How to Trade EUR/JPY

5 minutes for reading

This overview shares with you some important and useful information about the EUR/JPY currency pair: what it is, what trading characteristics it has, and how to trade it.

What is EUR/JPY currency pair

This currency pair is a cross rate of two popular Forex majors – EUR/USD and USD/JPY. They have already been described in our blog.

A cross rate is the price of a country’s currency expressed in the currency of another country and defined via the currency of a third one. As the latter, the US dollar is used, which is the main international reserve currency.

EUR/JPY represents the dynamics of the EU currency through the Japanese yen. The euro is the base currency of the pair, so the current price represents for how many yens one can buy or sell one euro. If the quotes of the pair go up, this means the European currency gets stronger. If the quotes go down, the euro gets cheaper against the yen.

Trading characteristics of EUR/JPY

- Predominance of the yen: the JPY has more influence on the dynamics of this currency pair. If there is a strong directed movement in the yen, the quotes of the whole pair are likely to follow.

- Trading time: the pair trades 24 hours a day except weekend. It is active during the Asian, European, and American trading sessions.

- Volatility: it has good intraday volatility of about 100 points.

- Spread: thanks to its popularity and high liquidity, spread in a calm market fluctuates between 1-1.5 points.

Factors influencing the quotes

The EUR/JPY rate demonstrates the relationship of the currencies of two global economies – the European and Japanese ones. Hence, important economic and political events in the EU and Japan have major influence over the quotes of the pair.

1. Economic events in the EU and Japan:

- Monetary policy of the ECB and Bank of Japan. Changes in the interest rate, QE programmes, currency interventions.

- Unemployment rate.

- GDP dynamics.

- CPI and PPI inflation indices.

- Industrial Production index.

- Trade Balance.

- Tankan report of the BoJ.

- ZEW and IFO European business sentiment indices.

2. Speeches by political influencers:

- Press conferences of the heads of the CBs.

- Statements and comments by politicians.

3. Political events:

- National leaders and CB heads changing.

- Changes in the government.

- Elections.

- Geopolitical events.

4. Force majeure:

- Emergencies.

- Natural disasters.

- Wars.

- Man-made disasters.

- Terror acts.

- Epidemics.

Ways of trading EUR/JPY

EUR/JPY is quite a universal pair, so various trading strategies are applicable to it. The most widespread ways of trading it are technical and fundamental analyses and indicator trading.

How to trade EUR/JPY by fundamental analysis

This approach means fundamental factors are analysed. Both short-term trading on important news and long-term trading on expectations of changes in the CB’s policy are possible.

Here is an example. At the beginning of 2022, due to the growing inflation the US and EU started winding up their QE programmes and gradually increasing interest rates to counter inflation. The US have already started increasing the rates, while the EU is getting ready for toughening the monetary policy.

Unlike these two, the Japanese economy has long rested in the state of deflation (the opposite to inflation), so the BoJ does not plan to increase the interest rate anywhere soon. Hence, the Carry Trade strategy has become popular again: it implies making a profit on the difference of interest rates, when a currency with a high interest rate is bought against one with a low interest rate.

Investors and traders started buying the USD and EUR against the JPY actively, hence, since the beginning of the year there has been a strong uptrend in the USD/JPY and EUR/JPY.

