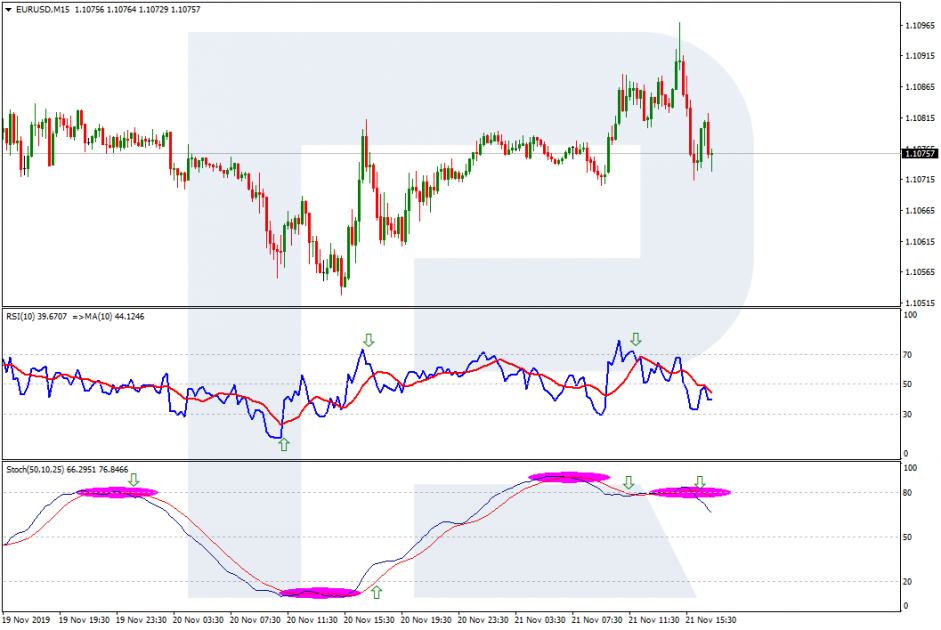

Mixed signals include both breakouts and crossings of signals lines that form one after the other. Such signals are characteristic of the Stochastic where the signal lines cross upon entering the overbought area and then break out the overbought line at 80%. Similar signals appear on the RSI but with a signal Moving Average as well.

Filtering signals

The market gives a lot of different signals all the time, that is why the trader needs to know how to filter the signals.

Filtering is a good method of reducing toxic trades and increasing the number of profitable ones. Filtering signals, the trader not only enhances their trading but also perfecting their personal and professional discipline.

Filters can be:

- cross-indicator

- time

- level

- mixed

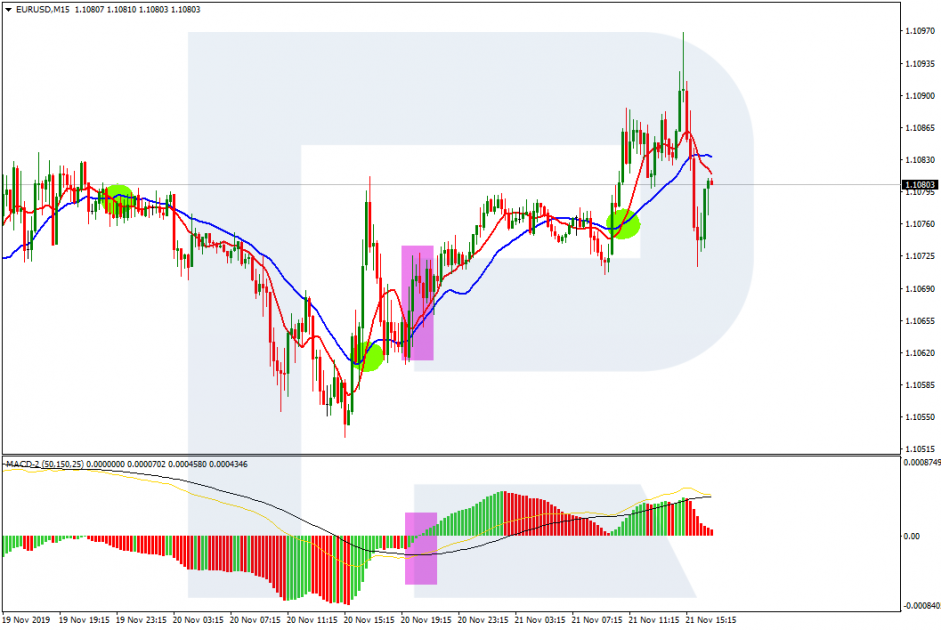

Cross-indicator filtering means double-checking the signals of one indicator on another, keeping the parameters of the signal in line.

Time filtering helps eliminate signals in non-liquid times, for example, at night, when trading becomes less active.

