7 Effective Trading Strategies for Beginners and Advanced

7 minutes for reading

In R Blog, we have discussed a whole range of forex trading strategies — from the simplest to the most intricate ones, from those suitable for beginners to those meant for experts, those with and without indicators. Today, I will try to enumerate 7 trading strategies, which will be especially useful for you if you have not tried some of them yet.

Always keep in mind that however beautiful trading strategies may seem, never rush at using it on real money. Start with a demo account where you can painlessly master the strategy, detecting its strong and weak sides. Only after you reach good results try trading on a real account.

Explore a world of diverse trading strategies in the list below, each accompanied by a comprehensive post featuring profound descriptions and clear trading rules. Simply click on the links corresponding to the strategy names to unlock all the essential information you need to confidently apply them in the financial markets.

1. The Fishing trading strategy

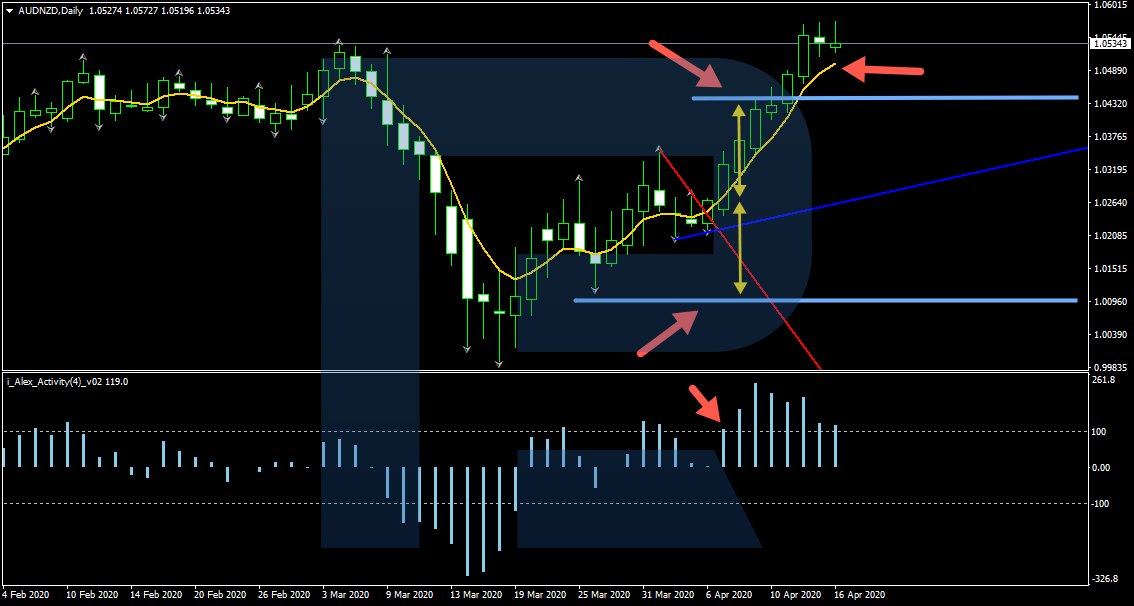

The Fishing trading strategy is meant for D1, however, you may try it on timeframes no smaller than H1. The strategy uses special indicators that you may download from the detailed description of Fishing.

The trading strategy gives two main signals for opening a position: a breakaway of the trendline drawn by the indicators and breakaways of the special sales and buy levels. In short, the whole work of Fishing is based on the indicators built in the strategy.

An obvious advantage f the method is trading on D1: you do not need to spend all of your time at the trading terminal; another advantage is that you trade the trend. The drawbacks are the lack of back-testing because the indicator draws the lines for the current moment only.

2. Woodies CCI trading strategy

The Woodies CCI trading strategy is based on an indicator with the same name — Woodies CCI. It will suit those who prefer analyzing the price chart themselves. The author offers various ways of trading by the indicator: using breakaways of trendlines, graphic levels, bounces off the zero line.