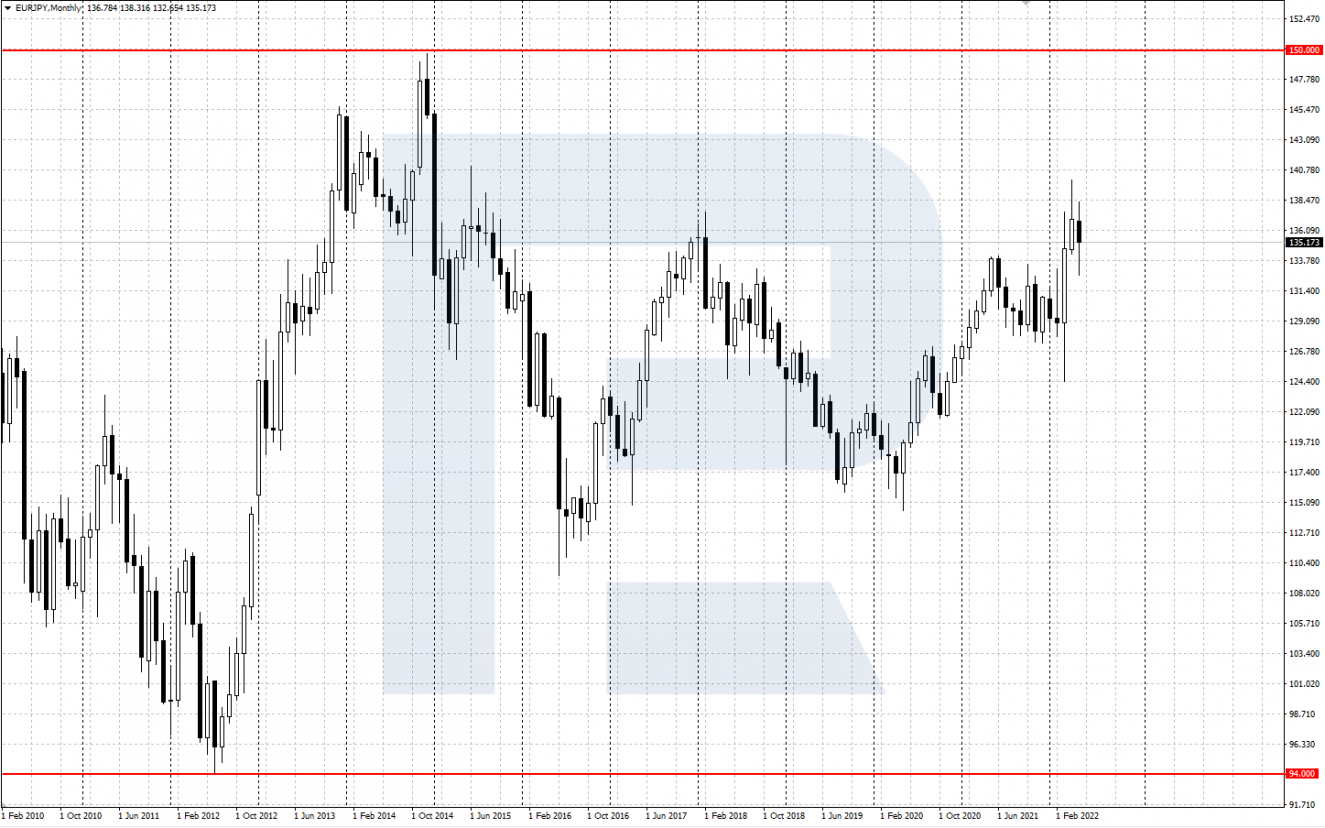

How to trade EUR/JPY by tech analysis

This way of trading is based on studying the chart of the currency pair by price patterns, support/resistance levels, candlestick combinations, and other tech analysis instruments.

Here is an example.

- On H1 of EUR/JPY, after a bounce off a strong resistance level (140) a reversal Head and Shoulders price pattern formed.

- A selling position can be opened after the price breaks through the neck line of the pattern.

- A Stop Loss is placed behind the nearest shoulder.

- A Take Profit suggestion would be the height of the pattern in points.