Level filtering helps filter impulse signals on flats. In other words, if an indicator shows a trend and you can see a narrow flat on the chart, you better not trade.

Mixed filtering includes all three ways.

How to create signals?

This expression is not literal because the trader and the indicator is not the one who “creates” signals, this is the job of the market. Your job as a trader is to form your own complex of signals that you will trust and follow neatly. This is how you will create your own trading system.

The main secret of creating a strategy based on technical signals is to coordinate them in a kind of natural order according to the market dynamics.

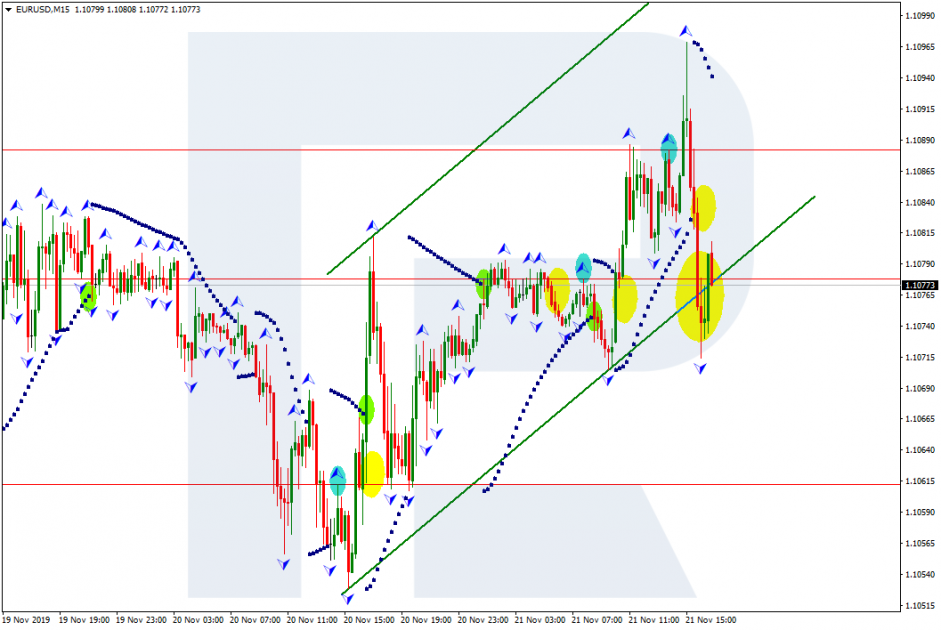

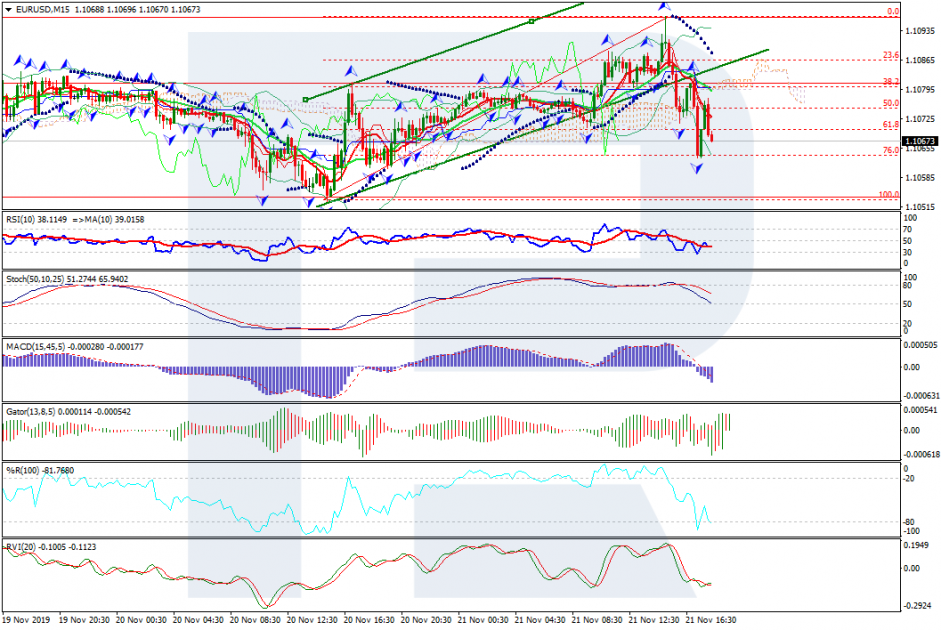

Most often, the desktop of a beginner trying to create their own system looks as follows:

Nice? Perhaps nice but inefficient. The more indicators you use, the more false signals you receive, the more losing trades you open.

The optimal number of helping indicators is three. The simpler, the better! Aim at optimizing your workspace. And good luck with trading!