The author gives an interesting variant of trading the indicator chart; in essence, we do not need the price chart at all, you may open positions by the Woodies CCI signals only. The drawback is exactly the difficulty of such a system for beginners; for good work of the trading strategy, you still need to know the basics of tech analysis. On the other hand, you can back-test all the signals, gaining useful experience of work with the indicator.

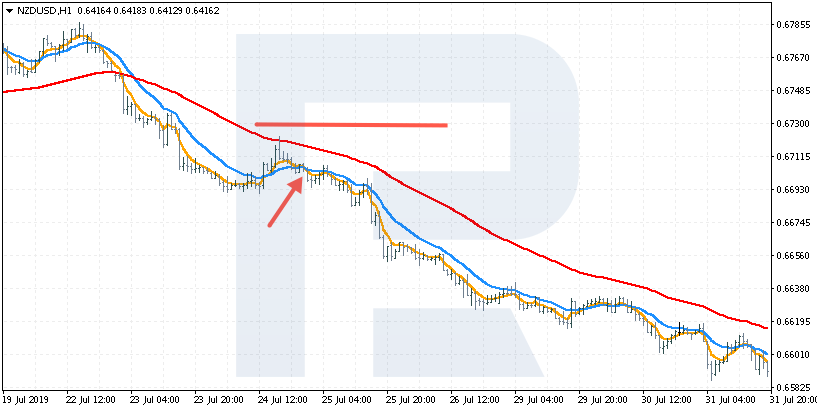

3. Three Moving Averages strategy

Moving Averages are the oldest instrument of tech analysis. As soon as a strong trend begins, virtually no indicator will give better signals by the trend.

The Three Moving Averages trading strategy uses three lines at once: EMA (65), EMA (15), EMA (5). EMA (65) is a trend indicator: the direction of the trend is defined by the position of the price related to this line. The EMA (15) and EMA (5) lines give signals to buy or sell by crossing.

Some might say that such signals will be lagging substantially, however, the strategy uses very small periods for the MAs. Moreover, for trading the trend, the entry moment is not that important as a strong movement will pull such a trade in tow. However, lagging instead of leading is, indeed, a drawback of MAs. Among the advantages of the trading strategy, I can name its simplicity and the possibility of back-testing.

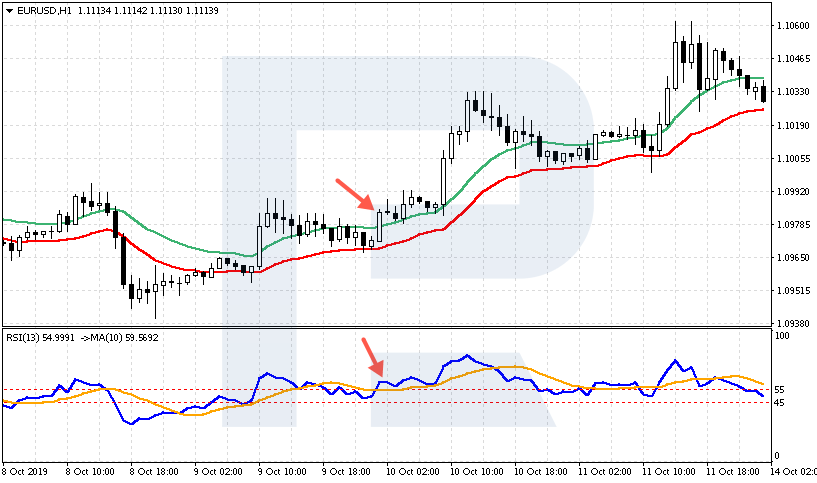

4. The Surfing trading strategy

The author of the Surfing trading strategy also suggests using the MAs, only with period 20 and drawn through the highs and lows. Thus, we get some sort of a channel: a signal to buy emerges as soon as the price rises above the channel while a signal to sell appears when the price falls below it.

An additional advantage of the trading strategy is the use of the RSI with an SMA (10). The combination of their mutual position and the position of the price related to the price channel will give signals to buy or sell.