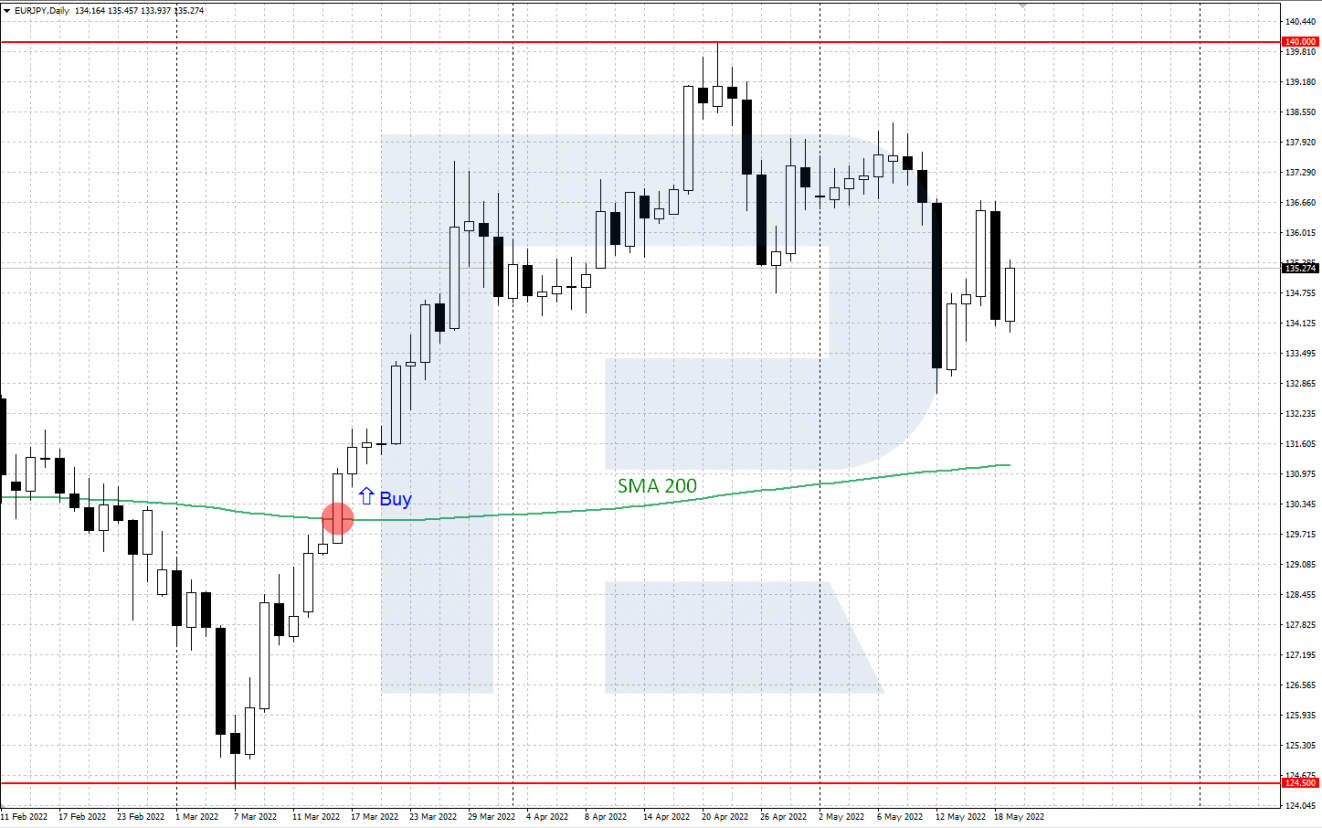

How to trade EUR/JPY by indicators

Signals from various indicators, either single or numerous, can be employed.

As an example, let us take trading the trend by a Moving Average with period 200 — SMA(200).

- On D1 of EUR/JPY, the quotes crossed the SMA(200) from below and secured above it.

- This signals an uptrend, so the trader can look for ways of opening a buying position.

Closing thoughts

EUR/JPY is the relationship of two very popular international currencies — the euro and the yen. Thanks to good volatility and a small spread, this currency pair is popular among traders. It can be traded by fundamental or tech analysis and with the help of indicators.

Beginners need to practice on a demo account first and switch to real trading only when they get a stable positive result.