The strong side of the strategy is the combination of a trend indicator, which is the two MAs, and an oscillator. Many traders note that such systems give very good signals along with the trend. Moreover, all signals are back-tested easily.

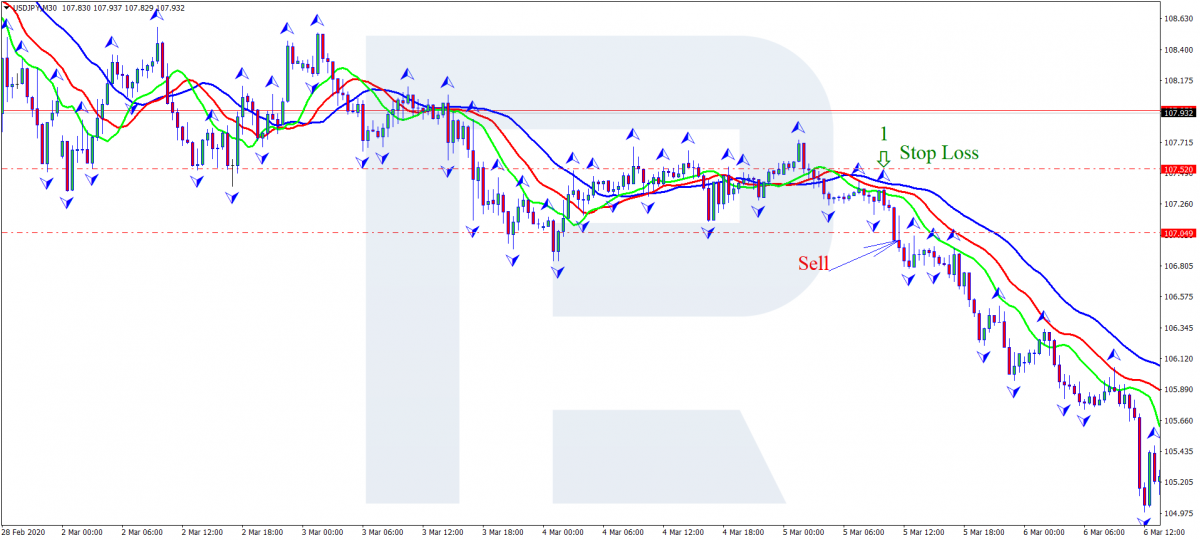

5. The Alligator+Fractals strategy

The Alligator+Fractals trading strategy implies using a trend indicator by Bill Williams called "Alligator" and the Fractals indicator that shows the local extreme as an arrow above a bar on the price chart.

The idea of the strategy is to detect a sideways movement on the chart when the Alligator lines go horizontally. We receive a signal to buy or sell when the price breaks the nearest Fractal up- or downwards.

For a beginner, it might be difficult to find a sideways movement; however, after you find a couple, it becomes much easier to do it. An undoubtful advantage is an opportunity to catch the very beginning of a trend which might, in the end, yield a good profit with minimal risks.

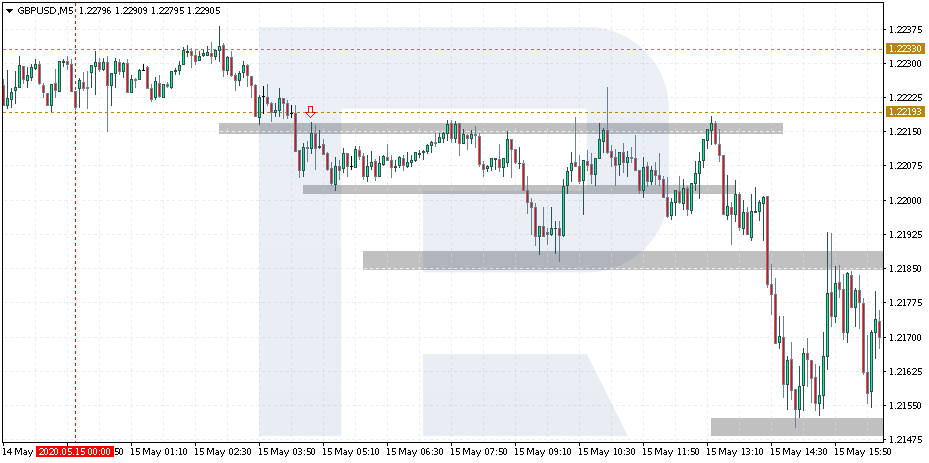

6. The Sniper trading strategy

The Sniper trading strategy is very popular over the the Internet. Here, we need to look for the channels that the market has formed during the Asian session. A breakaway of such a channel by certain rules will give a signal to enter the market. Then, we may open new positions by the current trend until it reverses. The system is based on the classical approach to market analysis by the levels and the trend.

The advantage of the trading strategy is trading market breakaways with small Stop Losses at the moments of low volatility, which may provide a good movement. However, the trader needs to work on small timeframes and track night channels.

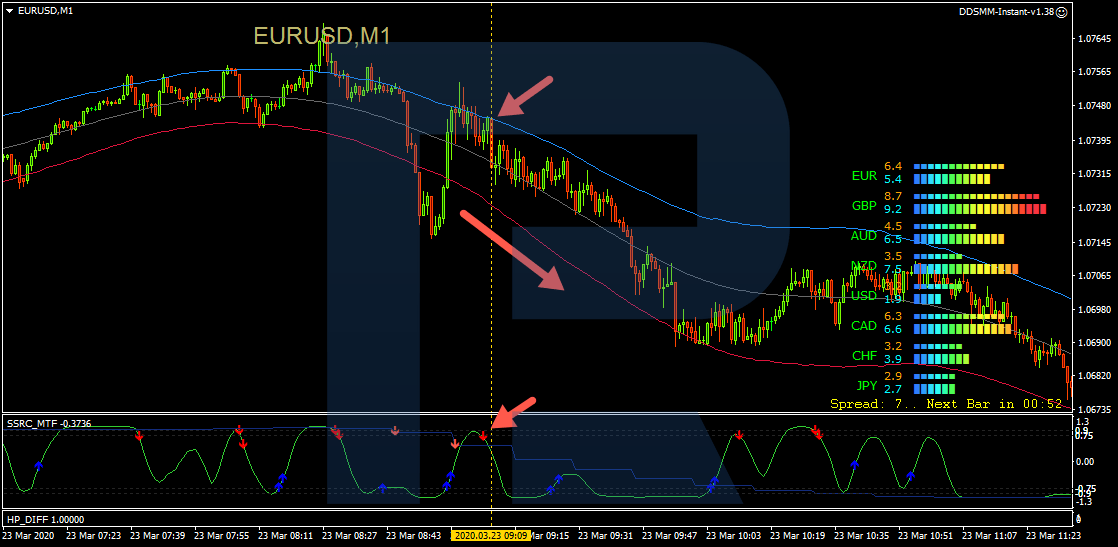

7. The Victory trading strategy

The Victory trading strategy uses scalping, i.e. trading on minute timeframes with quick entries to and exits from the market. It requires fast reaction and psychological readiness to trading with small profits but frequent trades. Here, we need to install a set of indicators that will signal entries and exits.

It might seem that you will need to track a lot of parameters, such as the width of the TMA channel or the power of the euro against the US dollar shown by the Currency Power Meter, or the formation of arrows on the SSRC. However, practice shows that later you open positions quite easily and allow trading fast, with near Stop Losses.

The advantages of the trading strategy are clear rules of entering and exiting the market and the minimal size of the risk. On the other hand, you have to scan a large amount of information from the indicators and open/close positions fast.

Summary

All trading strategies are unique and need attention and detailed studying. In our Top-7, there are both simple (Three MAs) and complicated (Victory) strategies.

Keep in mind that even a potentially profitable method of work never guarantees a good result for each trader. Some will skip a signal, some will enter with an excessive lot, etc. You may try several trading strategies and later choose one that psychologically suited you best. Only then start real work by the chosen method.